Bursting Of The U.S. Treasury Bond Bubble: Not So Fast!

Interest-Rates / US Bonds May 08, 2009 - 02:22 AM GMTBy: Guy_Lerner

The yield on the 10 year Treasury bond has spiked 10% in the past two weeks, and many are now jumping on the "bonds are the next bubble to burst" bandwagon. I was one of the first to be bearish on Treasury bonds calling for the likelihood of a secular trend change back in December, 2008 and a top in back in February, 2009. Higher Treasury yields are in our future, and it isn't a matter of if but when.

The yield on the 10 year Treasury bond has spiked 10% in the past two weeks, and many are now jumping on the "bonds are the next bubble to burst" bandwagon. I was one of the first to be bearish on Treasury bonds calling for the likelihood of a secular trend change back in December, 2008 and a top in back in February, 2009. Higher Treasury yields are in our future, and it isn't a matter of if but when.

Over the past 6 months in these commentaries, I have highlighted several fundamental dynamics that were sure to keep yields low. Now it appears these concerns are unfounded. One of these fundamental dynamics was continued and unfettered buying of our bonds by sovereign wealth funds. However, this now appears less likely as foreigners (i.e., China) have expressed concern over trends in the dollar and with the USA's current liabilities. Another dynamic that was sure to keep yields low was the Federal Reserve's announcement to buy $300 billion in Treasury bonds over the next 6 months.

Despite this quantitative easing, yields are higher today than when the Fed invoked the "nuclear option". The last reason for lower yields was economic weakness, or rather, it would be unusual for yields to rise during a recession. As discussed in "Maybe The Bond Market Is Right", yields generally rise well into an economic recovery. However, with the sprouting of "green shoots" and incessant talk of the economy finding a bottom - not recovery - yields are now moving higher. Remember the economy has only stopped going down; growth is somewhere off in the distance down a very bumpy road, and yields are already spiking.

So why are yields rising? Simple, it is supply and demand. Having to finance our recovery - or mortgage our future - with the creation of several trillion dollars of debt is causing yields to rise.

The government has been flooding the market with new Treasury issues, and investors are demanding higher yields.

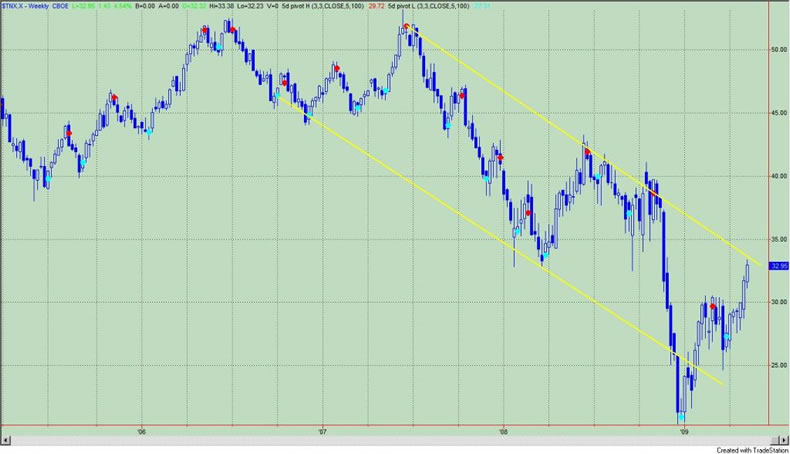

But the title of this article suggests that I am not on board with the bursting bond bubble - as in hold on, not so fast. So let me state again: higher Treasury yields are in our future, and it isn't a matter of if but when. My hesitation comes from the weekly chart of the 10 year Treasury yield shown in figure 1. As you can see, yields are butting up against an 20 month down trend line at the top of a channel, and from a technical perspective I have a hard time seeing yields pierce through these levels so easily.

Figure 1. 10 Year Treasury Yield/ weekly

In particular, if I am expecting stock market weakness - and this would likely be on concerns for sub par growth or some such nonsense - then yields should head lower. With "everyone" expecting the bursting of the bond bubble, I doubt such an event will come so easily or when investors are expecting it.

For the record, the secular trend for higher yields on the 10 year Treasury bond will be confirmed on a monthly close greater than 3.43%. And let me go on record now, and say that this will happen by the end of the third quarter of this year.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2009 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.