Stocks Portfolio Relative Returns vs. Absolute Returns

Portfolio / Investing 2010 Jan 13, 2010 - 09:25 AM GMT Monty Agarwal writes: The term “relative returns” refers to returns as compared to a benchmark index. Most money managers, such as mutual funds, will aim to produce returns that beat a benchmark, e.g. the S&P 500 or the Nasdaq 100.

Monty Agarwal writes: The term “relative returns” refers to returns as compared to a benchmark index. Most money managers, such as mutual funds, will aim to produce returns that beat a benchmark, e.g. the S&P 500 or the Nasdaq 100.

For example, suppose that the S&P 500 is down 25 percent in a year and the money manager produces returns that are down 20 percent. He can boast a superior performance and claim, rightly so, that he has beaten the benchmark index. But the financial reality is that you “cannot eat relative returns.”

If your portfolio is down 20 percent, it’s not going to make you feel any better knowing that you beat some benchmark index by 5 percent. So what good are relative returns? Yet in the U.S. alone the mutual fund industry manages upwards of $10 trillion, and most mutual fund managers do not even beat their benchmark index!

This brings me to the world of absolute returns …

As the name suggests, “absolute returns” refers to the returns of an asset class or strategy, without comparing it to any benchmark. Absolute return managers aim to produce positive, “eatable” returns year after year no matter what happens to the S&P 500 or any other index.

|

| For the most part, individual investors are unaware of the strategies hedge fund managers use. |

The specialized money managers that aim to produce these positive absolute returns are classified as hedge fund managers. However, given the draconian SEC regulations, most of the hedge fund industry and thereby the absolute return strategies, are not available to most individual investors. Consequently, not much is known about how these strategies go about producing positive absolute returns.

So in today’s Money and Markets column, I’ll provide you with some basic ingredients that hedge fund managers use to go after these returns.

Non-Reliance on Market Trends

Most relative return managers will rely on long-lasting market trends to make their returns. They’ll perform global as well as close-up economic analysis on companies to determine the direction of a particular stock or commodity for the next year or longer. And then they’ll take a position in it.

Conversely, absolute return managers have a very short time horizon. Most of these managers will not rely on long-lasting market trends. Rather they’ll look to trade the short-term price swings, both from the long as well as the short side.

Well Diversified Portfolio

Absolute return managers will create a portfolio that is diversified across asset classes, geography and economic cycles. They’ll pay special attention to the correlation between the various components in the portfolio to ensure that the portfolio will not be subject to wild swings based on any one particular market event.

Such a diversified portfolio could hold, for instance Nasdaq 100 stocks, gold, oil and cotton, which tend to hedge a down price move in one component with an up price movement in the others.

Solid Risk Management

Probably the cornerstone of any successful absolute return strategy is a robust risk management methodology. Absolute return strategies will set up risk management methodologies that address portfolio construction, stop losses, profit preservation as well as capital preservation.

Such risk management systems are dynamic in nature and tend to learn from and adapt to the evolving market conditions to stay on top of the recent trends and volatility shifts in the marketplace.

Well-Tested System Supported By Years of Results

And finally, a robust absolute return methodology would be backed by years, at least 10 to 15 years, of back-tested results. These back-tested results would try to ascertain the soundness of the trade picking system as well as the durability of the risk management systems across various market cycles, trends and shocks.

Biggest and Savviest Absolute Return Players

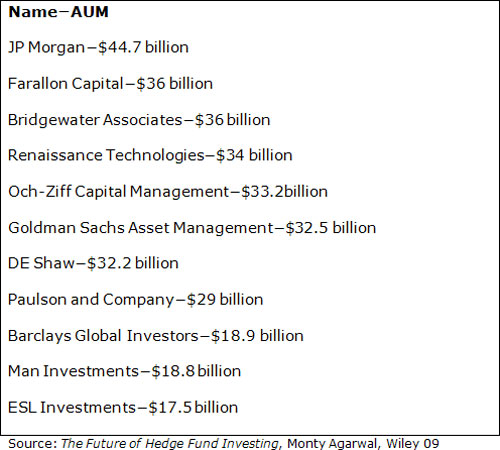

Here is a list of some of the top hedge fund managers in the world and the amount of money they manage (AUM). Most of these managers have produced absolute returns in excess of 15 percent a year for the past 10-15 years.

Single manager funds as of March 5, 2008

|

Can You Get into Absolute Return Strategies?

|

| Mutual funds are trying to implement absolute return strategies so they can compete with hedge funds. |

The simple answer is, you can’t. As I had mentioned earlier, given the current SEC regulations, hedge fund absolute return strategies can’t even be marketed to the general public … let alone sold. That’s because investors have to meet very stringent income and net worth criteria.

We are, however, starting to see the mutual fund industry realize the importance of absolute returns and the competition provided by the hedge fund industry. And they’re trying to come up with absolute return type strategies. But they are still a far cry from a real absolute return strategy as described above.

In my opinion, the SEC should relax the requirements for individual investors who what to invest in hedge fund strategies. But I fear that will take years before it comes to fruition.

Best regards,

Monty

P.S. Monty Agarwal is the author of The Future of Hedge Fund Investing. To read more about the book and order a copy, please visit http://www.macmllc.com/Future_Hedge_Fund_Investing.html.

This investment news is brought to you by Money and Markets . Money and Markets is a free daily investment newsletter from Martin D. Weiss and Weiss Research analysts offering the latest investing news and financial insights for the stock market, including tips and advice on investing in gold, energy and oil. Dr. Weiss is a leader in the fields of investing, interest rates, financial safety and economic forecasting. To view archives or subscribe, visit http://www.moneyandmarkets.com

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.