What's Next for Gold and Gold Stocks

Commodities / Gold & Silver 2009 Jun 19, 2009 - 12:27 AM GMTBy: Adam_Brochert

I am a big, big fan of Exter's liquidity pyramid. John Exter was a central bankster who worked at the federal reserve in the 1940s and 1950s. His concern about a global fiat money system, once it emerged, was that it would eventually blow out in a deflationary implosion rather than an inflationary one. This is not a common thesis, yet it is one I believe is being proven correct in front of our eyes.

I am a big, big fan of Exter's liquidity pyramid. John Exter was a central bankster who worked at the federal reserve in the 1940s and 1950s. His concern about a global fiat money system, once it emerged, was that it would eventually blow out in a deflationary implosion rather than an inflationary one. This is not a common thesis, yet it is one I believe is being proven correct in front of our eyes.

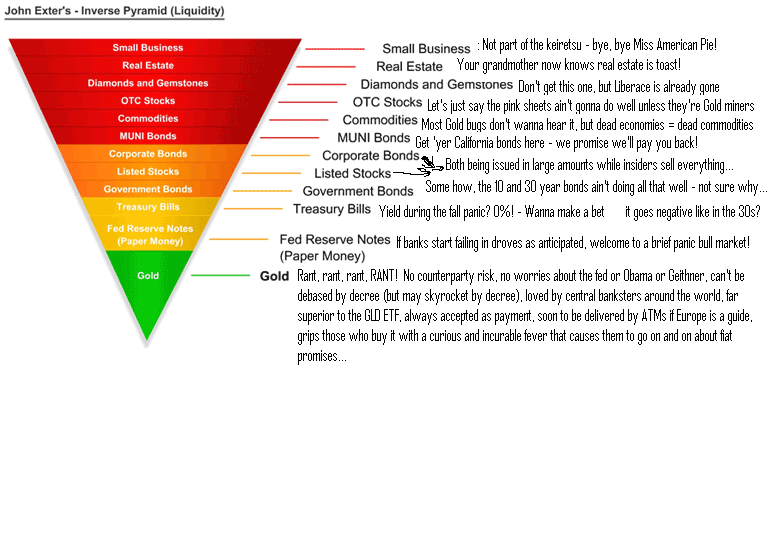

To review, the pyramid looks like this:

Exter believed that as deflation intensifies and gets worse, people "scramble" down the pyramid towards its apex to get more "liquid," since cash is king and other assets are all declining in price together in tandem. People forget about making money and try to preserve what they have.

So, what does it mean when the herd "scrambles" into a lower level of the pyramid? It means people sell the stuff on the layer above and use the proceeds to buy something on a lower level of the pyramid. In other words, asset prices decline at higher levels of the pyramid and increase towards the lower end of the pyramid.

There are stages of "herd behavior," though things don't travel in a straight line. I, for example, decided to go straight to Gold with a portion of my savings once I realized the jig was up, even though I knew it may take a little time for this investment to pay off. Traditional investors went to government bonds or bills this fall. Some poor souls are still trying to bottom fish the real estate market, even though it doesn't have a snowball's chance in hell of bottoming before 2011-2012. But, in aggregate, the herd is trending lower on the pyramid, which means things on the higher levels of the pyramid are unwise investment choices. In other words, what's next for general stocks is more losses.

Gold, as the apex of the pyramid, is trying to balance a helluva lot of paper illusions on its shoulders right now. The pyramid is drawn with Gold at the apex instead of the base for a reason: there ain't enough Gold to go 'round when the base collapses and a substantial increase in the relative Gold price is needed to restore confidence in paper assets and "re-liquefy" the system. Printing paper tickets won't cut it when confidence is lost, as is about to happen in spades.

At each stage of a deflationary collapse, another "layer" of the pyramid is abandoned and the "herd" trends towards burrowing closer and closer to the apex. Let's look at the pyramid again, but with some lunatic fringe rants scribbled across it:

Now, the important thing to remember about this pyramid is that, in extremis, it can be considered the same thing as a hyperinflation. In other words, things at each successive layer of the pyramid get sold off from base to apex. Once federal reserve notes get sold off near the apex of the pyramid, guess what? We're back to the tin foil hat-wearing hyperinflation crowd scenario!

If federal reserve notes are sold off in favor of Gold, it's game over. Now I'm not saying that's gonna happen, but holders of Gold are protected if it does, while holders of federal reserve notes (i.e. U.S. Dollars, which are issued by a private corporation that is as federal as Federal Express and cares about the United States about as much as Putin does) are betting that this deflation stops short of total chaos as in a typical recession.

This ain't a typical recession. If you don't understand that yet, you need to. This is a secular turn in the credit markets, just like occurred in the 1930s. A housing bubble collapse is always devastating to the economy because it wipes out the financiers (i.e. the people who made the home loans). When the financiers get wiped out, say goodnight to the credit markets. When the credit markets get overly cautious, the little gal/guy can't leverage up anymore and is actually asked to pay her/his tab. This is deflationary and kills an economy that relies on credit, as ours does. Ask Japan what it's like, now that they are mired in their 19th year of a wicked secular bear market.

So, yeah, based on history and this little pyramid from one of the smarter "insiders" as a guide, I feel great about holding physical Gold. I'll let the herd come to me and then I'll happily start to sell them my Gold once the Dow to Gold ratio gets below 2.

And by the way, "paper" Gold is not the same as physical Gold held in one's possession. A "note" on Gold, like the GLD ETF, is sort of like a corporate bond in terms of where it resides in the pyramid. If a default occurs, which it likely will in the GLD ETF, people believe that the government and securities law would protect them and pay them in federal reserve notes for their damages. All I can say is: maybe. The government has protected the bankstas through this whole fiasco as it always does and the custodians of the GLD ETF are the same financiers who have fed hungrily at the taxpayer teat throughout this debacle (think JP More-can, Goldman Sucks, etc.). If you think Uncle Sam favors you over the bankstas, perhaps you deserve to be swindled.

Gold stocks are a derivative of Gold and are not the same thing. Gold preserves wealth in this environment, while Gold stocks are a vehicle to speculate and try to increase wealth (and speculation requires taking a risk by definition). Now is not the time to invest new money in Gold stocks in my opinion, but this bear market in general stocks and other "traditional" assets won't last forever. And when the bear market in stocks ends, Gold stocks will be first sector out of the gate rushing into a new bull market and will outperform every other major asset class.

I believe late summer and/or fall will present opportunities in the Gold mining sector almost as good as this past fall. Get liquid, get patient and get ready to pounce once the dust settles later this year if you're willing to take some risk in the Gold mining sector. You will know this sector is the one to put money into due to its relative strength. Watch for general stocks to make new lows this year (and maybe even this summer) while senior Gold stocks refuse to do so.

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Adam Brochert Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.