Devastating Investment Losses Are Coming: What Is Your Advisor Doing About It?

Stock-Markets / Investing 2019 Jan 12, 2019 - 10:34 AM GMTBy: Nick_Barisheff

I hold financial professionals who recommend monetary gold to their clients in the highest esteem. It is their sage advice that will protect investors from the unprecedented dangers they face today in the markets. However, many advisors are no longer permitted to recommend physical gold or precious metals in client portfolios as a result of the new rules defining risk in mutual funds. Many clients who had been holding gold for years were forced to reduce their positions last year by their investment advisor’s dealer. The timing for this couldn’t have been worse, as the resulting rise in their gold holdings would have reduced the losses in their portfolios from the market carnage we have witnessed since late September.

I hold financial professionals who recommend monetary gold to their clients in the highest esteem. It is their sage advice that will protect investors from the unprecedented dangers they face today in the markets. However, many advisors are no longer permitted to recommend physical gold or precious metals in client portfolios as a result of the new rules defining risk in mutual funds. Many clients who had been holding gold for years were forced to reduce their positions last year by their investment advisor’s dealer. The timing for this couldn’t have been worse, as the resulting rise in their gold holdings would have reduced the losses in their portfolios from the market carnage we have witnessed since late September.

The equity selloff that began in October is intensifying and threatens advisors, MFDA dealers and investors with a high probability of a 50-70% loss of capital and a corresponding loss of income in 2019. A decline of this magnitude will have devastating effects on retirement portfolios. Many investors will not recover in their lifetimes. This could snowball into advisors and investment dealers no longer being viable. The Everything Bubble appears to be bursting and, as history has shown, investors’ fears can easily grow into a panic.

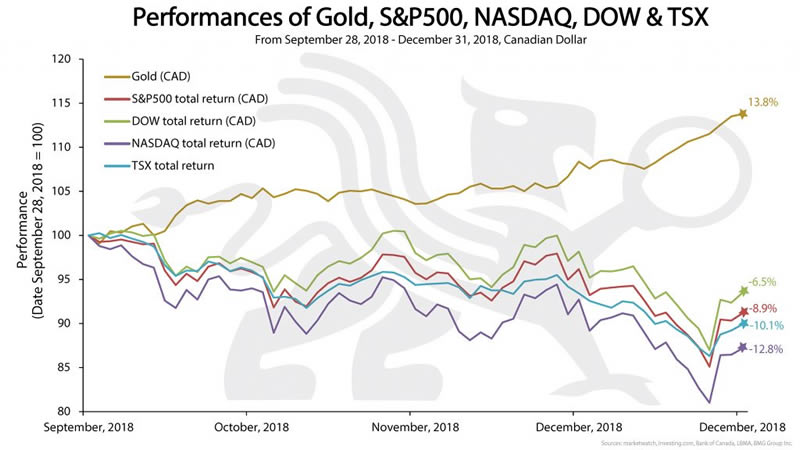

The final quarter in 2018 is a textbook display of why investors must own gold. There is no liquid asset more negatively correlated to the financial markets. Investors who do not own monetary gold may find themselves dangerously exposed to market volatility without the much-needed diversification/portfolio insurance that gold offers. If the current downturn in the market continues, as the world’s leading financial experts predict this asset may be the only form of wealth preservation that works

Experienced financial professionals understand that gold bullion is an alternative to cash. Ray Dalio, chairman of the largest hedge fund in the world (Bridgewater & Associates), once stated that, “If you don’t own gold…there is no sensible reason other than you don’t know history or you don’t know the economics of it.”

Referencing the above metrics, securities regulators have made a grave mistake in re-rating monetary gold to a medium-high risk relative to ‘Know Your Client’ (KYC) forms. These regulators, fund dealers and, by extension, their various compliance enforcement departments have ignored the fact that the Bank for International Settlements (BIS) that sets the rules for central banks and commercial banks has stated that “monetary gold is a risk-free asset on par with US Treasuries and US dollars.” They have also hamstrung investment professionals and their clients from protecting themselves with an asset that has done just that for over 3,000 years. In spite of nothing having changed in BMG funds, the new rules mandated by the provincial regulators across the country raised our official risk rating, making BMG funds unsuitable to many clients who have held these funds for years. An investor in a typical balanced portfolio should be concerned with not being properly diversified. For example, an equity portfolio can be diversified by style, capitalization and sector – but all equities are categorized as the same asset class. Gold, however, is an asset class unto itself with no substitute, no counterparty risk, no management risk and no default risk. Therefore, concentration limits in the traditional sense do not apply to monetary gold.

There is no issue if a client chooses to hold 100% of his or her portfolio in a money market fund. It should be equally risk rated for an investor to hold 100% of their portfolio in the BMG Gold Fund (BMG230). Currently investors would be prevented from holding more than 20% in their MFDA portfolio. The only choice investors would have is to move their account to a Discount Brokerage account, and purchase Class D units. Class D units have a 1.5% management fee instead of the retail fee of 2.25%, which includes a 1% trailer fee to the advisor. Investors that require additional investment information can go to the BMG DIY Investor site. Financial advisors are under the microscope for the unpalatable commission fees they receive. Many investors have already left their advisors due to this and switched to a Do-It-Yourself (DIY) discount brokerage account. They switched into fund classes (i.e., D-class) where they aren’t paying high commissions to an advisor. When an investor is told that they cannot hold the investments they want because of obtuse rules and are compelled to pay high fees to an advisor for financial products they don’t want (or, alternatively, should have a greater allocation to), it leaves the investor wondering why they have an advisor in the first place.

In addition, the last year has been infuriating for investors and financial professionals due to the arbitrary, misguided and potentially disastrous rule changes relating to measuring investment risk. Essentially, many investors were told they were no longer in control of their own wealth and were barred from holding monetary gold. In summary, the regulators mandated that the sole criterion for measuring an investment’s level of risk was Standard Deviation. This elementary investment tool measures both upside and downside moves, over a ten-year period, and finds an average of the two. The irony is, of course, that investors do not consider positive returns as risk – that is the objective. Investors only worry about downside risk. Investors are now being penalized for above-average returns even if the downside risk is extremely low. I am not alone in holding the view that downside risk is the best way to gauge the level of risk in an investment. Gold has a very low risk when measured this way.

This presents an irreconcilable paradox for an advisor who had recommended this asset for years as an essential component of a balanced and diversified approach to wealth preservation. Gold’s ability to off-set losses in traditional asset classes (i.e., stocks and bonds) in times of uncertainty, like we see today, is a key reason to own it. These rules were implemented with protecting the investor but are actually the exact opposite, and now put the investor at risk.

The unfortunate timing of last year’s rule change flies in the face of reason as we witnessed an equity bull market achieve three times the size of the last two bull markets and global debt reach an alarming $241 trillion – over three times global GDP. Mean reversion is inevitable, and the magnitude of an unwind is unthinkable to the average investor today.

Financial professionals were told that if they did not comply with the new risk-rating rules that they could be terminated – meaning that they would lose their clients and livelihood. In many instances, this was the case. In conjunction with the financial professional’s dilemma, many investors were livid upon being told that they had to reduce or redeem all of their physical precious metals investments. Some investors, who were forced to switch to another advisor, or a discount brokerage account after theirs had been forcibly terminated, had their entire gold position liquidated. These activities have the makings of class action lawsuit, as investors’ portfolios were made less diversified and left investors more exposed to market risks and losses.

The advisor’s position, and rightly so, was that one of the tenets of modern portfolio theory is predicated on the notion of diversification – i.e., a blend of assets that move in different directions. Investors who were forced to sell their gold remained in overvalued stocks and bonds, which studies suggest are more positively correlated now than ever.

Gold is well known as a safe-haven asset during times of uncertainty. Since late September, it has outperformed all traditional asset classes. This trend is likely to continue for the foreseeable future, as the world’s central banks seek to unwind the effects of their unprecedented and deleterious monetary policies introduced after the last financial crisis. Those who ignore what is happening right now are placing their financial well-being in harm’s way.

If your financial advisor, in addition to recommending monetary gold for diversification purposes, continues to advise on estate planning, tax planning, insurance options and other financial recommendations, then you are being guided by a true financial professional and they are worth their trailing commission compensation. If you don’t feel like your advisor offers you any real value, then why do you continue to pay them out of your fund’s management fee?

Investors need to be very wary of financial advice that does not follow, or runs contrary to, these empirically proven risk management practices. You have a choice. If your investment advisor, as a result of these new restrictions, cannot implement an effective risk management strategy, or fails to grasp the basics of Modern Portfolio Theory, then I strongly recommend that you contact us about Do-It-Yourself (DIY) investing and BMG Class D funds.

The headwinds investors and advisors face regarding the outlook for 2019 and beyond is daunting enough. They don’t need the added problem of restricted advice not based on financial acumen but in arbitrary rules and faulty logic.

You have worked your entire life for your vision of a retirement lifestyle. Don’t let the regulators and fund dealers tell you that you aren’t in charge of your own money and leave you unprotected against the greatest threat to your retirement dreams in 2019.

Email us at info@bmg-group.com, or call us at (888) 474-1001.

By Nick Barisheff

Nick Barisheff is the founder, president and CEO of Bullion Management Group Inc., a company dedicated to providing investors with a secure, cost-effective, transparent way to purchase and hold physical bullion. BMG is an Associate Member of the London Bullion Market Association (LBMA).

Widely recognized as international bullion expert, Nick has written numerous articles on bullion and current market trends, which have been published on various news and business websites. Nick has appeared on BNN, CBC, CNBC and Sun Media, and has been interviewed for countless articles by leading business publications across North America, Europe and Asia. His first book $10,000 Gold: Why Gold’s Inevitable Rise is the Investors Safe Haven, was published in the spring of 2013. Every investor who seeks the safety of sound money will benefit from Nick’s insights into the portfolio-preserving power of gold. www.bmgbullion.com

© 2019 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.