The U.S. Economic Recovery is a Tale of Two Economies

Economics / Economic Recovery Aug 30, 2009 - 12:29 AM GMTBy: Mike_Shedlock

How well corporations have fared in the recovery depends largely on two factors.

How well corporations have fared in the recovery depends largely on two factors.

1) How much cash on hand they had and how conservative they were heading into the recession

2) How much Uncle Sam (taxpayers) bailed them out

The Wall Street Journal has the story in Halting Recovery Divides America in Two.

The U.S. recovery is a tale of two economies.

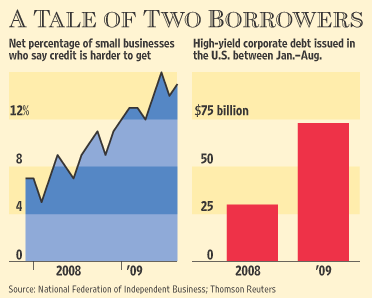

At one extreme of Corporate America is a cadre of companies and banks, mostly big, united by an enviable access to credit. At the other end are firms, chiefly small, with slumping sales that can't borrow or are facing stiff terms to do so.

On Main Street, there are consumers with rock-solid jobs -- but also legions of debt-strapped individuals struggling to keep their noses above water.

This split helps explain the patchiness of the recovery that appears to be taking hold after the worst recession in a half-century.

The split between companies that can borrow and those that can't shows the extent to which any recovery depends on reviving the nation's ailing banks and squeamish credit markets. Until that happens, the vigor of the economy will remain in doubt.

"If you're not making money, you need to borrow money," says John Graham, a finance professor at Duke University's Fuqua School of Business. But "you need to be creditworthy in order to borrow, and if you're not making money, you're creditworthiness isn't very strong."

Mr. Graham, who oversees a quarterly survey of CFOs, says more companies are doing better than they were a few months ago. Still, he estimates, one in four is in "dire straights due to lack of profits combined with not being able to borrow."

Companies big enough to bypass banks and go directly to capital markets are finding a warmer reception. That's because the markets are showing more willingness to make risky loans: In January, only eight of the 56 companies that sold bonds were rated below-investment-grade, or "junk," according to Dealogic. In August, by contrast, 24 of the 60 deals had junk ratings.

Since the start of the year, companies have been increasingly turning to the bond markets to raise money. Through August thus far, companies have issued $395.4 billion in bonds over 512 deals, according to Dealogic, a healthy increase from the second half of last year when the markets went months with fewer offerings and less than a handful of junk bond deals.

In the business of finance itself, a divide between early winners and others appears to be opening up as well. Many of the nation's biggest financial institutions, benefiting from federal-government backing, have been able to raise equity and debt from private investors. Some large money-management companies such as BlackRock Inc. are profiting by helping the Treasury with the clean-up from the burst bubble.

Some of the nation's largest banks could, in fact, emerge from the crisis stronger than they entered it. While they have suffered huge losses on complex financial products, and are still facing mounting loan defaults, they were stabilized with tens of billions of dollars of taxpayer money. In the second quarter, the seven largest commercial banks earned more than $14 billion, even as thousands of smaller banks were in the red.

Big lenders are currently enjoying an advantage in their "cost of funds" -- the raw material of a bank, which is in the business of borrowing cheaply and lending at a higher rate. The handful of banks with more than $10 billion in assets were paying 1.18% to borrow money in the second quarter, the FDIC said in data issued Thursday. By contrast, banks with $100 million and $1 billion in assets were paying 1.97%, a big difference in a business where tenths of a percentage point translates into millions of dollars in profits.

As of June 30 the three largest banks -- Bank of America, Wells Fargo, and J.P.Morgan -- collectively had $2.3 trillion in domestic deposits, or 31% of the industry total, according to the Federal Deposit Insurance Corp. Two years earlier, the top three had only 20% of the industry total.

There is much more in the article including some winners and losers. Panera Bread, having no debt is a winner. Panera franchisees have a tougher go.

And the biggest of big banks, Bank of America, Wells Fargo, and J.P.Morgan appear to be doing well thanks to bailouts and low costs of funds. Because those banks are regarded as "well capitalized" they pay a smaller insurance rate to the FDIC. "Regarded" is the key word. They can continue to be regarded as "well capitalized" but commercial real estate loans, credit card defaults, and pay option ARMs problems are the 800 pound gorillas in the room.

When it comes to deposits, the big got bigger. Too big to fail is now "Too Bigger To Fail".

However, as long as the corporate bond market holds together, equities will fetch a bid. How much longer that can last is anyone's guess. I suspect not much longer. The pool of greater fools is not unlimited.

In the meantime ponder the key sentence in the article by Mr. Graham, who oversees a quarterly survey of CFOs "one in four [businesses] is in dire straits due to lack of profits combined with not being able to borrow."

That is in addition to: Greater Than One in Four FDIC Insured Institutions are Unprofitable; Bank Problem List at 15 Year High.

The best all this world record stimulus could do is create a bifurcated economy leaving one in four businesses and banks on the brink of disaster. Meanwhile there is no recovery in jobs, and no relief for cash strapped consumers.

In due time this "recovery" is going to start flying apart.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.