Deflation or Inflation, Which Lurks Around the Corner?

Economics / Deflation Dec 15, 2009 - 04:45 PM GMTBy: Jeff_Clark

In the short term, a catastrophic deflation is quite possible. But in the long term, extremely high levels of inflation are now inevitable. The situation is very serious. Gold is the best hedge against both of these things. The better part of your financial assets should be in gold, augmented by well-thought-out speculations. Doug Casey, November, 2009.

In the short term, a catastrophic deflation is quite possible. But in the long term, extremely high levels of inflation are now inevitable. The situation is very serious. Gold is the best hedge against both of these things. The better part of your financial assets should be in gold, augmented by well-thought-out speculations. Doug Casey, November, 2009.

Doug Casey and the editors at Casey Research are very skeptical that we are experiencing any sort of economic recovery. In our opinion, too many economic indicators are based on faulty data and optimistic assumptions. Our research suggests that a recovery isn’t sustainable yet. And with that, we lack the foundation needed to support the rapidly rising stock markets.

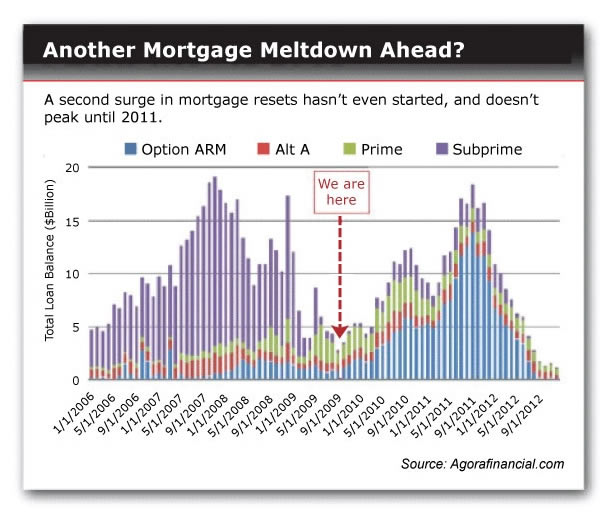

Among the many reasons for our doubt is this standout:

Over the next two years, the so-called Alt-A and Option ARM loans face massive resets. Even with today’s low mortgage interest rates, most of these home loans, currently enjoying ultra-low teaser rates or pick-your-own-monthly-payment schemes, will see their monthly payments adjust higher – far higher. The result: loan losses and write-downs will balloon for banks, and mortgage holders will get hit with another wave of homeowner defaults. We just don’t see any way for the economy and markets to escape the fallout.

Even the Fed’s perpetual public smiley face can’t hide what’s happening. In their own statement last month, they said, “Household spending appears to be expanding but remains constrained by ongoing job losses, sluggish income growth, lower housing wealth, and tight credit.” A clear and present danger remains in the system.

What does this mean for our favorite sector? Following the market lows in March, gold and gold stocks have, with some exceptions, mirrored the market’s moves both up and down. If the markets correct again, whether mild or severe, gold and gold stocks could get taken down as well.

There will come a point when gold stocks separate from the movements of the general markets, and we look forward to that day. But for now they’re still holding hands.

In the meantime, our view of the big-picture outlook hasn’t changed. Rising inflation and a falling dollar are baked in the cake. Price inflation follows monetary inflation, and governments around the globe have pursued an unprecedented and unsustainable policy of inflating the money supply. Monetary inflation + time = price inflation. It’ll come, and when it does, it will wipe out those who are unprepared.

But in the near term, current economic uncertainties mean heightened risk and call for caution. In other words, this isn’t the time to be aggressive with stock purchases.

So, how does one invest in this kind of environment? Is there a way to hedge your exposure against price fluctuations?

Yes! The secret lies in asset allocation.

Achieving good portfolio performance is possible without overexposing yourself to stocks. The strategy involves playing defense as well as offense.

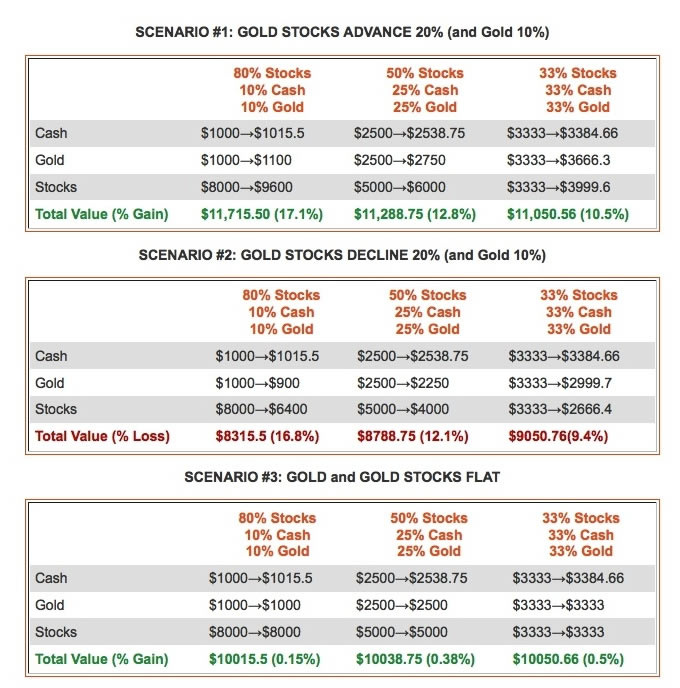

The following tables compare the returns an investor could expect using different asset allocation models under three hypothetical market scenarios, and assumes a starting portfolio of $10,000.

*All returns exclude commissions and taxes

*Cash return for 1 year of 1.55% based on use of money market account; higher rate possible with a CD, but access to your cash is restricted, and it involves fees and penalties for early withdrawal.

You can see that you’re giving up only 6.6% in gains in Scenario #1 by apportioning your portfolio in equal thirds vs. being overweight stocks. But if stocks decline while you’re overweight that category, as shown in Scenario #2, you stand to lose 16.8%.

If you don’t elect a defensively positioned portfolio at this point, and gold stocks indeed get sucked into the vortex of a general market sell-off, you’ll wish you had that extra $2,300 in cash – which buys well over 100 shares of Kinross at today’s price. And when KGC likely doubles in a couple years, as we expect, remorse may be knocking on your door.

By allocating your investments in a more defensive mode, you’re making a small sacrifice for possible profits over the next six months without sacrificing long-term returns.

You can continue to follow the thinking of the editors at Casey Research — and get specific recommendations for solid, secure gold investments — with an inexpensive subscription to Casey’s Gold and Resource Report. It comes with a free report called The Three Best Ways to Invest in Gold, and until December 18, you’ll get a free subscription to Casey’s Energy Opportunities — all for only $39. Click here to find out more.

© 2009 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.