Stock Market Draining Lower...Earnings On Deck...

Stock-Markets / Financial Markets 2009 Jul 12, 2009 - 05:34 AM GMTBy: Jack_Steiman

As the market opened for trading today, the world seemed to be watching whether today would be the day when the highly anticipated 875 Sp neck line would finally break down. We closed seven points above it yesterday and with the futures lower and hovering right near that grand number, anticipation seemed to fill the air. The bears were falling all over themselves thinking today would be it. We opened lower and tried to move higher but that didn't last as the bears came charging in, taking the SP 500 a few points below the magical level.

As the market opened for trading today, the world seemed to be watching whether today would be the day when the highly anticipated 875 Sp neck line would finally break down. We closed seven points above it yesterday and with the futures lower and hovering right near that grand number, anticipation seemed to fill the air. The bears were falling all over themselves thinking today would be it. We opened lower and tried to move higher but that didn't last as the bears came charging in, taking the SP 500 a few points below the magical level.

As this occurred, yet another technical blow was about to hit the bears over the head. While it's true the daily charts across the board are broken, the sixty minute time frame charts were flashing Rsi's right around 30, a level you never want to put on new shorts at, while also flashing huge positive divergences. The air was let out of the balloon and the bears realized that for yet another day, they would not be able to get any true satisfaction. No, the market didn't blast off as those daily charts are just too weak to allow anything huge to the up side.

However, the bears had to settle for yet another close above 875 and with major earnings coming up next week from some financial stocks, it seems as if the bears may have a bit longer to wait than they'd like. With Goldman Sachs (GS) on deck before the market opens for trading on Tuesday, it's hard to imagine too much market selling before it knows just what this massive leader will say. It may say great things and we gap up and then fail but it seems as if the market is going to want insight as to what the leader of all leaders is saying so they can figure out what all the others might be in line to do.

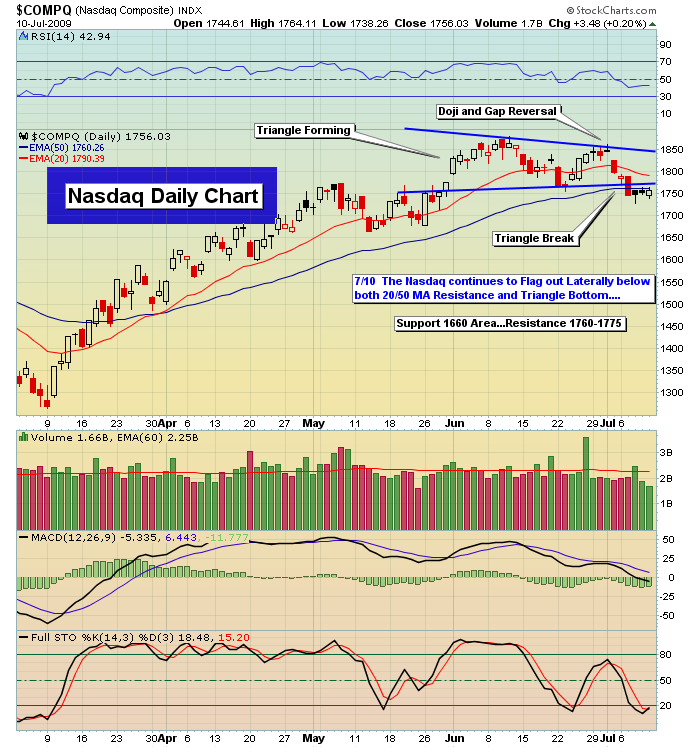

We simply are trading in a range and obviously near the very bottom of that range. With the major indexes all trading below their daily 20 and 50 day exponential moving averages, you can't say anything positive about them. Their Macd's are all pointing down but not from deeply compressed levels. There is plenty more downside room if the bears can seize on things. Rsi's are near 40 thus they are not oversold by any means. These bearish realities keep me from getting long this market but you simply can't be aggressively short or short much of anything near such critical 875 Sp neckline support.

You'd want a rally to short in to if we can back test those 20 and 50 day exponential moving averages or short a breakdown and retest that rolls over. Shorting much right in front of this huge level hasn't bought very much satisfaction for the time being. Sp 894/900 and Nas 1760/1775 are good areas, if we can get that high, to short in to. The more you do right here the more likely it is you'll get frustrated by the whipsaw action that the bifurcation between the 60's and daily's is causing. Sixty minute charts good while the daily's are bad. The longer term trading range of 956 to 869 is in place. The short term range is now 900 down to that 869 level. Just not much there to take advantage of at this time.

We have those big earners to look at next week and here is a list of reports you'll want to watch very closely throughout the week. Monday we have CSX Corp. (CSX) and Novellus (NVLS). Tuesday we have GS and Johnson and Johnson (JNJ) along with Intel (INTC). Thursday is huge. We have Biogen (BGEN), JPM Morgan (JPM), International Business Machines (IBM) and Google (GOOG). Friday we have two more financial's in Citigroup (C), Bank Of America (BAC) and lastly General Electric (GE). Don't underestimate the power of these earnings reports and what they can do to the markets. Loads of whipsaw coming no doubt. Please be very careful.

Sentiment Analysis:

The bulls can be heard saying that there are fewer and fewer of us as everyone turns bearish because of that clear and undeniable head and shoulders pattern in place. The bears will say that this pattern bodes poorly for the market and technically it should. One problem is that everyone and I mean everyone is talking about it. Cnbc talks non stop about this pattern and when something becomes too well known and talked about in the stock market, it usually has a hard time becoming a reality. Everyone piles in on the trade most likely to occur and thus it never happens. The trade gets too crowded with shorts and they can get frustrated quickly and cover those shorts and the pattern never plays out. This is still unclear of course and the pattern is nasty for sure. Just something to ponder as sentiment plays a huge role in the stock market as most of you I'm sure have learned and know by now.

Sector Watch:

Most of our Sector charts are more or less mixed with some above/below respective 50 EMA's. Many sector charts have flattened out ahead of some important earnings reports due out on the next couple of weeks which will provide some good visibility. One area not immune to the hard selling this week was that of the Commodities. Most commodity areas got annihilated with the Oil Services Index down 30 points from top to bottom the past month finally seeing a bit of upside retracement late week.

The Oil Contract broke badly through our 50 EMA like a knife through butter which likely will provide resistance now on bounces (see 5th chart below). In addtion, Gold continues to find major headwinds at the $950-1000 level and both Gold and Silver rolled over this week to new multi-month lows. First Support for Gold comes in at $875 our 50 EMA and then $775 our longer term Rising Support Line. If the market does continue to correct few groups will be left behind. Both the key Financials and Transports are more or less flatlining near our 50 EMA's and will trade off coming reports.

The Week Ahead:

So here we are. We're at the precipice of breaking down below that critical neckline at Sp 875. If it breaks hard and closed forcefully below, at least by 1%, then the door is open to much deeper selling by the bears. The bulls will have lost all support from the 20 and 50 day exponential moving averages to the last line in the sand, the 875 neckline. Very few if any will want to step in and be a hero as they know the bears will get very aggressive based on there being no real support directly in front of them.

The earnings report will be a huge player. Some nights will be better than expected and other nights worse. The market will swing wildly back and forth. The bears need to seize on things soon as the longer they go without taking out the 875 Sp neckline, the more the daily charts will unwind downward thus making the break below that key level and holding it harder and harder. It's do or die time soon for the bears. They have no excuses left. The daily charts are weak but yet to be massively oversold. Slow and easy is the only way to play a market such as this is for now. Respect both pivots out of our current 870-900 range.

Peace

Jack Steiman

Jack Steiman is author of SwingTradeOnline.com ( www.swingtradeonline.com ). Former columnist for TheStreet.com, Jack is renowned for calling major shifts in the market, including the market bottom in mid-2002 and the market top in October 2007.

Sign up for a Free 30-Day Trial to SwingTradeOnline.com!

© 2009 SwingTradeOnline.com

Mr. Steiman's commentaries and index analysis represent his own opinions and should not be relied upon for purposes of effecting securities transactions or other investing strategies, nor should they be construed as an offer or solicitation of an offer to sell or buy any security. You should not interpret Mr. Steiman's opinions as constituting investment advice. Trades mentioned on the site are hypothetical, not actual, positions.

Jack Steiman Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.