Germany's DAX: What You Can Learn from the 2007 Stock Market Top

Stock-Markets / Stock Market 2022 Apr 03, 2022 - 06:27 PM GMTBy: EWI

Why investors should be aware of a divergence between stock prices and consumer confidence

Among the scores of stock market indicators, there's at least one that may be off many investors' radar screens.

And, that is the trend in consumer confidence. Specifically, a peak in consumer confidence tends to precede a peak in the stock market.

With that in mind, back on Nov. 25, the Telegraph said:

Consumer confidence has dropped sharply in Germany. ...

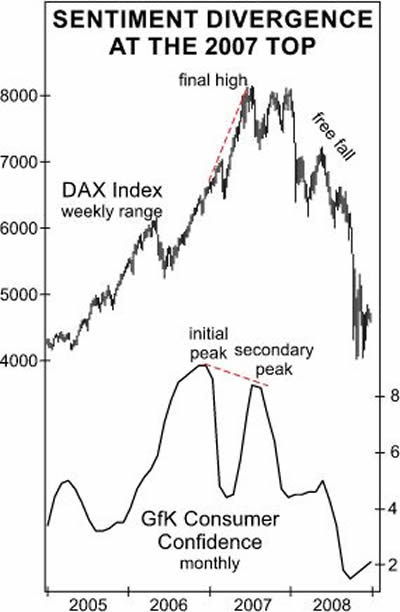

A few days later, the December Global Market Perspective, a monthly Elliott Wave International publication which offers coverage of 50-plus worldwide financial markets, provided a retrospective of Germany's DAX and consumer confidence with this chart and commentary:

As the DAX approached its July 2007 peak 14 years ago, a telling divergence popped up between stock prices and consumer confidence. The GfK Consumer Confidence indicator, which surveys about 2,000 households every month, reversed in December 2006, seven months before the DAX reversed. Consumer confidence fell for three months, and then rallied to a secondary but lower peak in July 2007, coinciding with the stock market's final top on July 13, 2007. Only then did the bottom fall out.

Market history usually does not repeat exactly, however, do know that the DAX is trading lower than it was at the time of that big drop in consumer confidence, which the Telegraph reported in November.

The key takeaway is that consumer confidence tends to trend with stocks.

Indeed, here's one of the more recent headlines about consumer confidence in Germany (Dow Jones Newswire, Feb. 23):

German Consumer Confidence Is Expected to Continue Its Downward Trend

Does this mean that a big crash is just ahead for Germany's main stock index?

Well, you can get a good idea of what to expect next for the DAX as you look at the index's long-term Elliott wave labeling in the March Global Market Perspective. Inside the same issue, you'll find analysis of the DAX's price-to-sales ratio, as well as the price-to-book ratio.

If you'd like to learn about labeling Elliott waves on a stock market chart, you are encouraged to read Frost & Prechter's Elliott Wave Principle: Key to Market Behavior. Here's a quote:

All waves may be categorized by relative size, or degree. The degree of a wave is determined by its size and position relative to component, adjacent and encompassing waves. [R.N.] Elliott named nine degrees of waves, from the smallest discernible on an hourly chart to the largest wave he could assume existed from the data then available. He chose the following terms for these degrees, from largest to smallest: Grand Supercycle, Supercycle, Cycle, Primary, Intermediate, Minor, Minute, Minuette, Subminuette. Cycle waves subdivide into Primary waves that subdivide into Intermediate waves that in turn subdivide into Minor waves, and so on. The specific terminology is not critical to the identification of degrees, although out of habit, today's practitioners have become comfortable with Elliott's nomenclature.

You may be interested in knowing that you can access the entire online version of the book -- free!

That's right -- all that's required for free access is a Club EWI membership -- which is also free. In case you don't know, Club EWI is the world's largest Elliott wave educational community, and members enjoy complimentary access to an abundance of Elliott wave resources on financial markets, investing and trading -- with zero obligation.

Get started right away by following this link: Elliott Wave Principle: Key to Market Behavior -- free and instant access now.

This article was syndicated by Elliott Wave International and was originally published under the headline Germany's DAX: What You Can Learn from the 2007 Top. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.