Stocks Bull Market End Game Bear Start Strategy Part 2

Stock-Markets / Stocks Bear Market Aug 09, 2025 - 05:01 PM GMTBy: Nadeem_Walayat

Dear Reader

This is part 2 of 2 of my extensive analysis in preparations for the next bear market, part 1 was emailed / posted a ferw days ago - Stocks Bull Market End Game Bear Start Strategy

The whole of this article was first made available to patrons who support my work, so for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

Stocks Bull Market End Game Bear Start Strategy

CONTENTS

Money Printer Getting Ready to go Brrr

Trumponomics Breaks the US Dollar

S&P Correction Trend

Deviation Against Stock Market Trend Forecast

Recession Self Fulfilling Prophecy

Next Stocks Bear Market How Bad Could it Get?

AI Stocks Portfolio Current State

Buying the Dip

Elon's Butt Must Hurt

Stocks Bull Market End Game Strategy in Brief

PSYCHOLOGY FOR SUCCESSFUL BEAR MARKET INVESTING!

Bull / Bear Strategy To Do List

The During the last legs of the bull market

During the bear market

Road Maps and Ongoing Analysis

Post bear market

FX Impact - Sterling Bear Market Hedging

AI Tech stocks During a BEAR MARKET

Draw downs from 2021 highs to lows 2022 lows

Best and Worst Stocks to Hold During the Nest Bear Market

Agent Orange Stock Market / Financial System Doomsday Scenario

Most Recent analysis -

AI Tech Stock Earnings Into Stock Market Correction Window

CONTENTS

S&P Base Case Achieved

US Interest Rate Cut - Becareful What You Wish For!

AMD at $180, Do You Feel Lucky?

AI Stocks Portfolio

MSFT $512 - EGFS +5%, +9%, Dir +1%, PE ranges 116%, 89%

META $700 - EGFS -4%, +5% Dir -16%, PE ranges 97%, 91%

LRCX - $99 - EGF 24%, 10%, Dir +108%, PE Ranges 125% / 108%

QCOM $162 - EGFS -2%, 5%, Dir -16%, PE ranges 35%, 28%

AMAZON $231 - EGF's -5%, +11%, Dir -20%, PE Range 38%, 17%.

KLAC $702 - EGFS +19%, +22%, PE ranges 138%, 89%

Stocks Bull Market End Game Strategy in Brief

1. Reduce exposure to stocks

2. Build up cash on account

3. Retain exposure to core holdings.

4. Neutralise FX risk

5. Profit from the bear market.

1. Aim to get the amount invested down towards zero, easier said then done i.e. AMD is 140% invested whilst META is 8% Most are sub 100% so AMD is the outlier.

2. The plan to increase cash on account by trimming as stocks run to bull market highs .Exiting crypto's in their final bull run could add 10% to portfolio cash of 22% if things pan out as expected, So overall exiting crypto's and trimming stocks should see my portfolio get to about 40% cash by the time the next bear market starts vs 22% today.

3. Retain Exposure to Core Holdings

The 2022 bear market illustrates this fact that IF one had sold none of the primaries and secondaries and just held all the way through the bear market, perhaps adding during the dips then where would one stand today? Every stock would have delivered a gain vs where the stock stood at the peak of the last bull market, all without having sold a single share for the duration, so food for thought for all those who FEAR a market drop, And it gets even better for non US investors as during bear market distress the US dollar tends to go up and boy did it go up, sterling dropped 33%! Imagine as a UK investor your portfolio drops by 1/3rd but so does sterling and thus where's the draw down?

So do not fear a bear market, it is above all else a buying opportunity, and UK ./ Euro investors should think twice of panic selling just because a bear market looms because as I voiced during the last bear market, I SOLD TOO MUCH in the run up to the top which became apparent during the bear market as I attempted to rebuy what I had sold which is easier said then done! So for the next bear market I aim to hold on to more than I did last time.

4. Neutralise FX

EUR / GBP will FALL during the next bear market so one should seek safe havens in either the US Dollar or the likes of the Swiss Franc. Since one is seeking to BUY US stocks then one should seek to hold cash in DOLLARS.

5. Profit from the bear market, to do so means shorting stocks or go long short ETFS such as XSPS, this is always going to be a marginal exercise i.e. like crypto's I can't see myself committing more than about 5% of my portfolio to such an exercise, especially as shorting carries a far higher risk than being long even during a bear market! Anyway a none leveraged short ETF such as XSPS could prove useful

PSYCHOLOGY FOR SUCCESSFUL BEAR MARKET INVESTING!

Forget about THE TOP - DISTRBUTE during the bull market

Forget about THE BOTTOM - ACCUMULATE during the bear market.

Folk need to get experienced in the act of pressing the sell button as the price goes higher without regard to where the stock will top, it's called trimming, the more expensive a stock gets the more one trims. take TSLA, the higher it went the more I sold, yeah sure I had a target price in mind for Tesla which was that it probably could get to about $440, but I wasn't waiting for $440 before I started selling, having over exposure I started selling well before $440 and once it reached and breached $440 I continued selling the higher it went the more I sold, for instance at $480, $500+ looked doable but as I told folk I'm not going to wait for $500 before selling because at $480 the potential rewards is $20 for a potential $200 risk i.e. Tesla could drop to below $300 so why am I going to risk $200 of profit for just an extra $20, yes it would be great of Tesla continued higher to beyond $500 and if it did I would continue selling what I held but as I warned at the time there are a lot of investors who have placed their sell orders at $500, trying to play the game of picking THE TOP! Well the highest Tesla got to was $488, folk risked $200 profit for an extra $12 bucks?

Forget about THE Top or the Bottom, alls one needs to do is to sell for more than one bought, and same its the same all the way down, to buy for less than one sold, and that's it! Whilst the most often question folk ask me where will x stock top or bottom, yeah I can give my best guess but for me it's not what I focus on which is what price did I buy at and what price did I sell at. Waiting for tops and bottoms will get you killed as it has all those who were waiting for $500 which looked doable at $486 but it was not worth the risk!

So as stocks fall one wants to accumulate at a price that is LESS than where one sold / trimmed during the bull market, where the more a target stock falls the more one accumulates.

Most investors want an easy ride with little work, they want X price to buy and Y price to sell, but that strategy as Tesla illustrates is VERY HIGH RISK. The same will be true on the way down, so yes buy some Tesla at $320, but if that breaks it targets $270, so buy some more at $270, yeah but if that breaks Tesla targets $200 so buy some near $200 but if that breaks then Tesla targets $140! See that's effectively what the buying ranges are. They are NOT Bottoms, they are where prices during a correction should trade THROUGH to enable one to accumulate.

The biggest mistake folk make is that they think they can act with the benefit of hindsight i.e. at say Tesla $230, they should not have bought any Tesla at $320. But you only KNOW that for sure with the benefit of hindsight. Yes, I warned that Tesla could trade down to under $200 but that's not good enough when it comes to the profession of investing, what one seeks is to accumulate and distribute with an eye on the spread between that were one bought, and then sold and then re-bought so I roughly know I sold a lot of Tesla at an average price of $440, which means buying back some at $320 is an effective rebuy at $200. That's a lot better then just holding on to what ones got waiting for fantasy prices of $650 as many were on the likes of fool tube and twatter. I've stopped posting videos on fool tube because there is no point, as I spend 90% of my time on analysis and maybe 10% left to production to make the video look good, Whilst fool tubers from what I can tell just regurgitate what others have already said, so 0% on analysis and 100% on production value, I can't compete against that so no point posting videos.

Buying ranges are an aid so as not to buy too early in a trend, they are not forecasts for where a stock will bottom, I can give a best guess, i.e. such as for AMD when above $180 when asked I would comment I would not be surprised if AMD fell to $110, that does not mean I am going to WAIT for $110 before buying any, especially in a bull market because we will only know THE LOW with the benefit of hindsight, alls I know is what the metrics say in whether a stock is expensive or cheap and act accordingly.

So I will give bear market targets for stocks once the stock market has topped some will be very close, some will be way off,. most will likely be within 20% of the eventual low, but I won't be waiting for THE lows because we will only know for sure with the benefit of hindsight. In actual fact I may not do that much different for the AI tech stocks than what I am already doing, i.e. keep buying the dips as exposure gets to and passes 100%. Of course it's much better to start at a low percent invested then being already at over 100% invested such as for AMD (142%) but this also means AMD has less downside risk.

Following are brief lists of what to do that maybe useful to print out and stick your wall.

Bull / Bear Strategy To Do List

1. Concentrate holdings in core AI stocks i.e. based on potential and valuations and robustness of their financial position in terms of cash and debt levels.

2. Reduce exposure to high risk junk stocks as opps present themselves to do so i.e. the likes of Roblox which now stands at 50% invested of target.

3. Build up a sufficient cash mountain for the bear market, my objective is to reach 40% cash, by the end of the last bull market I was at approx 60% in cash.

4. Deploy strategies to counter negative FX impact i.e. the US dollar will strengthened during a bear market which means sterling investors will feel the pain, so varying strategies deployed to mitigate the impact of fx.

5. Prepared Psychologically for the bear market. Be prepared to see every stock fall by as much as 50%.

6. The objective during a bear market is to gain exposure and NOT make a profit.

7. BUY the PANIC, BUY the DIPS, i.e. buy when the stocks plunge, when fear is at it's maximum, use gauges such as the VIX, and deviation against the 200day moving average.

8. The cash has to last for the duration of the bull market, so pace oneself, i.e. have a maximum limit of how much one commits to stocks each month at 15% in any given month, keep a close eye on ones percent cash, the worst thing is to run out of cash during a bear market.

9. Even if core stocks get crushed like a bug in the rug, understand that it CAN recover during the next bull market, i.e. Amazon lost 90% of it's value during the dot com bust, but those who DCA' d all the way down won big.

10 MARKET PANICS are the best buying opportunities because the rebounds can be swift and near immediate. Bear markets usually end in a blind panic selling capitulation.

During the last legs of the bull market

1. Reduce exposure to high risk stocks.

2. Concentrate holdings in core stocks as they trade at good valuations i.e. percent of PE range columns.

3. Reduce exposure to stocks to a low percent invested going into the bear market so that one has scope to build positions, for instance right now I am 8% invested of target in META, which despite that is 3.9% of my portfolio, that has been achieved through hard work of trimming during the bull market and buying the dips, and similar with many other target stocks i.e/ Broadcom 6% invested, IBM 0%, Amazon 39%.

4. Increase percent of cash on accounts. my target is 40%.

5. Implement fx protection strategies such as sell sterling to buy dollars.

During the bear market

1. Buy the dips, the deviation from the highs and during earnings volatility.

2. Capitalise on panic events such as August 5th 2024 by having limit orders already in place, amend and adjust limit orders as you go along in response to ongoing analysis and price action.

3. Be measured in committing cash to positions, it's going to have to last the duration of the bear market.

4. DO NOT USE MARGIN OR LEVERAGE! Leveraged investors get WIPED OUT during bear markets.

5. Usually one will only know THE bottom in hindsight as all the news is bad and there is no silver lining, alls one can do is to go into getting bloodied by falling knives mode.

6. You are never meant to run out of cash during a bear market, either keep fresh funds flowing or trim on counter rallies at a profit to maintain cash on accounts.

7. Greatly limit buying of high risk stocks as they are a gamble on how low they could go and if they can recover.

8. Ignore the news focus on the valuations and the price action, the news is pure BS, it will tell you to buy when you should sell and tell you to sell when you should buy!

9. Shorting stocks - you are not going to make money shorting stocks even during a bear market, it's going to be hard enough to be focused on getting the buying job done without the contra strategy of trying to profit from shorting stocks.

Road Maps and Ongoing Analysis

Give an edge in terms of the big picture direction of travel i.e. it's a big thing to KNOW we are going into a bear market BEFORE IT BEGINS! Let alone the magnitude of in terms of price and time,

Where focus is on deviation against the trend forecast as well as what unfolding earnings state for each stock in terms of how well they are managing to withstand the recession. And of course if one calls the start of the bear market before it begins then why not call the end of the bear market as well!

(Charts courtesy of stockcharts.com)

By which time I was about 96% invested which means I was nearly out of cash on virtually all accounts, which is the best one can hope to achieve during a BEAR MARKET, to run out of cash right at it's very bottom!

Post bear market.

1. Do not make the mistake of selling for peanuts, this is where many go wrong, after all that hard work and draw down pain suffered many are relieved just to finally break even and sell. This happens every time, April 2020 folk asking me if they should sell at a 20% profit and similar during 2023.

2. Bull markets follow bear markets and tend to be many times that of the preceding bear market in terms of price and time. Unfortunately MSM garbage does most investors in, I mean the rally off the low all the way to a new all time high was ALWAYS A BEAR MARKET RALLY and thus frightened investors tend to get kicked out their positions well before the big moves happen.

June 2023 - S&P 4200

3. Trim over exposure to build up depleted cash levels with an eye on maintaining exposure all the way to new all time highs.

The bottom line do not fear bear markets as typically the S&P drops 25% to 35% over a year or so, whilst bull markets see the S&P first push to a new all time high and then many times that which delivers stocks doubling, tripling and some 10xing.

FX Impact - Sterling Bear Market Hedging

Sterling's total collapse during 2022 thanks to Liz Truss caught everyone by surprise which meant I ran out of dollars long before the October low, and thus converting sterling to dollars to buy US stocks during October 2022 was painful!

Sterling and Euro investors need to be aware of the impact of FX especially when buying US stocks during a bear market because the fall in ones currency can offset much of the fall in the stock price.

Say if Nvidia tops at $200 and one sells all of ones position at an average price of $180 with GBP at 1.4 returning £128.57 per share.

Nvidia falls all the way to $100 and one buys back at an average of $120 but now sterling is at 1.10 costing £109.10 per share.

So whilst the stock has fallen by 50% of which one has managed to capture $60 of the move move by selling at $180 and buying back at $120, however fx means that one is only $21 better off then if one had sold nothing and just held during the bear market!

All that hard work for just a 20% advantage, it's not worth the risk as what if Nvidia had bucked the bear trend and gone higher and you are sat in cash watching from the sidelines!

So FX is an important consideration as is NOT SELLING ALL of ones holdings i.e. to maintain exposure.

So Sterling's blood bath put a dampener on my October 2022 buying spree, whilst the bond blood bath had no material effect on me other than to add further complexity to my analysis at the time. Which means for next time I am going to better engineer my dollar position than last time, hold far more dollars during the bear market and thus I have been seeking mechanism to do so, such as the IBKR SIPP that allows easy low cost conversions, and other mechanisms and funds as such dollar ETFS..

Sterling could drop by 33% during the next bear market, what does that mean for a UK investor?

It means if one expects a stock to drop by LESS than 33% during the next recession then ones better off NOT selling and riding out the bear market! because if worst comes to the worst and say Google drops 33% AND ones sold all and sat in sterling then goes to rebuy and finds that in sterling terms there is no buying opp!

So for UK investors at least, you want to beware that the best thing to do in the run up to a bear market / recession maybe to do nothing and then see how things go during the bear market in terms of buying the dips, that's the easiest thing to do.

GBP 1.29 - Continuing to confirm direction of travel to above 1.3. My long view for the bull market that began October 2022 is that we could see sterling trade to as high as 1.4.

Stocks usually go up strongest with a falling dollar, so strong dollar = weak stock prices, and very strong dollar = bear market. So folk need to understand this fact, it's not a case that Nvidia has gone up despite the weakening dollar, it's BECAUSE of the weakening dollar to significant degree!

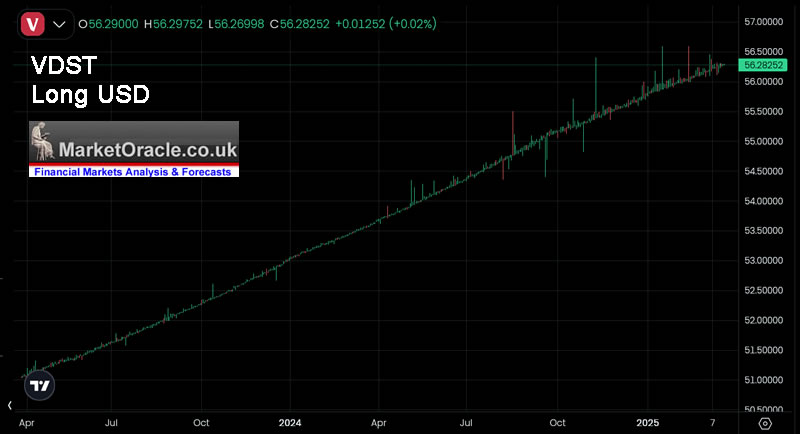

The basic strategy would be to use ones cash mountain to start accumulating dollars above say £/$1.32 as high as sterling goes where within ISA's one can utilise ETFs such as VDST the Vanguard US Treasury 0-1 year Bond (Acc). Cash dollars or the likes of VDST are the least risky as one is holding dollars where VDST earns a yield that gets reinvested hence the rising price.

The next riskier dollar pot is a non leveraged ETF that would be twice the risk of cash dollars but twice the upside, such as GBUS, say start accumulating above 1.34.

Third and smallest pot would be a 3x leveraged ETF such as USP3 as that would be 4X the risk vs cash dollars,

Currently I am at just 1% dollars, that's 1% of total funds on accounts, which I am fine with letting naturally build up to about 2% as a function of sell limits on my SIPP being sold into dollars so not actively managing my dollar position until I see sterling trade to above £1.33 when I will start accumulating dollars and eventually deploy strategies as above.

AI Tech stocks During a BEAR MARKET

During calendar year 2022 the S&P dropped 18.1%, Nasdaq 32.4%. So criteria for which stocks to hold during the next bear market are those that fall the least , i.e. less than the Nasdaq and some stocks will even go up, this is further tweaked in terms of the current state of valuations, but starting point is to see how they did during the previous bear market, in terms of from the start of 2022 into the end of the year.

NVIDIA (NVDA) -50%

Google (GOOGL) -39%

AMD -59%

Microsoft (MSFT) -29%

META (FB) -65%

TSMC (TSM) -42%

Qualcom (QCOM) -50%

ASML -31%

Broadcom (AVGO) -30%

Lam Research (LRCX) -30%

IBM +5%

KLAC +3%

AMAT (Applied Materials) -30%

Amazon (AMZN) -50%

TESLA (TSLA) -69%

Micron (MU) -40%

Apple (AAPL) -28%

Therefore going into a bear market one stock that stands out as a beater is IBM, whilst KLAC was very volatile, nevertheless ending the year UP! So folk who own these can sleep easy to some degree.

Now to further refine the list in terms of where they currently stand in terms of valuations i.e. many AI tech stocks such as Google and QCOM are already pretty cheap in terms of valuations so whilst they will get cheaper during a recession, its unlikely to be by much.

Draw downs from 2021 highs to lows 2022 lows

Another similar exercise taking the 2021 high vs each stocks 2022 lows in terms of max high to low draw downs as an indicator where a stock stands in terms of extremes, the purpose being that if for instance a stock such as AMD is already down 56% then it's not got much further downside left so presents a much better buying opp then for instance a stock such as META that could suffer a severe draw down during the next bear market but currently is trading only 16% off its high.

NVIDIA -64

Google -54

AMD -66

Microsoft -29

META -77

TSMC -50

Qualcom -31

ASML -45

Broadcom -25

Lam Research -50

IBM -20

KLAC -50

AMAT -50

Amazon -54

Tesla -69

Micron -55

I've coloured the stock name to indicate how well the stock could withstand a bear market draw down and added two columns to the spread sheet (R and S) so one can gauge against current draw down for each stock vs the 2022 bear market..

So basically what one is weighing up is valuation, current deviation from the high and using what the stock did during the last bear market as a guide which removes a lot of the uncertainty that folk feel, i.e. you can look at the spreadsheet and in real time see that for instance in valuation terms AMD is cheap, in deviation from the highs its cheap and in terms of bear market extreme is -67% vs current -56%, so does that prompt one to sell or buy AMD today?

Best and Worst Stocks to Hold During the Nest Bear Market

As I've said before I won't be surprised if some of the AI tech's stocks buck the bear market trend and head higher. It's all got to do with how over valued they are going into the bear market, strength of moat, strength of revenue streams i.e. how badly they can be disrupted, balance sheet strength, past history, how big a part they actually play in the AI story.

If I had to pick which are the most likely to buck the recession trend that sees the S&P drop by 30%, and that could even surprise to the upside then the top of my list would have to be Microsoft, I can't see it deviating much from $400, maybe dip down to $340 temporarily.

Worst - Tesla of course! That stock is going to get a pasting during a recession, if it's trading at say $300 by the end of thus bull market then We'll be looking at Tesla dropping to something like $100!

Then we have the impact of TARIFFS! Which basically translates into how much of each stocks revenues rely on CHINA!

Here's an analysis of the best and worst to fair during the recession and what I will likely be doing.

So the best stocks would be

1. MSFT - Seeking to expand exposure from current 24%

2. Google - Light trimming from current 99%

3. Amazon - Seeking to expand exposure from current 40%

4. IBM - Seeking to expand exposure from current 0%

5. QCOM - Seeking to trim from current 114% to about 80%

Worst stocks, looking back at what happened last time, cyclical earnings, valuations etc...

1. TESLA - Light accumulation over $200 heavier under.

2. Micron - Seeking to reduce exposure from 66% down to about 45%

3. LRCX - Seeking to reduce exposure from 62% down to about 45%

4. AMAT - Seeking to reduce exposure from 91% down to about 55%

5. AMD Seeking to reduce exposure from 142% down to under 100%.

6. NVIDIA - Seeking to reduce exposure from 74% down to about 60%

7. ASML - Seeking to reduce exposure from 84% down to about 65%

8. META - I'll continue to range trade it as normal, i.e. sell over valuation buy under.

Yes Nvidia will take a dump, no matter the rose tinted glasses we wear, just take a peak what it did during 2022!

So the strategy is to hold the defensives whilst lightening exposure to the cyclical's, you especially don't want to be left holding too much Tesla or Micron.

AVGO - I am only 7% invested so will probably seek to increase exposure.

Medium Risk Stocks

Medium risk stocks are going to get hit hard, typically at least 50% drop on recession expectations. Strategy is to trim those expected to suffer the worst whilst retain those set to drop the least.

Best - Approx 10% to 20% drop

TAK - I'm seeking to disinvest.

ADSK - Continue to range trade.

GPN - Seeking to reduce to under 100% invested from current 179%.

Worst - At least 50% drop. - Seeking to reduce exposure to all.

DIODE

WDC

HPQ

LOGI

JBL

High Risk - Reducing exposure.

Best - BABA, Tencent, DOCU, CRISP

Worst -

CRSR, SYNA, RBLX

Crypto's - Await one more pump to disinvest what I have left.

Currently I am 21.8% in cash after dip buying, I would like to see percent cash reach at least 35% during the remainder of this bull market which should be achievable if the crypto's pump and S&P trades to at least 6600.

Agent Orange Stock Market / Financial System Doomsday Scenario

If things were not bad enough we have Agent Orange to contend with, specifically his inability to control what spews out of his mouth!

What if protectionist Agent Orange announces that he is going to restrict foreign ownership of US stocks in response to say EU retaliatory tariffs.

What would happen next?

US stocks would CRASH triggering a credit event the magnitude of which is hard to quantify.

US Dollar would initially spike higher as investors will sell into dollars before it too eventually crashes due to flight of capital, it's already happening to some degree.

It would be the death of the US Dollar and the End of the US Empire. It does not matter if Trump backtracks because the damage will have been done! The market will now discount such a possibility.

What can investors do in advance of such an Agent Orange black swan event?

1. Increase percent cash

2. Hold more non US equities though all stocks would suffer.

3. Seek to capitalise on the dollar spike and subsequent crash, i.e. use dollar strength to sell out of US assets into domestic currencies.

4. See it as an extinction level event , i.e. it's better to SELL than buy the Crash Dip as it would be a harbinger of something akin to the 1930's Great Depression.

What's the chances of Trump doing something so moronic as this?

Trump is incapable of controlling his mouth! He sees everything from the prism of foreigners taking advantage of the US, and he may well do the same with foreign investors in US stocks, the problem is he is an idiot so does NOT think things through in terms of consequences, just look at the crap that spews out of his mouth in lack of respect for Canada's sovereignty, that is pushing Canada towards Europe in the creation of a NEW military and economic block that will rival the US. So there is a real risk of Trump stating that he does not want foreigners to hold shares in US stocks without thinking through the consequences for what it means for the global financial system, which is one system that when broken won't be able to be fixed not unless Congress orders the immediate arrest of Agent Orange and annulment of executive orders that triggered the collapse.

The fact that the risk of this happening is not zero is high enough! So even a 1% risk would be bad. So seeing the damage Trump has done in 2 months then that risk is significant, I would put it at shockingly high 20%! I can imagine the chaos that Agent Orange would unleash if this came to pass, it would be catastrophic beyond anything we have experienced since WW2.

So what should you do if you ever hear the words "Today I am signing an executive order restricting foreign ownership of US stocks"

SELL! SELL! SELL!

SHORT! SHORT! SHORT!

Have a list of stocks that you will sell immediately

Have a list of stocks / indices that one will short immediately.

One needs to be prepared beforehand to act and not be off reading tweets and watching fool tube to try and work out what to do.

In fact you'd want to sell everything held in the US that's property, gold, silver and repatriate the capital asap else face the risk of seizure as the US government did when it seized everyone's gold in 1933.

I did warn over a year ago that Trump would be the harbinger of the stock market apocalypse and this would definitely do the trick of making the apocalypse become manifest!

Your preparing for the next bear market analyst.

Nadeem Walayat

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

Most recent analysis -

AI Tech Stock Earnings Into Stock Market Correction Window

CONTENTS

S&P Base Case Achieved

US Interest Rate Cut - Becareful What You Wish For!

AMD at $180, Do You Feel Lucky?

AI Stocks Portfolio

MSFT $512 - EGFS +5%, +9%, Dir +1%, PE ranges 116%, 89%

META $700 - EGFS -4%, +5% Dir -16%, PE ranges 97%, 91%

LRCX - $99 - EGF 24%, 10%, Dir +108%, PE Ranges 125% / 108%

QCOM $162 - EGFS -2%, 5%, Dir -16%, PE ranges 35%, 28%

AMAZON $231 - EGF's -5%, +11%, Dir -20%, PE Range 38%, 17%.

KLAC $702 - EGFS +19%, +22%, PE ranges 138%, 89%

This Time It's Different! AI Tech Stocks Q2 Blow Off Top Earnings Season

CONTENTS

S&P SEASONAL ANALYSIS

Presidential Election Cycle - Year 1 Seasonal Trend

Stock Market Volatility

Retail FOMO

S&P Blow off top current state

Why I'm Not Waiting for the Final Pump

Shorting Stocks Using -1X Leveraged ETFs

AI Tech Stocks Earnings Season

Google $192 - EGFS +10%, +10%, Dir +6%, PE ranges 34%, 8%

TSLA $332 - EGFS -40%, 1%. Dir -44%, PE Ranges 283%. 280%

IBM $282 - EGF -17%, 10%, Dir -21%, PE Range 132% / 111%

FLEX $52 - EGF's 3%, 17%, Dir-14%, PE ranges 107% / 82%

ULH $26.2 - EGF's -64%, -21%, Dir -15%, PE ranges 69%, 118%

Bitcoin Enters $120k to $170k Target Zone

COIN Comes Full Circle

My Total Wealth Breakdown

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

Stock Market Blow off Top vs Trump Uncertainty Syndrome

CONTENTS

Birth of the AI God

Economic War

Dieser ist der Führer

CPLIE and US Interest Rates

US DOLLAR

When's the Next PANIC Event?

US Bond Market Crisis

Bond Market Panic Event

CI18 Crash Indicator

S&P Fake Rally to New All time Highs

Signs of a Stock Market Blow off Top

Current State of the Getting Lucky Rally

Where to Start Investing?Trimming the Bull Market

Buy the Dips Trim the Rips Strategy

REINFORCEMENT LEARNING

How to Read Momentum

AI Stocks Portfolio Current State

Quantum Computing Bubble Mania

Investing in Demographics - Brief

Safe UK Dividend Range Trading Stocks - Brief

European Defence Stocks in Brief

Bitcoin ETFs Cripple Bitcoin

Gold and Silver Brief

How Gain Your Freedom!

The God of Trade War vs AI Inflation Mega-trend Stock Market 2025

CONTENTS:

The Getting Lucky Rally

The Trump US Debt Downgrade

Trade War Day 105

US Supply Chain Disruption Inflation

US Dollar Bear Market

BOND Market Vigilantes

Trump Regime First Three Months

Trump Regime Next 100 Days

The Technical Analysis Paradox

Sell Rising Prices, Buy Falling Prices

Yen carry Trade unwind...... CONTINUES!

What if the US WINS the Trade War?

Trump Trade War is ACCELERATING the AI Mega-Trend

OIL PRICE SIGNALLING RECESSION

Gold Save Haven

Trends are Made at the Margins

Why The Risk is Always to the Upside!

Extreme Bearish Market Sentiment

S&P 6150 AND 4800

The 50% indicator.

S&P Sector PE Ratios

Presidential Election Cycle - Year 1 Seasonal Trend

Stock Market Deviation Against the Trend Forecast

S&P Trend Forecast May to December 2025

AI Stocks Portfolio

TESLA Rebounds As Musk Retreats from Nazism

Bitcoin Tops Spectrum Analysis

Bitcoin - Betting on One Last Pump

Bitcoin Exit Strategy

MSTR & COINBASE

Stock Market Tarrified as President Dump Risks Turning Recession into a Stagflationary Depression

For immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

And access to my exclusive to patron's only content such as the How to Really Get Rich 3 part series.

Change the Way You THINK! How to Really Get RICH Guide

Learn to Use the FORCE! How to Really Get Rich Part 2 of 3

The Investing Assets Spectrum - How to Really Get RICH

It's simple, you pay $7 and you get FULL access to ALL of my content -

※ Patrons Get FIRST access to all of my In-depth analysis and high probability Trend Forecasts, usually 2 full months before the rest of the world. Notified by Patreon by email as well as posted on my patreon page and I also send a short message in case the time extensive email does not make it to your inbox.

※Access to my carefully constructed and maintained AI Tech Stocks Portfolio that is updated on an ongoing basis, that includes on going commentary and a comprehensive spreadsheet that features unique innovations such as the remarkably useful EGF's.

※A concise to the point Investing Guide that explains my key strategies and rules for successful investing.

※ Regular content on How to Trade & Invest incorporated into most articles so as to keep patrons eyes on the big picture and not get too sucked into the noise of price swings.

※ Access to my comprehensive How to Really Get Rich series of articles and 3 part guide, clear concise steps that I may eventually form a Patrons only ebook.

※ Access to conclusions from my ongoing market studies from a total of over 200 conducted studies over the decades. updated whenever the market poses a question to be answered. Also enjoy the fruits of R&D into machine learning such as the CI18 Crash indicator that correctly called both the pandemic crash (Feb 2020) and the 2022 bear market (Dec 2021) well before the fact.

※Join our community where I reply to comments and engage with patrons in discussions on a daily basis.

※ I will also keep my Patrons informed of what I am currently working on each month.

※ Influence over my analysis schedule.

My objective is to provide on average 2 pieces of in-depth analysis per month and regular interim pieces of analysis as market briefs. So over a 12 month period expect to receive 24 pieces of in-depth analysis. Though my focus is on providing quality over quantity as you can see from the extent and depth of each analysis which I deem necessary so as to arrive at that which is the most probable market outcome.

So for immediate first access to ALL of my analysis and trend forecasts then do consider becoming a Patron by supporting my work for just $7 per month, lock it in now at $7 before it rises to $10 per month for new sign-up's. https://www.patreon.com/Nadeem_Walayat.

And ensure you are subscribed to my ALWAYS FREE newsletter for my next in-depth analysis.

Your analyst "with friends everywhere".

By Nadeem Walayat

Copyright © 2005-2025 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 35 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 1000 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.