Gold – Nothing More, Nothing Less, Nothing Else

Commodities / Gold and Silver 2021 Dec 19, 2021 - 06:29 PM GMTBy: Kelsey_Williams

GOLD – NOTHING MORE

Gold is real money; nothing more. That is a hard pill for some investors and advisors to swallow. Actually, it is the second part of the statement that raises the most concern.

More than just a few people will readily affirm their belief that gold is real money. Beyond that, though, there is a tendency to get carried away with descriptions and analyses regarding “fundamentals” for gold.

Those fundamentals are many and varied; but they have nothing to do with gold or its price.

As the cumulative loss in purchasing power of the US dollar becomes more apparent, and as the price of gold continues to rise, more people take notice.

Investors and consumers are price conscious; which is fine. The problem is that most of them confuse price vs. value.

The only reason the price of gold goes up is to reflect the loss in purchasing power of the US dollar. In other words, the rising price of gold is correlated inversely to the US dollar’s actual purchasing power loss.

Specifically, this means that a higher gold price occurs after the effects of inflation have settled in and taken their toll – not before and not in anticipation of those effects.

Let’s be very clear about something: gold’s higher price in dollars at any time NEVER represents an increase in gold’s value and is ALWAYS indicative of dollar weakness that has already occurred.

Gold’s value is constant and unchanging. That is why gold is the perfect money. Gold is original money and a long-term store of value. (see Only One Fundamental For Gold)

GOLD – NOTHING LESS

Just as much as it is true that people focus on gold when its price is rising, they tend to ignore and disregard it when the price is declining. They become downright disinterested over longer periods when, in their words, “it isn’t doing anything”.

We are currently seeing some negative response to gold’s “failure to respond” to fundamentals and as a result of gold’s price not meeting or exceeding its expectations.

A similar thing happened after gold peaked in 1980. Many people were convinced that the dollar would be decimated by runaway inflation and that the price of gold would move well beyond $1000 oz (it peaked briefly at $850 oz.).

As the years passed, discouragement found a home and eventually apathy reigned. The effects of inflation became less and less of an obvious issue. Also, the stock market was rising rapidly and the economy was booming.

After twenty years gold was under $300 oz and as low as $250 oz. It was not uncommon to hear things like “gold is dead” and “who needs gold?”

This was another example of most people’s misunderstanding about gold’s value. Its price had dropped considerably so the inference of a “loss in value” and a “bad investment” were assumed.

However, all during 1980-2000 the US dollar was stable or stronger. With the apparent effects of inflation on the wane, the US dollar found favor on a world-wide basis.

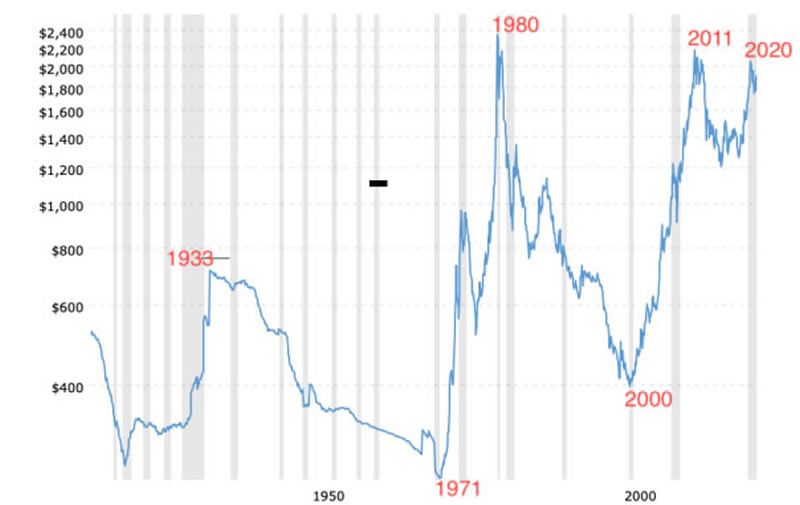

Periods of rising gold prices and a weaker dollar contrasts with other periods of declining gold prices and a stable or stronger US dollar. See the chart below…

There are five major turning points for gold’s price that are reflected on the chart. All five turning points (1933, 1971, 1980, 2000, 2011) coincided with major turning points in the US dollar.

Gold is priced in US dollars and since the US dollar is in a state of perpetual decline, the US dollar price of gold will continue to rise over time.

There are periodic changes in US dollar valuations and these changes can last for years, such as 1980-2000 and 2011-2016. During such periods the price of gold can and does decline considerably. We are seemingly in such a period now.

Over the past year and one-half the price of gold has declined reflecting strength and stability in the US dollar. To what extent the decline continues depends on how the US dollar fares.

GOLD – NOTHING ELSE

Whenever I am asked about gold, I preface my remarks by stating that gold is not an investment. Most usually take exception to that proclamation. Some even get angry.

Nevertheless, it is true. Gold is not an investment; nor, is it a hedge against inflation. In fact, even gold is subject to inflation.

Gold’s price is not Influenced by political instability, social unrest, insurrection or war. It does not change in price or value due to headline economic statistics or a weak economy.

Gold is not correlated in any manner to interest rates, the stock market, inflation expectations, etc.

The ONLY reason for the higher price of gold over time is continual loss in purchasing power in the US dollar – nothing else.

CONCLUSION –

Believing in false fundamentals leads to unrealistic expectations. Those unrealistic expectations usually end in disillusionment; and they can be accompanied by financial loss.

As far as gold is concerned the entire precious metals arena is awash in proclamations and predictions that have no real fundamental basis.

(also see: The Gold Price And Inflation)

Kelsey Williams is the author of two books: INFLATION, WHAT IT IS, WHAT IT ISN’T, AND WHO’S RESPONSIBLE FOR IT and ALL HAIL THE FED!

By Kelsey Williams

http://www.kelseywilliamsgold.com

Kelsey Williams is a retired financial professional living in Southern Utah. His website, Kelsey’s Gold Facts, contains self-authored articles written for the purpose of educating others about Gold within an historical context.

© 2021 Copyright Kelsey Williams - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.