Why Stock Traders Must Stay Optimistically Cautious Going Forward

Stock-Markets / Stock Markets 2019 Feb 19, 2019 - 01:47 PM GMTBy: Chris_Vermeulen

The one interesting facet of the various research posts our team continues to digest is the continued bearish sentiment that exudes from some analysts. It appears these technical gurus have become married to the concept that global economic issues will crash the US stock market in the near future. We have to give them some credit though. We wanted to take a few minutes of your time to try to highlight how and why we believe these technical gurus are making these points so clearly now and why we believe there are multiple catalysts that they are simply failing to comprehend.

The one interesting facet of the various research posts our team continues to digest is the continued bearish sentiment that exudes from some analysts. It appears these technical gurus have become married to the concept that global economic issues will crash the US stock market in the near future. We have to give them some credit though. We wanted to take a few minutes of your time to try to highlight how and why we believe these technical gurus are making these points so clearly now and why we believe there are multiple catalysts that they are simply failing to comprehend.

Our team of researchers continues to learn from other skilled researchers, clients, and technicians. Every time we read some news item or someone’s research post, we don’t take the research with a pretense that “these researchers are wrong in their conclusions”. We start off with the pretense that “maybe these people are highlighting something we missed – let’s investigate it”. Thus, our quest is never-ending in the search for greater knowledge and practical application of price theory and technical analysis.

Our recent article highlighting the Expanding Wedge price pattern that is currently setting up in the US stock markets shows what we believe will be the likely outcome for the near-term future – the formation of a Pennant/Flag formation followed by an upside breakout move higher. Although we believe this is the most likely outcome, traders still need to be optimistically cautious going forward.

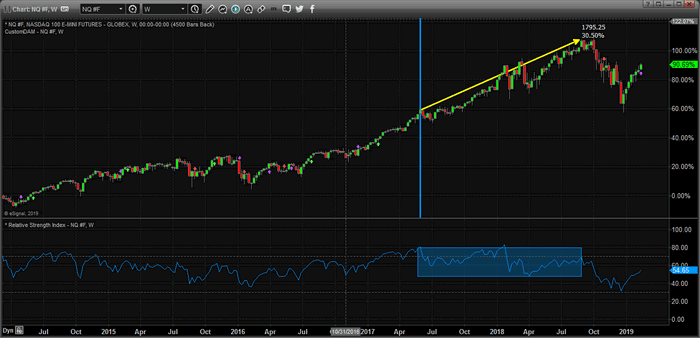

Tools like MACD and RSI are great for making points on charts. These technical indicators can show historically valid triggers and generate a sense of panic if presented in a certain context. Here is an example.

RSI Peaking! History has shown that when RSI peaks above 80, the markets typically correct by at least 8%. Look out below! Look at the right side of this chart, RSI is currently at the highest level since November 2014 and we can see the markets rotated downward by at least 5% shortly after this peak.

Yet, what really happened after this peak is shown in the chart below. We’ve highlighted the RSI PEAK date with a light blue vertical line. See how the markets shot up over 30% after this PEAK/SELL Signal?

The point behind this example and this entire article are that almost anything can be used to make a strategic point if placed in the proper context. We want to learn to read not only the critical points of interest but also the entire scope of the global markets and how the dynamics within these markets are playing out.

Within this multi-part research article, we will attempt to stress three key facets of global market analysis that we feel is critical to the understanding of the future market moves.

_ First, the past 10+ years has resulted in a critical shift from traditional market theory. Prior to 2006~07, the US Federal Reserve continued to operate under the premise of Keynesian Economic Theory (a reference to these points can be found here: https://www.britannica.com/topic/Keynesian-economics).

_ Second, global central banks and the US Federal Reserve had very few functional tools to address global inflation and monetary concerns over the years spanning 1970 to 2006 in terms of credit creation, globalization, capital market influences, and geopolitical shifts.

_ The current market conditions are about to change all traditional means of thinking if we are correct.

Let’s start by reviewing how things have changed over the past 50+ years and why this is important for all investors to understand. First, we’ll take a look at how global trade and globalized manufacturing has changed how the world operates.

Prior to 1970, the foreign markets were not as heavily traded and it was not easy or efficient for US investors to move capital into foreign asset classes without a very high degree of risk. US investors typically invested in US stocks, bonds, assets and more. They didn’t venture very far outside the US borders unless they possibly wanted to buy real estate in another country.

At the same time, the capital was somewhat isolated and regionalized into localized economies. Yes, the US Dollar had made its way all across the globe by the 1970s, but retail investors typically conducted business in local currencies and with local buyers. The globe was not as inter-connected then as it is now. Everything started to change in the 1980s though and the boom cycle of the Internet (the last 1990s) took all of us to a completely different level.

Once the technology boom cycle started and US companies started outsourcing manufacturing, engineering, software development, resources, culture and opportunity, the role of the central banks changed dramatically. With globalization, the central banks were not simply supporting a localized economy, they were now supporting a globalized economy and had little control over what we call “the bleed our effect”. When we add the September 11, 2001 attack in New York City and the subsequent wars and global destabilization that resulted from continued geopolitical turmoil – what should one expect the result of this outcome to be on the global economy?

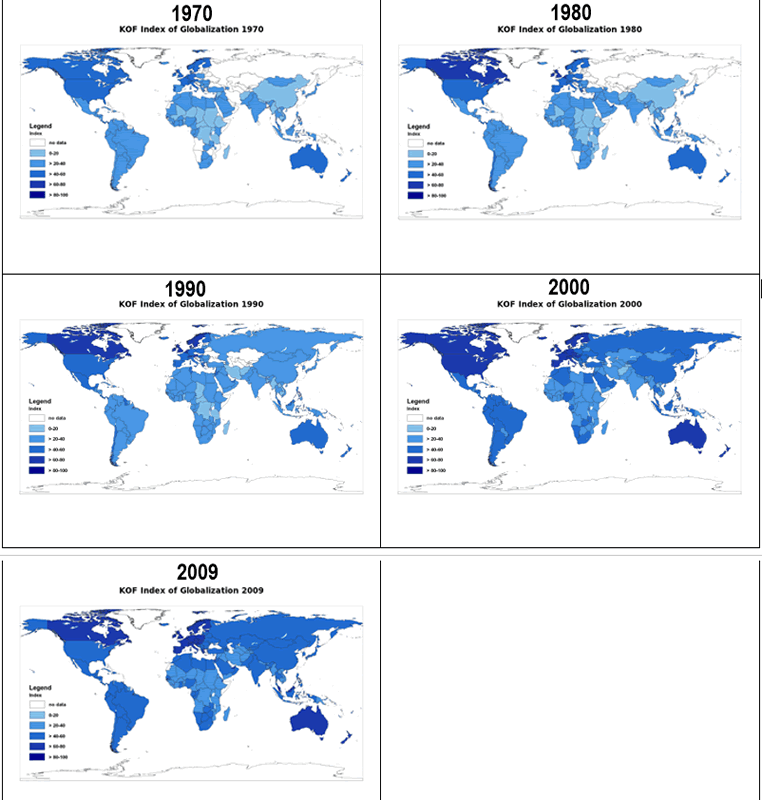

Take a look at these images to see how thing changed from the 1970s through 2009.

(Source: Graphsnstuff.com)

If you can read these tiny charts of how industrial and manufacturing globalization has expanded over the past 50 years, you will quickly understand how capital and economic advancement has also followed this expansion. Throughout the last 50+ years, continued global expansion of technology, resources, industrialization, and manufacturing has created immense opportunity throughout the planet for billions of people and continues to do so. The question we need to focus on is “is the current global market in any way similar to the markets of 30+ years ago?”

What would it take to replicate a market crash that occurred in 1929 or 2009 at this point? Sure, 2009 is a recent example of a global credit market crisis that was the result of many decades of policy and expansion in the making. Yet, at this time, what would it take to replicate this type of market crash and what would the process of this crash originate from?

In the next part of this article, we’ll continue to focus on aspects of the global economy that we believe support our longer-term global market analysis and continue to explore the total scope of the global markets instead of singularly focusing on single points of interest.

If you want to join a group of professional traders, researchers, and friends, then visit www.TheTechnicalTraders.com to learn how we can help you find and execute better trades. Take a look at some of our recent winners to see how we help people, just like you, create success. We believe 2019 and 2020 will be incredible years for skilled traders and we are executing at the highest level we can to assist our members. In fact, we are about to launch our newest technology solution to better assist our members in creating future success. Isn’t it time you invested in your future success by joining a team of professionals dedicated to giving you an advantage in the markets every day?

Chris Vermeulen

www.TheTechnicalTraders.com

Chris Vermeulen has been involved in the markets since 1997 and is the founder of Technical Traders Ltd. He is an internationally recognized technical analyst, trader, and is the author of the book: 7 Steps to Win With Logic

Through years of research, trading and helping individual traders around the world. He learned that many traders have great trading ideas, but they lack one thing, they struggle to execute trades in a systematic way for consistent results. Chris helps educate traders with a three-hour video course that can change your trading results for the better.

His mission is to help his clients boost their trading performance while reducing market exposure and portfolio volatility.

He is a regular speaker on HoweStreet.com, and the FinancialSurvivorNetwork radio shows. Chris was also featured on the cover of AmalgaTrader Magazine, and contributes articles to several leading financial hubs like MarketOracle.co.uk

Disclaimer: Nothing in this report should be construed as a solicitation to buy or sell any securities mentioned. Technical Traders Ltd., its owners and the author of this report are not registered broker-dealers or financial advisors. Before investing in any securities, you should consult with your financial advisor and a registered broker-dealer. Never make an investment based solely on what you read in an online or printed report, including this report, especially if the investment involves a small, thinly-traded company that isn’t well known. Technical Traders Ltd. and the author of this report has been paid by Cardiff Energy Corp. In addition, the author owns shares of Cardiff Energy Corp. and would also benefit from volume and price appreciation of its stock. The information provided here within should not be construed as a financial analysis but rather as an advertisement. The author’s views and opinions regarding the companies featured in reports are his own views and are based on information that he has researched independently and has received, which the author assumes to be reliable. Technical Traders Ltd. and the author of this report do not guarantee the accuracy, completeness, or usefulness of any content of this report, nor its fitness for any particular purpose. Lastly, the author does not guarantee that any of the companies mentioned in the reports will perform as expected, and any comparisons made to other companies may not be valid or come into effect.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.