Stock Market BULL Trap SET!

Stock-Markets / Stock Market 2022 Sep 24, 2022 - 12:12 AM GMTBy: Nadeem_Walayat

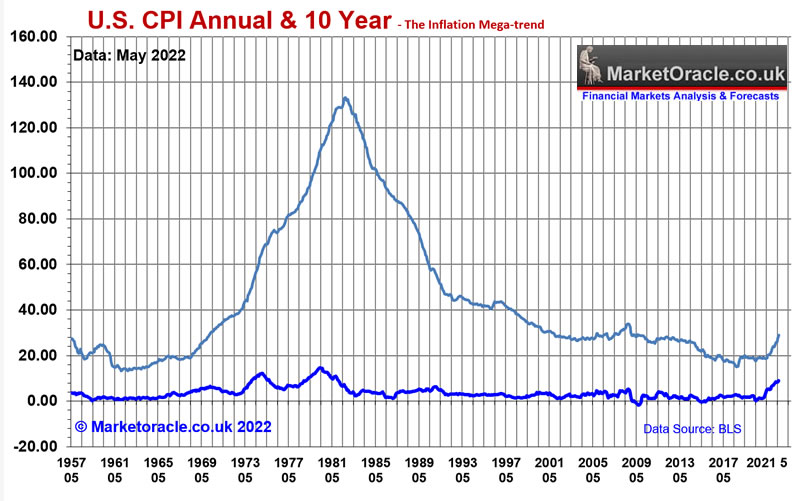

Stock Market FOMO's to 4280 Friday close ending at the high of the day! Short covering rally triggered by CPLIE of 8.5% down from 9.1% for June, all blind to the reality of what Inflation above 4% let alone above 8% actually means for the US economy and how it impacts the every day lives of ordinary americans that are destined for greater pain with each passing month even if CPLIE nose dives to under 4% which will make NO difference in terms of the Inflation pain that I suspect will run for the whole of this decade as the 10 year inflation graph warns of what looks set to come to pass. It's not rocket science, it's the consequences of over $9 trillion of QE, and $35 trillion of total GLOBAL money printing QE, the only way it won't show up in the inflation indices is if they systematically exclude everything that goes up in price, perhaps only leaving the ball point pen that Jerome Powell fidgets with at every Fed meeting.

Everyone is asking the same question is the Bear market over?

Is the bear over?

We need a RETEST of the lows, at this point the most probable outcome is a CORRECTION to a higher low. in the range of 3720 to 3920 where if I had to pick a number it would be 3820. So I see this rallies demise as being imminent, as the extent of the rally has FILL FILLED everything that a BULL TRAP rally would require to inflict maximum PAIN on all those who FOMO 'd into the latter stages of the rally after a few minutes of watching the fools on CNBC who are like reeds blowing in the wind.

SWINGS - In terms of price the rally has been very powerful, up 15%, but in terms of time the up swing is on par with that of the March rally, today (Monday) reaching up 32 days vs 33 days in March..

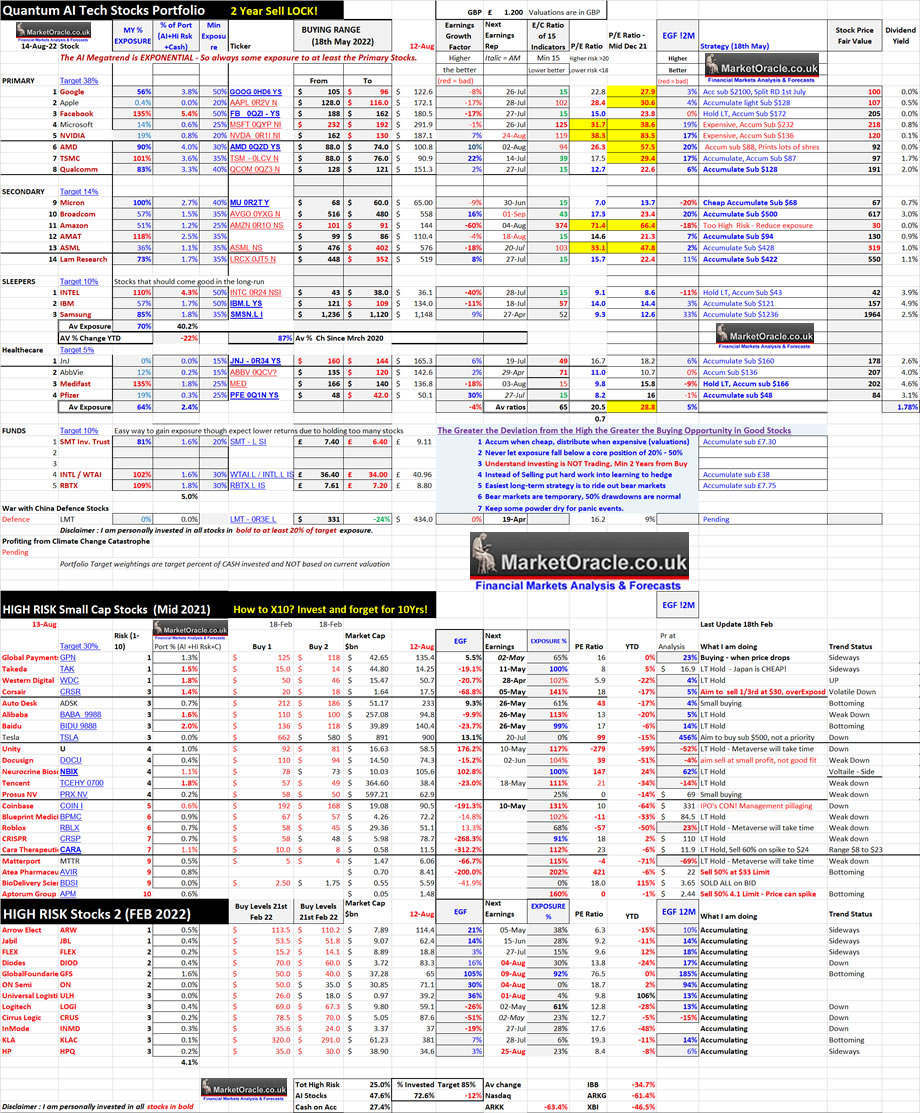

But at 4290 I can imagine it definitely is hard to fight against the FOMO! Whilst I have completed most of my trimming of what I over bought near the lows, with only a few significant sell orders remaining pending in the likes of AMD and TSMC rallying, which leaves my current exposure at 72.6% invested. This is what it feels like perched at the top of a powerful bull run that has galvanised many talking heads to forget that we are technically still in a BEAR MARKET. So as the rally continues on Monday with the S&P at 4290 as I write I am seeking further opportunities to lightly trim my holdings in advance of the NEXT LEG down which I see as IMMIINENT! Probably no more than being a day or so away from getting started.

Table Big Image - https://www.marketoracle.co.uk/images/2022/Aug/Quantum-AI-tech-stocks-portfolio-12-8-big.jpg

As for THE bottom, I know from past experience that we will only know where the bottom is in when looking in the rear view mirror and without the benefit of hindsight all one can do is position oneself based on ones scenarios to -

a. capitalise on the bear market by accumulating target stocks at new lows, which is NOT EASY TO DO as those who bought Medifast recently got a taste of! Yes, in hindsight buying Medifast at below $130 will look like a great buy, BUT right then and there it was literally a case of "Oh My God it could go to ZERO!", which is as it has been when buying EVERY stock at new lows, easy in hindsight but at the time, at the low, it's a case of JUST GETTING THE JOB DONE!

On the short-term the stock market has now virtually fulfilled all of my expectations for how far this rally could go by punching through resistance at 4180 by adding 100 points to get to 4280 by Fridays close, the last level standing for the bears is a rally to above 4300, maybe to as far as 4333 which I am pretty sure will have wiped out any remaining bears, nursing their wounds unwilling to entertain new shorts at probably the top of the rally, meanwhile 4300 will be accompanied by even more FOMO buying in the fantasy that new all time highs are the markets next destination, so even though we are at 4290, I suspect the trend through 4300 is going to prove short lived rather than act as a base for a run to 4400, and so the sell off could begin before Monday's close with the downswing taking the market to below 4000 for which there are many indicators such as most Semi's / Tech's not following this rally to new swing highs, VIX is now well below 20, Bond market yields reversed their earlier dip, 2 year went form 3.3 to 3.1, ending Friday at 3.21. So the stock market is due a deep pull back with lots of indicators suggesting so.

So my expectations are for an imminent correction that will take the S&P over the coming weeks to BELOW 4000. Beyond which I am working on my next in-depth analysis that is on par with that of my September 2021 analysis which at that time laid out a guide for what to expect for the stock market for 2022 that so far has proved very reliable even beyond the original forecast range of Sept 2021 to May 2022, as it firmly placed a bear market in ones expectations and that the Dow would end 2022 lower than where it began the year, all back in September 2021!

Stock Market FOMO Hits September Brick Wall - Dow Trend Forecast Sept 2021 to May 2022

"As for beyond April 2022, stocks could be in for a rough patch, even a bear market of sorts for a good 6 months."

I aim to complete this mega analysis before the end of this week to conclude in a detailed trend forecast that will seek to update my existing trend expectation..

In the meantime here as an excerpt from my forthcoming analysis -

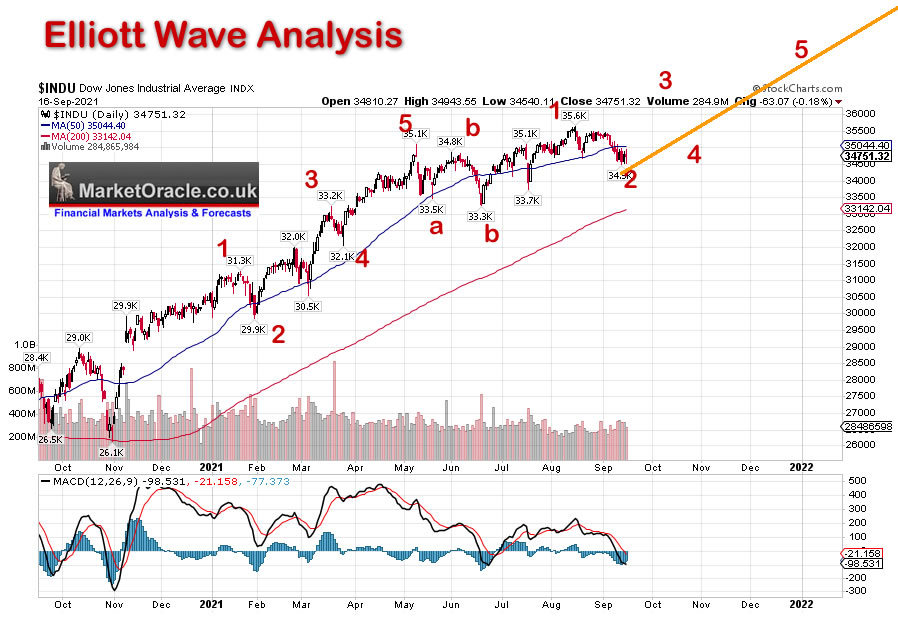

ELLIOTT WAVES

Despite being skeptical of Elliott wave theory and not abiding by any of it's tenants, i.e. I number the counts as I see them regardless of following the 'rules'. Nevertheless Elliott wave proved a useful tool during 2021 in the count down to the end of the Stocks bull market and the start of this bear market as the charts illustrate that there are times when EW BS actually works!

So what does my 'skeptical' interpretation of elliott wave theory suggest for the remainder of 2022? The June bottom being a 5 wave decline to mark the A wave down, that if true should result in a powerful B wave rally that far exceeds the preceding bear market upswings, so far so good.

The FUTURE - What comes next should be a C wave decline that could either comprise 3 waves or 5 waves, since wave A comprised 5 waves then that suggests C wave will likely comprise 3 waves! Therefore EWT suggests a volatile trend to a new Dow low probably by late October targeting approx 28,600 which then should give birth to a NEW stocks BULL MARKET!.

The alternative count is...... there is no alternative count, alternative counts are for losers who hedge their bets.

Now imagine if I left my analysis at that, and the above came to pass, Roll over Prechter there is a new EW kid in town! This coin flip theory actually works! Though only if one is SKEPTICAL and FLEXIBLE in it's application and does not allow oneself to get carried away by the hype that it tends to engender in it's followers and high priests, as it can help focus one mind on price action to the extent that ones neurons fire in blast of activity to reveal a pattern that one has seen countless times before and hence has had imprinted in ones brain's pathways, can it be taught? easily replicated in others? I doubt it.

China Could Deliver the MOTHER of ALL BLACK SWAN's!

Continuing the trend trajectory of China's collapsing insane ponzi property market that is triggering bank runs and CCP crackdowns including the deployment of tanks to meet protesting bank customers who are systematically having their lifetime savings stolen, converted from bank deposits into risky investments in bankrupt developers, then this trend towards financial collapse could result in the mother of all Black Swan events that is not on anyone's radar which is that Chairman Xi Mao Jinping literally presses the RESET button in a new GREAT LEAP BACKWARDS! THAT CHINA COULD ONCE MORE TURN FULL BLOWN COMMUNIST! The slaves got a taste of CCP capitalism which they then erased ALL of the masses hard earned wealth on the click of a mouse button.

THE MOTHER OF ALL BLACK SWANS! COMMUNIST CHINA 2.0!

And if China can press the RESET button and become COMMUNIST than there is a chance of an even BIGGER BLACK SWAN in that the West that once more becomes CAPITALIST! For central banks printing over $35 trillion to monetize government debt is NOT CAPITALISM! it is an extreme form of SOCIALISM! So all those looking forward to the Fed resuming QE need to consider that the more QE the weaker it becomes right up to the point when the powers that be decide that it's no longer working and so it's time for something completely different, PRESSING the RESET BUTTON and ERASING QE because it does not work, too inflationary. That is the WEST's MOTHER of ALL BLACK SWANs! to REVERSE QE back to ZERO.

Anyway I think it would be wise to reduce exposure to chinese stocks on the next bounce, there should be enough time to do so as I doubt most pundits will see this coming until after the fact when it is too late to act.

Your Analyst Preparing to Get Radiated!

Meanwhile in Europe Czar Putrid appears determined for Europe to experience Chernobyl 2.0 as he plays Russian roulette with Europe's largest nuclear power plant at Zaporizhzhia as it gets shelled as the russians use it as cover for it's artillery and missile launchers aimed and firing at the Ukrainian city of Nikopol some 12 miles distant. These nuclear monsters at the best time are barely under control, let alone when smack bang in the middle of a war zone with shells landing left, right and centre. Europe could be heading for major deliberate nuclear disaster which I am sure will be timed for when the wind blows WESTWARDS!

So it's back to being ready to pop some pills, for the Pandemic it was Vitamin D, for Czar Putrid it's Potassium Iodide to protect ones Thyroid gland from radioactive Iodine, at the moment this is not on the radar of most folks ,so there is no mad rush to buy Potassium Iodide tablets, yet!

Apparently the daily dose for adults is 130mg in the event of a nuclear event. And don't expect Britain's useless NHS is to do anything until the nuclear event is long past, so 10 quid looks like a fairly good investment, though when the nuclear SHTF prices will multiply and what stock that will be left to buy will probably be under dosed to being completely useless Vegan versions.

Your in the event of an air attack warning duck and cover practicing analyst..

Nadeem Walayat

Copyright © 2005-2022 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.