Is Fed Money Printing About to Trigger Inflation?

Economics / Inflation Sep 21, 2009 - 02:19 AM GMTBy: Mike_Shedlock

Inquiring minds are wondering about the possibility of "pent-up" inflation from the massive expansion money supply by the Fed. Our search for the truth starts with the question "Which Comes First: The Printing or The Lending?"

Inquiring minds are wondering about the possibility of "pent-up" inflation from the massive expansion money supply by the Fed. Our search for the truth starts with the question "Which Comes First: The Printing or The Lending?"

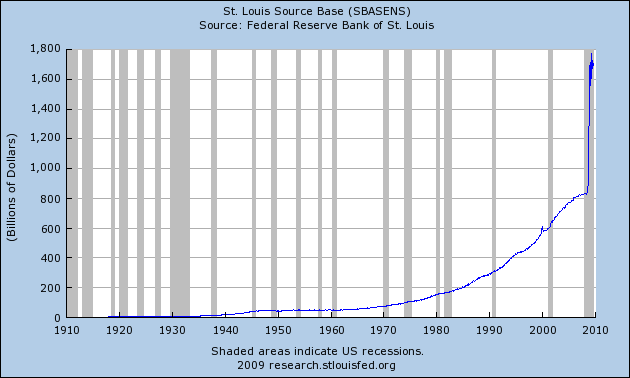

This is a critical question given the massive expansion of base money by the Fed as shown in the following chart.

Base Money Supply

Since the beginning of the recession, the Fed has expanded base money supply from $800 billion to $1.7 trillion. Conventional wisdom suggests this money is going to come soaring into the economy at any second causing hyperinflation on the notion banks will lend out 10 times the amount of reserves.

So is this pent-up inflation just waiting to break out?

Hardly.

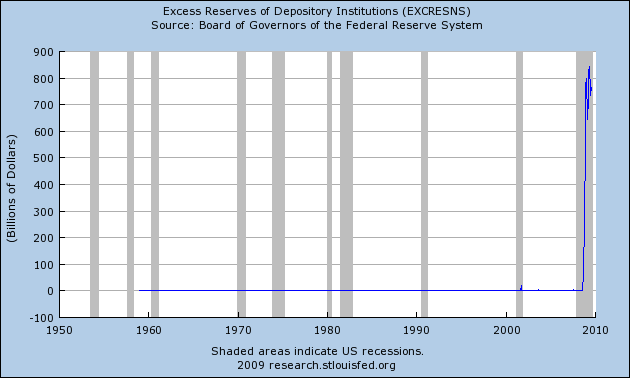

A funny thing happened to the inflation theory: Banks aren't lending and proof can be found in excess reserves at member banks.

Excess Reserves

Banks are Insolvent, Consumers Tapped Out

Because of rising credit card defaults, commercial real estate defaults, foreclosures, walk-aways, and other bad debts, banks need those reserves to cover future losses.

In practice, banks are insolvent, unable or unwilling to lend. Moreover, tapped out consumers are unable or unwilling to borrow. As a result, Spending Collapses In All Generation Groups.

Bernanke can flood the world with "reserves" and indeed he has. However, he cannot force banks to lend or consumers to borrow.

Yet every day someone comes up with another convoluted theory about how inflationary this all is. It is certainly "distortionary" in that it creates problems down the road and prolongs a real recovery by keeping zombie banks alive (as happened in Japan). However, it is not (in aggregate) going to cause massive inflation because it is not spurring the creation of new debt.

Consumers and banks both are suffering from a massive hangover. Their willingness and ability to drink is gone. No matter how many pints of whiskey Bernanke sets in front of someone passed out on the floor, liquor sales will not rise.

In a debt-based economy, it is extremely difficult to produce inflation if consumers will not participate. And as noted above, demographics and attitudes strongly suggest consumers have had enough of debt and spending sprees.

Those pointing to flawed measures of money supply as proof of inflation just don't get it, and likely never will.Banks Lend, Reserves Come Later

In practice, banks lend money and reserves come later. When defaults pile up, the Fed prints reserves to cover bank losses. Thus, those "excess reserves" aren't going anywhere. They are needed to cover losses. It's best to think of those reserves as a mirage. They don't really exist.

In the meantime, the Fed is pretending banks are solvent and banks are pretending they are well capitalized. Furthermore, in a world of falling asset prices and rampant overcapacity, banks have little reason to lend even if they were solvent.

These are simple concepts, yet few understand them. Australian economist Steve Keen is one of few who do. Some don't want to understand because it shatters their hyperinflation dreams.

Steve Keen On the Edge

On Friday, Steve Keen was On the Edge with Max Keiser discussing these issues.

Did The Government Rescue The System?

Steve Keen has a "debtwatch" blog that's well worth following. Please consider

It’s Hard Being a Bear (Part Five): Rescued?

In explaining his recovery program in April, President Obama noted that:

“there are a lot of Americans who understandably think that government money would be better spent going directly to families and businesses instead of banks – ‘where’s our bailout?,’ they ask”.

He justified giving the money to the lenders, rather than to the debtors, on the basis of “the multiplier effect” from bank lending:

"The truth is that a dollar of capital in a bank can actually result in eight or ten dollars of loans to families and businesses, a multiplier effect that can ultimately lead to a faster pace of economic growth."

This argument comes straight out of the neoclassical economics textbook. Fortunately, due to the clear manner in which Obama enunciates it, the flaw in this textbook argument is vividly apparent in his speech.

This “multiplier effect” will only work if American families and businesses are willing to take on yet more debt: “a dollar of capital in a bank can actually result in eight or ten dollars of loans”.

So the only way the roughly US$1 trillion of money that the Federal Reserve has injected into the banks will result in additional spending is if American families and businesses take out another US $8-10 trillion in loans. What are the odds that this will happen, when they already owe more than they have ever owed in the history of America?

If the money multiplier was going to “ride to the rescue”, private debt would need to rise from its current level of US $41.5 trillion to about US $50 trillion, and this ratio would rise to about 375% — more than twice the level that ushered in the Great Depression.Keen Concludes:

Obama has been sold a pup by neoclassical economics: not only did neoclassical theory help cause the crisis, by championing the growth of private debt and the asset bubbles it financed; it also is undermining efforts to reduce the severity of the crisis.

This is unfortunately the good news: the bad news is that this model only considers an economy undergoing a “credit crunch”, and not also one suffering from a serious debt overhang that only a direct reduction in debt can tackle. That is our actual problem, and while a stimulus will work for a while, the drag from debt-deleveraging is still present. The economy will therefore lapse back into recession soon after the stimulus is removed.There is much more in the article including charts of US debt (private and government), Money multipliers, and money supply. Inquiring minds will want to take a look.

There is also a very good interview with Michael Hudson on a A Tax Program for U.S. Economic Recovery based on the concepts of a needed debt destruction as opposed to a bank bailout. Please take a look.

Finally, George Washington's Blog discusses the question "Which Comes First: The Printing or The Lending?" in 2 Nobel Economists Confirm that Credit is NOT Created Out of Excess Reserves.

Of course I have been with Steve Keen on this issue from the very beginning as noted in Fiat World Mathematical Model and Global Debt Bubble, Causes and Solutions.

It's good to see others picking up on Keen's construct.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.