The Avoidable Ukrainian Crisis, the unavoidable global hit

Politics / Ukraine War Mar 14, 2022 - 09:37 PM GMTBy: Dan_Steinbock

To Russia and Ukraine, the crisis is an existential issue. To the US/NATO, it's an enlargement power play. To Europe, it spells a new era of uncertainty. In the world economy, it takes us all closer to an edge.

The Ukraine crisis did not come out of the blue. It was allowed to happen. How did we get here?

The dominant view is to blame everything on Russia, as international media largely does. But critics and peace advocates see other factors as well. In effect, there’s four plausible scenarios and they are not mutually exclusive.

Brzezinski’s trap

The idea to trap Russia in a Ukrainian quagmire may go back to 1979. That’s when President Carter signed the first directive for secret aid to the insurgents against the pro-Soviet regime in Kabul. And Zbigniew Brzezinski, his security adviser, declared the aid would "induce a Soviet military intervention." Hence, the financing, arming and training of Islamic extremism, including Osama bin-Laden.

The trap resulted in the CIA’s Operation Cyclone, supported by the British MI6, with costs soaring to $630 million per year by 1987. It profited Pentagon’s big defense contractors (Figure 1).

Four Scenarios

[Upper left] Afghan mujahideen with Pres. Reagan in 1983 (Wikimedia). [Upper right] NATO enlargement from 1949 to present (Wikimedia). [Lower left] Victoria Nuland with Oleh Tyahnybok of the far-right nationalist Svoboda; Vitaly Klitschko, center-right Mayor of Kiyv; Arseny Yatsenyuk, championed by Nuland as Ukraine's PM, whose reforms nearly collapsed the economy in the mid-2010s. {screen capture: France 24, 2014). [Left] RAND’s "Overextending and Unbalancing Russia" (screen capture, RAND 2019).

After the first terrorist attack in the World Trade Center in 1993, another followed in 2001 in which 3,000 people were decimated. That led to misguided wars and two decades of counter-insurgency operations with costs exceeding $8 trillion, according to U.S. think-tanks. It was a bonanza to defense suppliers and private paramilitaries.

NATO expansion, Nuland’s regime change

To regime-change strategists, Ukraine is just another Afghanistan or Iraq. Hence, the uses of Ukraine’s far-right and white supremacist paramilitaries in progressive escalation (see my “Ukraine's denied development, Blackwater and NATO plans,” TMT, Mar 7, 2022). Hence, the second scenario: the NATO expansion.

However, as U.S. foreign policy leaders foresaw in 1997, NATO’s enlargement would likely result in bilateral mistrust and new conflicts, even a new Cold War (see my “Ukraine crisis, global fallout: colossal failure of diplomacy,” TMT, Feb. 28).

The third explanation stresses the role of the key actors during the 2014 crisis, including president Obama’s VP Joe Biden and deputy national security advisor Antony Blinken, and Biden’s top security aide Jake Sullivan. The key role in Ukraine belonged to Victoria Nuland. Now all four are back.

As a former co-founder of the neoconservative Project for the New American Century and as a board member of the National Endowment for Democracy, Nuland has long promoted regime change in Russian economy.

As secretary of state Blinken’s right hand since May 2021, she has pushed for the administration's elevated anti-Russian sanctions to “punish Putin” and “fuel Russian unrest.”

RAND’s plan

The fourth scenario is the RAND report “Overextending and Unbalancing Russia” (2019), aiming to derail Russia’s economy. In this view, Ukraine is the means, not the objective. The ultimate target is Russia’s economy.

The objective is to exploit Russian reliance on gas and oil exports, by weaponized commercial and financial sanctions. Europe is incited to decrease Russian natural gas imports, which will be replaced by US natural gas.

A central role belongs to the ideological and information front – read: international media – to derail Russia’s international image and promote protests in the country.

In the military front, US must get European NATO countries to increase their forces against Russia. Consequently, EU countries, which are most exposed to Russian trade, will suffer the worst economic hit, unlike the US which is least exposed.

The crisis benefactors feature Pentagon’s big defense contractors, which supply for the Pentagon and national security agencies, which finance RAND itself.

Potential for "one of the largest energy shocks ever"

Due to the central role of both Russia and Ukraine in the global agricultural markets, the crisis will have a highly adverse impact, especially in the poorest developing economies. The Commodity Index (CRB) has increased 63 points or 25 percent since the beginning of 2022 (Figure 2).

Figure 2 Commodity Index

Source: Trading Economics, Difference Group

Before the crisis, the Biden administration declared that sanctions would be highly targeted and not harm the Russian people. The pledge was quickly reversed. As the sanctions were launched, they hit Russian economy and its people. Rapidly, oil prices surged to their highest level since 2008, driven by the escalating proxy/hybrid conflict. Given Russia’s key role in global energy supply, the global economy, as Goldman Sachs has predicted, "could soon be faced with one of the largest energy supply shocks ever."

How bad could it get?

Goldman Sachs’s three scenarios range from a resumption in exports in the coming months to a sustained two-thirds reduction of Russian seaborne exports. Amid the “still intensifying military conflict, escalating Western sanctions and growing isolation of Russia,” GS currently expects a base case of 1.6 million barrel/day disruption. As a result, it raised the 2022 Brent spot price forecast to $135 per barrel.

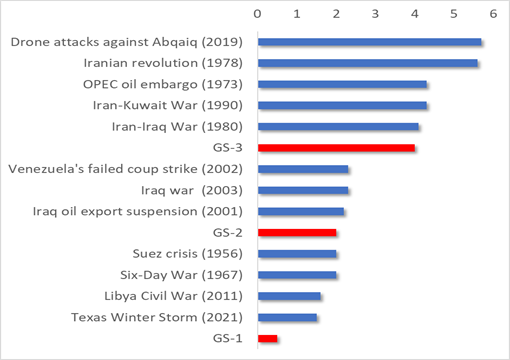

The most benign scenario (GS-1) is an underestimate. The medium scenario (GS-2) would require proactive diplomacy. Without such initiatives, the world economy could inch toward the severe scenario (GS-3). If these figures are set in the context of the largest past disruptions (Figure 3), an Iraq War or Iran-Iraq War-like scenario cannot be excluded. And due to the downside risks, it could get a lot worse.

Figure 3 Largest post-war oil supply disruptions

Source: Peak supply loss in millions of barrels per day. GS scenarios in red color. (Data: Goldman Sachs; Difference Group)

Sanctions inching global economy too close to the edge

Whatever the cause – Russia or Putin, Brzezinski’s precedent, NATO expansion, Nuland’s designs, RAND’s plan, or a mix of these all - the ongoing sanctions approach to the crisis risks making a horrible status quo far worse. Here’s why.

First, Russia is no Afghanistan. It’s a $1.8 trillion economy and the world’s 11th largest. And it is a global supplier of oil and natural gas, plus a major nuclear power.

Since the onset of the US trade wars, global recovery has been undermined. The world economy is far more fragile today than in the pre-trade war 2017.

Third, the global pandemic and the consequent global depression has reversed all economic progress since 2008. The effect? Lost years in most high-income economies, lost decades in many poor economies. As a result, the Ukraine crisis comes at a time when the world economy can least cope with it.

Fourth, the new Cold Wars and military responses will steer fiscal packages away from welfare and security, where they are most needed, toward military rearmament drives, which only benefit the world’s largest defense contractors.

Fifth, as the Federal Reserve will begin its rate hikes in the coming weeks, the impending energy and commodity crises, escalated by the sanctions, will result in downgraded global growth prospects, once again. That will hurt most the world’s most vulnerable economies.

Taken together, these factors pushed world economy closer to the edge before the Ukraine crisis, while the impending rate hikes will reinforce the downside risks.

The misguided sanctions will not bring peace, but they do have potential to amplify the impending economic disasters worldwide.

Dr. Dan Steinbock is the founder of Difference Group and has served at the India, China and America Institute (US), Shanghai Institute for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

© 2022 Copyright Dan Steinbock - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dan Steinbock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.