How Strange! Gold Rises on Strong Payrolls!

Commodities / Gold and Silver 2021 Nov 12, 2021 - 09:54 AM GMTBy: Arkadiusz_Sieron

US economy added 531,000 jobs in October, surpassing expectations. Gold reacted… in a bullish way, and jumped above $1,800!

US economy added 531,000 jobs in October, surpassing expectations. Gold reacted… in a bullish way, and jumped above $1,800!

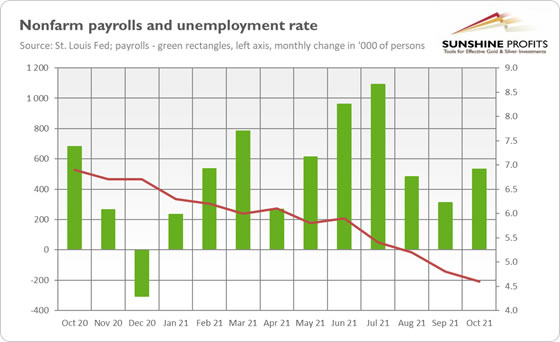

The October nonfarm payrolls came surprisingly strong. As the chart below shows, the US labor market added 531,000 jobs last month, much above the expectations (MarketWatch’s analysts forecasted 450,000 added jobs). So, it’s a nice change from the last two disappointing reports. What’s more, the August and September numbers were significantly revised up – by 235,000 combined. Let’s keep in mind that we also have the additions of 1,091,000 in July and 366,000 in August (after an upward revision).

Additionally, the unemployment rate declined from 4.8% to 4.6%, as the chart above shows. It’s a positive surprise, as economists expected a drop to 4.7%. In absolute terms, the number of unemployed people fell by 255,000 - to 7.4 million. It’s a much lower level compared to the recessionary peak (23.1 million), however, it’s still significantly higher than before the pandemic (5.7 million and the unemployment rate of 3.5%).

Implications for Gold

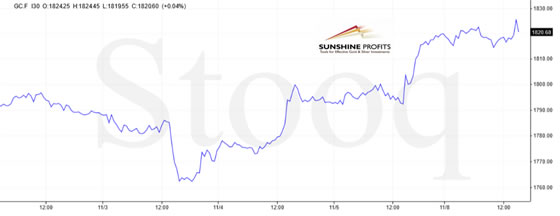

What does the recent employment report imply for the precious market? Well, gold surprised observers and rallied on Friday despite strong nonfarm payrolls. As the chart below shows, the London P.M. Fix surpassed the key level of $1,800.

To show gold’s reaction more clearly, let’s take a look at the chart below, which shows that the price of gold futures initially declined after the October Employment Situation Report release. Only after a while, it rebounded and rallied to about $1,820.

It’s a surprising behavior, as gold usually reacted negatively to strong economic data. Until now, gold liked weak employment reports as they increased the chances of a dovish Fed that would continue its easy monetary policy. Now, something has changed. But what?

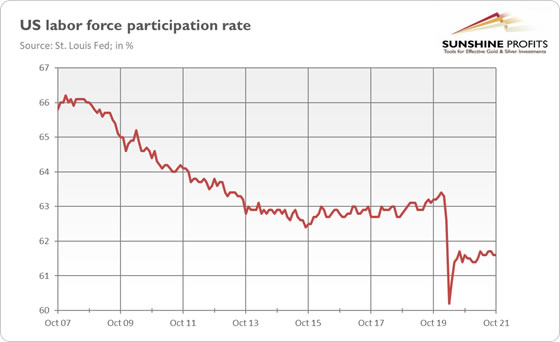

Well, some analysts would say that nothing has changed at all. Instead, they would tell us that the latest employment report is not as strong as it seems. In particular, the labor force participation rate was unmoved at 61.6% in October and has remained within a narrow range of 61.4% to 61.7% since June 2020, as the chart below shows. The lack of any improvement in the labor force participation rate could be interpreted as a lack of full employment and used by the Fed as an excuse to leave interest rates unchanged for a long time.

I’m not convinced by this explanation. “Full employment” does not mean that all people are working, but all people who want to work are working. And, as the chart above shows, the fact that after the Great Recession the labor participation rate didn’t move back to the pre-crisis level didn’t prevent the Fed from hiking interest rates in 2015-2019.

There is also another possibility. It might be the case that investors are now focusing on inflation. The employment report showed that the average hourly earnings have increased by 4.9% over the past twelve months, raising some concerns about wage inflation and general price pressure in the economy. Remember: context is crucial. If the new narrative is more about high inflation, good news may be positive for gold if they also indicate strong inflationary pressure.

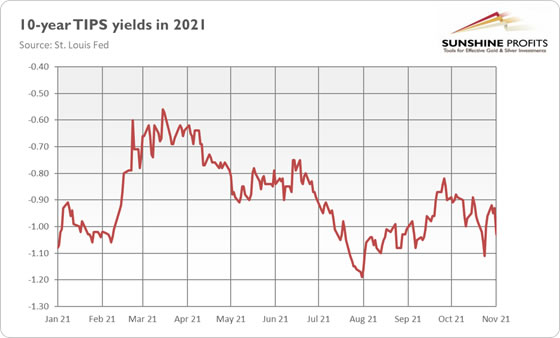

Although I like this explanation, it’s not free from shortcomings. You see, stronger inflation concerns should increase inflation premium and bond yields. However, the opposite is true: the real interest rates declined last week (see the chart below), enabling gold to catch its breath. After all, the markets are expecting a more dovish Fed than before the announcement of tapering. This is a fundamentally positive development for the gold market.

Having said that, it’s too early to declare the start of the breakout. If inflation stays high, the US central bank could have no choice but to hike interest rates next year. Also, although the recent jump despite strong payrolls is encouraging, gold has yet to prove that it can stay above $1,800.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.