How China Wins Trade War

Economics / Protectionism Jun 03, 2019 - 05:07 PM GMTBy: Richard_Mills

The trade feud between the US and China has deteriorated into trench warfare, with tariffs used as bayonets to bludgeon the other’s economy into submission. China’s Huawei has been blacklisted and US firms ordered to stop doing business with the telecom giant, further souring the bilateral relationship. For Part 1 of this series read:

The trade feud between the US and China has deteriorated into trench warfare, with tariffs used as bayonets to bludgeon the other’s economy into submission. China’s Huawei has been blacklisted and US firms ordered to stop doing business with the telecom giant, further souring the bilateral relationship. For Part 1 of this series read:

US is winning trade war with China...for now

Recent decisions made by the Trump and Xi administrations to either pile on more tariffs or increase the rate on existing ones, mean there is virtually no more tariff leverage either side can exert on the other, to extract the concessions needed for a deal.

The United States earlier this month raised tariffs on $200 billion worth of Chinese goods from 10% to 25%, effective June 1; China retaliated with $60 billion worth of 25% tariffs on American products. The Trump administration is reportedly “very strongly” considering tariffs on the remaining $325 billion of Chinese imports.

The Chinese government has less room to maneuver. It’s already launched its last salvo of tariffs - the $60 billion it just announced plus the earlier $50 billion worth; the $110 billion total represents most of its imports of American products. China imports far less raw materials and merchandise from the US than the US buys from China - hence the US-China trade deficit Trump has vowed to rein in.

What this means, is the belligerents will soon be looking at other means in which to exert pressure, if Trump and his counterpart, President Xi Jinping, fail to reach a deal, mano a mano, at the upcoming G20 summit in Osaka.

In this article, we go beyond the tariffs to see what other weapons China could haul out to strike back against America, if the Trump administration ups the ante.

Sell Treasuries

China being the largest holder of US debt, which is at a gasp-worthy $22 trillion, the idea of selling US Treasury bills is often trotted out as China’s most powerful weapon against its trading adversary.

The country holds close to $1.2 trillion in US bonds, notes, bills etc. among its vast foreign exchange reserves, worth around $3 trillion. The argument goes something like this: China has less levers to pull, as far as slapping more tariffs on American products. Therefore the longer the trade war goes on, the more likely it is that China will pull “the nuclear option” of dumping its US Treasuries.

A large-scale sale of US debt on the bond market, the argument goes, would cause US interest rates to rise, bond prices to tank and yields to go ballistic. The latter would exacerbate federal budget deficits, because interest payments would rise on the national debt.

The US dollar would plummet, as a loss of confidence in the greenback ripped through the global economy.

The US goes into deficit each year, and further into debt, because it knows that China and other countries will buy its debt. Like gold, US Treasuries are a good safe haven. But if China stopped buying them, the US could run into trouble financing its deficits.

There’s been plenty of analysis done lately on the fallout of a Chinese sell-off of US Treasuries. The consensus seems to be, it ain’t gonna happen. Here’s why:

The first reason is that, except for gold, there really aren’t any better options than US Treasuries for China to purchase with its stacks of dollars. They are the most liquid financial instrument in the world, meaning easily sellable, and they carry a decent yield. Moreover, if China were to suddenly liquidate its Treasuries, it would have trouble finding ways to invest the dollars, other than T-bills. Here’s ‘Fortune’ magazine’s take on the idea:

One analyst Fortune spoke to labelled the hypothetical move as “simply nuts” because if China dumped U.S. bonds it would find itself with a devalued portfolio, fewer bonds to sell later, and a stockpile of U.S. dollars that it would struggle to spend.

Second, selling US Treasuries would strengthen the yuan, because the dollar would fall in relation to the Chinese currency. That would make Chinese exports more expensive. It would also make US multinationals that sell into China more competitive, and therefore more profitable, something China would not want to see if it’s fighting a trade war.

Third, China needs dollars to purchase commodities and many other good and services priced in US dollars. Selling a very large chunk of dollars denominated in T-bills doesn’t make any sense, as long as the US dollar remains the world’s reserve currency.

The fourth reason China won’t dump Uncle Sam’s IOUs, is that doing so would cause bond prices to plummet, thereby reducing the value of China’s remaining Treasuries. Reuters points out that the yuan is not free-floating, it uses its Treasury holdings to stabilize the currency within a targeted range against the dollar. Selling T-bills diminishes this ability.

And finally, all the negative fallout from the selling of Treasuries would hurt the US economy. The US is the destination for one-fifth of Chinese exports, so a weakening of the US economy is also going to hurt Chinese companies. Their fortunes are very much inter-twined.

In fact we already have examples of large-scale Treasury dumps by China, with little to no effects. In March China sold $200 billion worth - the most in two and a half years. The Street cited a new report saying that China’s central bank might have to start selling Treasuries regardless of the trade war, to meet growing demand for dollars, from Chinese importers and tourists.

Weaponize the yuan

The problem for the United States is that throughout the past several years, the dollar has remained high in relation to other currencies, and that has created a large trade deficit. It is primarily the result of the trade deficit – and especially the trade deficit with China – that prompted the Trump administration to start a trade war with its most powerful economic competitor.

Trump campaigned on reducing the deficit by hammering US trading partners and promising to rip up “horrible trade deals” previous administrations had negotiated. This included NAFTA, the Trans PacificPartnership which the US withdrew from, and the trading relationship with China which Trump has always described as unfair. Trump and other US officials have accused not only China but Germany, Russia and Japan as trying to gain a trade advantage by keeping their currencies weak.

It has come up for discussion then, in the context of the current trade war escalation, whether China should devalue the yuan as a way to pressure the United States into making a deal.

While China’s central bank has been pursuing a policy of propping up the yuan’s value as the country shifts from an export-driven to a consumer-oriented economy, Forbes quotes Chen Long, a China economist at consultancy Gavekal Dragonomics, stating it is now in Beijing’s best interest to let the yuan slide:

“The renminbi exchange rate is one of the most powerful weapons Beijing has in the trade war with the U.S.,” Chen wrote in a report. Chen argues that a weaker yuan would support China’s exporters. While China’s importers would be worse off, the benefits outweigh the costs because China is a net exporter. But, more importantly, a depreciated renminbi [aka the yuan] could rattle global markets and, consequently, pressure Trump to switch tack.

An op-ed in the South China Morning Post takes a different view. The author, a senior emerging markets economist at Commerzbank, writes that, while it makes sense to devalue the yuan to make exports cheaper thereby increasing volumes, doing so may provoke the United States into placing tariffs on the remaining $325 billion of Chinese imports (of course, this argument is only valid until the US decides to tariff those goods anyway.) Also, it would make China’s trade surplus with the US widen, just as the United States appears to be closing the gap. (the deficit recently fell to a five-year low, evidence the trade war is working) This could “poke the bear” and result in a more aggressive US stance.

The US may rail against China for devaluing the yuan and escalating the trade war, but the irony is that the US Federal Reserve has done the same thing through its monetary policy known as quantitative easing (QE). The Fed pushed through a series of rounds of QE between 2008 and 2015, buying trillions of dollars of government bonds and mortgage-backed securities. Throughout the controversial QE program, done to stimulate the US economy after the 2008-09 recession, the Fed’s (central bank) assets ballooned from $900 billion to $4.5 trillion.

What the US was really doing, was engaging in a currency war with its trading partners, just as China has done, and has the option to do now. In a currency war, those on the losing end of trading relationships decide to engage in a policy of competitive devaluation. By keeping their currencies low, through monetary policy explained above, the idea is that exports will be cheaper. On the other hand, devaluing a currency also makes imports more expensive, which can hurt companies that purchase a lot of foreign parts for assembling their products. The worst effect of a trade war is for countries in economic trouble to keep devaluing, thereby driving export shipments, in a constant “race to the bottom”.

On the one hand, devaluation would be good for China’s exports, but on the other hand, Chinese companies importing American products must shell out more yuan to get the same number of dollars as before the currency got devalued. China exports to the US much more than it imports from America, though, so on balance, this strategy of “weaponizing the yuan” would favor China. It will be interesting to see whether they try it.

And there’s this from Alex Kimini over at Safehaven;

China’s efforts to open up its capital markets could end up having an unintended consequence (maybe not so unintended? Rick) - an even weaker yuan. As the People’s Bank of China (PBOC) allows more market forces to play a greater role in determining the value of China’s currency, the yuan is likely to become more volatile and likely weaken even further (the currency is down nearly seven percent against the dollar this year).

Hit critical metals

Although this trade war started with seemingly benign and boring duties on aluminum and steel, it’s really about technology, and how both superpowers are positioning themselves in the world order. Huawei’s control over the next-generation 5G network is troublesome to the US, and Canada, who fear that the company’s close ties to the Communist government make it a security threat.

But China has ambitions beyond Huawei and 3G. It wants to be the leader in artificial intelligence, robotics, electric cars, aerospace and other high technologies. The ‘Made in China 2025’ initiative is Beijing’s 10-year plan to shift the country’s industrial policy from low-tech mass production, to high-tech, thus reducing the country’s dependence on foreign technology. Semi-conductors, the ubiquitous chips used in so many electronics applications, are a key focus.

Washington however sees the project as relying on forced technology transfers, intellectual property theft and cyber-espionage. Many say the trade war is really about limiting China’s access to high-technology and its attempt to rule the world through technological superiority.

If that is true, and we see no reason to believe it isn’t, then it makes sense that a key target in China’s cross-hairs might be critical metals. Because without rare metals like lithium, rare earth elements, tellurium, antimony, etc., the United States would be seriously hamstrung in its attempt to advance cutting-edge technologies necessary for the economy of the future.

On Wednesday morning I opened up my web browser to discover China’s threat of restricting rare earths exports to the United States all over the news. The headlines were reporting Chinese newspapers raising the prospect of Beijing cutting exports of the commodities that are critical to America’s defense, energy electronics and auto sectors.

“United States, don’t underestimate China’s ability to strike back”, the official ‘People’s Daily’ newspaper stated. “Will rare earths become a counter weapon for China to hit back against the pressure the United States has put on for no reason at all? The answer is no mystery,” it added in an apparent reference to the United States blacklisting Huawei for reasons of US national security.

Suddenly, the once-remote possibility of using critical metals like REEs, as pawns in the trade war, has become more likely.

We like REEs, and the spectre of a rare earths embargo is certainly very interesting but there is much more to the story than that. Many minerals are critical in the supply chain of a modern economy and a country’s defense. But how critical they are has to take into account:

- Who controls how much of supply/production and where is this supply coming from?

- Size of market.

- Who controls processing?

- Who manufactures end products?

Bloomberg has this to say regarding China’s REE threat:

Once every decade or so, the world goes through a collective freak-out about rare earths.

The suite of 17 elements strung toward the bottom of the periodic table are notable in that they’re essential in several high-technology applications such as wind turbines, electric cars and lasers, and largely made in China.

That makes them a scary-sounding weapon in economic and diplomatic disputes. Back in 2010, China cut off exports of the minerals to Japan when the two governments were in dispute over ownership of some islands east of Taiwan. Now, state-owned Chinese media have been clamoring to do the same again in the trade war with the U.S. “If anyone wants to use products made of China’s rare-earth exports to contain China’s development,” the Global Times quoted an unnamed official as saying, the Chinese people “will not be happy with that.”

The truth, however, is that rare earths are a paper tiger. As we wrote last week, the 2010 case backfired spectacularly for China. Fearful of being caught short again, Japan Oil, Gas and Metals National Corp. – a government agency – went in with trading house Sojitz Corp. to provide a series of development loans to Lynas Corp., an Australian company looking to build a rare-earths supply chain outside China.

Here’s what many suspect will happen. An embargo on Chinese REEs to the US will set off a security of supply backlash. Mainly that the US will be forced to process its own rare earths and manufacture it’s own magnets.

China currently controls almost all REE processing and magnet manufacturing. But they import a considerable amount of REEs. Meanwhile North America is well endowed with huge quality rare earth deposits, enough to supply us with decades and decades of production. What we lack is processing and larger scale manufacturing. But we have a ready supply for what tonnage wise is an admittedly smallish market (ie the US Military uses a total amount of REE equal to 500 metric tonne) and REE processing has already started happening outside China:

- Mountain Pass in California will start processing REE’s by the end of 2020.

- Lynas signed a joint venture agreement with Blue Line Corp. to build a processing plant in Texas.

- Solvay SA, a French chemicals company, recently set up a demonstration project to produce nearly 200 tons a year of rare earths just from recycling light bulbs.

Manufacturing of all needed value-added rare earth products will surely follow REE security of supply.

If the US and China continue their trade spat, and we think there’s more then a fair chance they will, then a few REEs (those specifically used in magnets) will hold their recent, volatility not demand driven, price gains.

Bigger fish to fry

Rare earths are a relatively small, niche market compared to some of the other metals China supplies like lithium and cobalt (sourced from the DRC). If China really wanted to hit back at the US, it would bring out the big guns, and target the big market metals that go into lithium-ion batteries, primarily lithium and cobalt.

Both lithium and cobalt are prime examples of how China has the United States over a barrel when it comes to security of critical mineral supplies. Since the electric vehicle began to penetrate the internal combustion engine (ICE) car market, lithium and cobalt have become the commodities to secure.

Lithium is the metal, in our opinion, that China would target, if it really wanted to hurt the US clean-tech economy.

In fact, our friends at Benchmark Mineral Intelligence tell us that growth in rare-earths consumption is flat, but demand for lithium-ion batteries, containing other critical raw materials that China either controls through off-take agreements (lithium and cobalt) or is the biggest exporter of (processed graphite) is expected to grow 10-fold over the next decade.

“If you’re looking at severe economic impacts of embargoes, there are much bigger fish to fry,” says Simon Moores, managing director at Benchmark Mineral Intelligence, a critical minerals industry research firm.

He’s right.

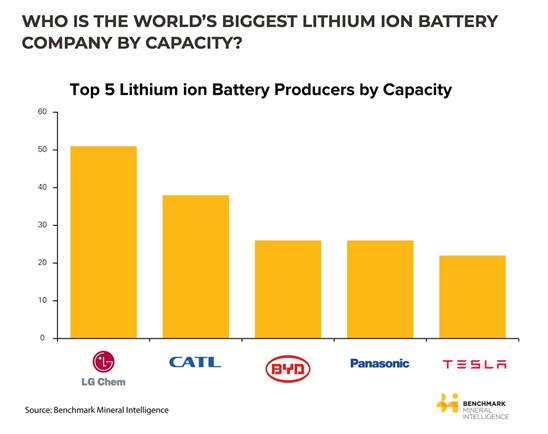

The International Energy Agency is predicting 24% growth in EVs every year until 2030. China is already the world’s largest solar power producer and sells the most electric vehicles. By 2020, the Chinese government wants its battery makers to double their capacity (BYD is the largest electric vehicle battery company in the world) and start investing in production facilities overseas. The United States is far behind China and Europe in terms of EV penetration, but it’s catching up. Volkswagen has said it will invest $800 million to construct a new electric vehicle – likely an SUV - at its plant in Chattanooga, Tennessee, starting in 2022.

GM is planning to sell its first EV this year, a 2020 Cadillac SUV, built in Spring Hill, Tennessee, in a move designed to challenge Tesla.

Meanwhile more battery factories are being built, driven by the demand for lithium ion batteries which is forecast to grow at a CAGR of over 13% by 2023.

There are 68 lithium-ion battery mega-factories already in the planning or construction stage.

In December Korean company SK Innovation said it will invest US$1.6 billion in the first electric vehicle battery plant in the United States, and is considering plowing an additional $5 billion into the project, planned for Jackson County, Georgia.

But it could all come to a crashing halt if China were to stop processing lithium bound for US end-users. China doesn’t produce much lithium compared to the top two producers, Australia and Chile, but it has made up for its lack of production capacity by becoming the dominant player in processing the element, and by inking offtake agreements with overseas lithium miners.

In December, China’s Tianqi Lithium paid $4.1 billion to become the second-largest shareholder in SQM, Chile’s state lithium miner. The mega-deal effectively gives Tianqi control over half the world’s lithium production. The company already owned 51% of the largest hard-rock lithium mine, Greenbushes in Australia.

Chinese entities also control 60% of the world’s electric battery production, and the majority of lithium hydroxide, the high-grade lithium product that goes into Tesla’s lithium-ion EV batteries, for example.

This has put the United States in a vulnerable position with respect to securing the lithium it will need for current and future consumer and military handheld devices, electric vehicle production and clean energy storage programs.

The United States has just one lithium brine operation, the Silver Peak Mine in Nevada, but it’s been operating since the 1960s and its grades are said to be declining. Silver Peak’s lithium is processed into lithium hydroxide and shipped to Asia.

If China were to embargo all the lithium it mines or processes, destined for the United States, the result would be a serious setback for the country. The absolute size of this market, the fact China controls production, processing and manufacturing all means an extremely lengthy and painful set back. Just as the US is taking steps to become a major player in the lithium space.

Conclusion

Donald Trump started a trade war with China thinking, obviously, that his administration could win it. Through a combination of hubris and ignorance, this president didn’t bother to find out what is America’s soft underbelly, its Achilles heel. The answer is the country’s heavy reliance on foreign supplies of critical minerals. And not just any critical minerals - the raw materials it needs to become a leader in high technology, transportation, energy and defense. Materials like lithium, rare earths, cobalt and graphite.

For years the United States and Canada didn’t bother to explore for these minerals and build mines. Globalization brought with it the mentality that all countries are free traders, and friends. Dirty mining and processing? NIMBY. Let China do it, let the DRC do it, let whoever do it.

China recognized opportunity knocking and answered the door. The possibility of the country’s main supplier becoming its enemy was far from the minds of presidents long before Trump. Now the issue is in the headlines, on China’s radar.

Americans may be buying less Chinese goods, its companies and citizens effectively paying an extra 10-25% tax that are the tariffs, but the Chinese are not worried, nor are they in any hurry to strike a deal. They “hold the nuts” as the poker expression goes.

Allow me to explain. Not only has China locked down the world’s supply and processing capacity of battery metals, lithium, cobalt and graphite it can also use currency manipulation to make its good cheaper. A 30% devaluation of the yuan would make its exports competitive again, not only to the United States, but the rest of the world. Devalue the yuan enough, and everyone will be knocking at China’s door to buy its inexpensive goods. Pretty soon China won’t even need the US anymore.

Combine a currency devaluation with continued investment in the Belt and Road Initiative and embargoing critical metals exports to the US and you see where China is going with this.

BRI is a vast network of railways, pipelines, highways and ports that would extend west through the mountainous former Soviet republics, south to Pakistan, India and southeast Asia.

So far over 60 countries, containing two-thirds of the world’s population, have either signed onto BRI or say they intend to do so. According to the Center for Foreign Relations, the Chinese government has already spent about $200 billion on the growing list of mega-projects projects including the $68 billion China-Pakistan Economic Corridor. Morgan Stanley predicts China’s expenditures on BRI could climb as high as $1.3 trillion by 2027.

The Belt and Road Initiative is seen by proponents as an economic driver of proportions never seen before in human history. It would not only allow Asia to relieve its “infrastructure bottleneck” ie. an $800 billion annual shortfall on infrastructure spending, but bring less-developed neighboring nations into the modern world by providing a growing market of 1.38 billion Chinese consumers.

Opponents argue that is naive and the real intent of BRI is to carve new Chinese spheres of influence in Asia that will replace the United States, in-debt poor nations to China for decades, and restore China to its former imperial glory.

I’m in the latter camp. Consider this: All China has to do is stop buying US Treasuries, and use their $1.2 trillion worth of T-bills to invest in Belt and Road projects. Continue to make loans to poor developing nations that want to become part of BRI, using US dollars, while the USD is still the reserve currency. The loans are paid back using offtake agreements for raw materials from these countries, which become part of the largest trading block in the world, thereby further distancing China from the West. Remember, Russia is part of BRI. The Kremlin and Beijing have already signed billions worth of energy deals, and are talking about a new payments system that allows for trade in rubles and yuan, excluding the US dollar.

Devalue the yuan, so that China’s new south Asian trading partners can buy competitively priced Chinese goods, further enslaving them with crippling trade deficits.

Meanwhile, hit back at US companies as retribution against the United States which dared to stand in the way of companies like Huawei and ZTE. Embargo their critical metals, effectively starving their supply chains, and watch them slowly wither and die.

When you think about it, it’s a beautiful plan. People thought President Xi was crazy when he invoked ‘The Long March’ to describe his 15-year battle plan with the US. Trump thinks this can all be over in time for re-election in 2020. But China has other ideas. It has the resources, the technology and the population to lay siege to the United States for a long time. Just before he made that speech in Jiangxi province, the start of the 6,000-mile trek referred to as the Long March of 1934, which preceded the emergence of the Chinese Communist Party and Mao Zedong, Xi visited a rare earths facility, giving a hint as to how this new march might begin (an embargo). He urged his comrades to dig in for the long and difficult road ahead. The symbolism was clear: China will ultimately prevail, and when it does, Xiwill be the leader of “a new China” in much the same way as Chairman Mao.

The silver lining to all of this drama would be a realization by the United States, that it must start investing in its critical metals supply chain so as to avoid China’s poisonous arrow that right now could easily sever its vulnerable Achilles heel.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including: Wall Street Journal, Market Oracle, USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2019 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.