U.S. Real Estate Market: A 24% Problem

Housing-Market / US Housing Jan 19, 2024 - 05:12 AM GMTBy: EWI

"...24% of U.S. single family homes are owned by investors."

A big reason that U.S. home prices have skyrocketed is that big investors like corporations did a lot of buying.

As a Redfin.com headline noted nearly two years ago (Feb. 16, 2022):

Real Estate Investors Are Buying a Record Share of U.S. Homes

Redfin defined an "investor" as any institution or business which purchases residential real estate.

As Elliott Wave International has said, when houses are treated like stock certificates instead of shelter, prices can rise and fall just like with the stock market.

The February 2023 Elliott Wave Theorist, a monthly publication which provides analysis of noteworthy financial and social trends, explained that what occurred with the housing boom 15-20 years ago has been happening again:

Today, real estate prices have reached absurdly high prices because corporate investors have taken over the housing market from individuals in a program encouraged, once again, by the federal government.

Robert Prechter's book, The Socionomic Theory of Finance, drives the point home in a nutshell:

When the bulk of participants in the market are consumers who think of houses as shelter, prices are stable. When a significant portion of participants in the market are speculators who think of houses as investment items, prices soar and crash.

So, we know that prices have already soared. Is a crash just around the corner?

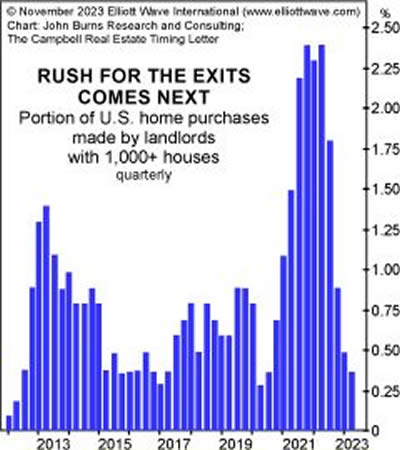

Here's a chart which shows the portion of U.S. home purchases made by landlords with 1,000 or more houses and commentary from our December Elliott Wave Financial Forecast, a monthly publication which offers analysis of major U.S. financial markets:

The chart [reveals] the percentage of U.S. homes purchased by landlords who own more than 1,000 homes [and] shows the unrivaled extent to which homes became financial assets. ...

The sharp decline from 2.5% of all home purchases to less than 0.4% represents another light-switch decline for the economy. At this point, ATTOM Data Solutions, a provider of U.S. property data, notes that 24% of U.S. single family homes are owned by investors. If 10% went on the market in the next year, 2.4 million homes, the inventory of homes for sale would triple from current levels.

One thing we do know is that the median price for new homes sold in the U.S. is beginning to decline.

This is not surprising because history shows that a slackening off of home sales generally precedes a drop in prices, and the peak in new home sales occurred in August 2020. Here's the latest headline on that front (Reuters, Dec. 22):

US new home sales fall to one-year low in November

What's also important to keep in mind is that real estate prices typically follow the stock market. Both are governed by the trend in social mood, which expresses itself as Elliott wave patterns on price charts. That's why, if you're looking to buy or sell a home, or simply want to get a high-confidence idea of whether the value of your home will be higher or lower in the months and years ahead, you may want to keep an eye on the stock market trends.

If you're unfamiliar with Elliott wave patterns, read Frost & Prechter's definitive text on the subject, Elliott Wave Principle: Key to Market Behavior. Here's a quote from that book:

Any dedicated student can perform expert Elliott wave analysis. Those who neglect to study the subject thoroughly or apply the tools rigorously give up before really trying. The best learning procedure is to keep an hourly chart and try to fit all the wiggles into Elliott wave patterns while keeping an open mind for all the possibilities. Slowly the scales should drop from your eyes, and you will be continually amazed at what you see.

You can read the entirety of the online version of Elliott Wave Principle: Key to Market Behavior for free.

All that's required is a Club EWI membership, which is also free. Club EWI is the world's largest Elliott wave educational community with approximately 500,000 members. Members enjoy complimentary access to a treasure trove of Elliott wave insights into financial markets, trading and investing.

Get started now by following this link: Elliott Wave Principle: Key to Market Behavior -- free access.

This article was syndicated by Elliott Wave International and was originally published under the headline U.S. Real Estate: A 24% Problem. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.