Good News For Borrowers As Exit Mortgage Exit Fees Fall, But At the Cost of Rising Mortgage Arrangement Fees

Personal_Finance / Mortgages Aug 02, 2007 - 07:56 PM GMTBy: MoneyFacts

Julia Harris, Mortgage Expert at Moneyfacts.co.uk – the money search engine, comments:“The month following the latest base rate rise to 5.75% has seen a raft of rate rises. Not only have variable rate mortgages increased, with swap rates also on an upward trend, fixed rate deals have been hit hard with rising rates too.

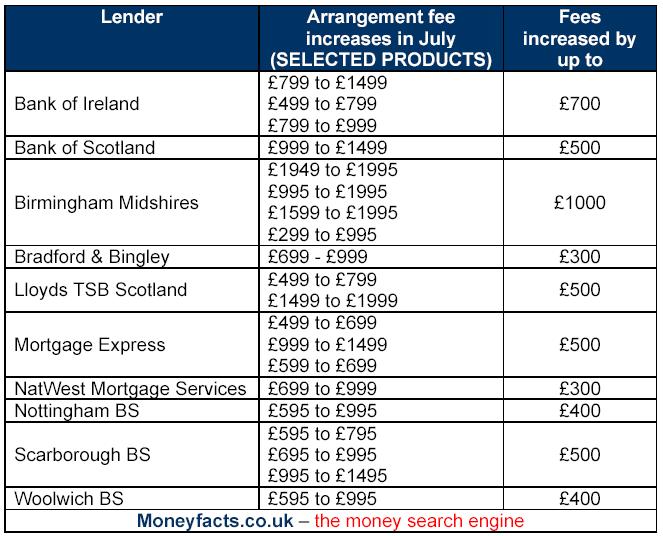

“But for any borrower looking to take out a new mortgage, these rate rises are only part of the equation. Continuing with the trend of rising fees, July has not been without exception. The table below shows the lenders and their fee increases in July, with some rising by up to a staggering £1K.

“While some of these large fee rises can be offset by lower interest rates, the overall trend for borrowers is rising rates and fees.

“With the exit fee deadline just passed, its good news to see that some lenders have already taken action and either reduced or lowered their exit charge. But is very unlikely that its going to be a clear cut reaction.

“With the actual cost of administering the exit of a mortgage deal estimated to be substantially lower than the fee charged by the lender, the vast proportion of the exit fee is profit. And, like any other profit making organisation, the lenders are unlikely to surrender this revenue stream without a fight.

“Lenders such as C&G, Standard Life, RBS Group, Northern Rock and the HBOS group have announced the removal of their exit fee. While Coventry has reduced its fee, following in the footsteps of Portman and West Bromwich which reduced theirs earlier this year. But Abbey and Bank of Ireland Group (Including Bristol & West and Giraffe) have adopted a different approach of renaming the fee. Take the Bank of Ireland for example; the fee remains unchanged at £195, but rather than being called an exit fee it’s now a lending fee and has the option of being paid up front at the start of the deal.

“Lenders won’t be happy to lose this revenue, and the proof is in the pudding. Already we are seeing lenders half-heartedly adhering, using sneaky name changes. And could the increases in arrangement fees be used to supplement revenues lost in exit fee reductions?

“The aftermath of the OFTs intervention to cap credit card penalty fees still rumbles on almost one year on, with rates rising, fees increasing and new charges being introduced. So if this is anything to go on, the mortgage market will see interesting times ahead as lenders explore avenues to recoup this income.

“If other rates and fees do increase or new charges implemented, surely this is not in the interest of the consumer. A transparent fee, which as long as fixed from the date of application, is fairer and clearer for the consumer to see, and consistent across the market to allow for comparison. Lenders using a multitude of ways to regain this money is not in the borrower’s interest.”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.