Greek, European Debt Crisis Boosts the U.S. Dollar

Economics / Global Debt Crisis Feb 12, 2010 - 08:48 AM GMTBy: Andy_Sutton

News junkies, currency buffs, and economists of an Austrian tilt have been having quite an entertaining few weeks. Between massive blizzards from Virginia to New England, another baseless Dollar rally, and the hilarious notion that a little Greek debt could unwind the Euro, there certainly has been plenty to talk about. These ‘black swan’ events are certainly becoming more and more commonplace these days; almost to the point where they can’t even be called black swans anymore. What would previously have been considered ridiculous is now normal, and what was normal is now considered ridiculous. Such is the way of things as empires unwind. Our circumstance today is no different.

News junkies, currency buffs, and economists of an Austrian tilt have been having quite an entertaining few weeks. Between massive blizzards from Virginia to New England, another baseless Dollar rally, and the hilarious notion that a little Greek debt could unwind the Euro, there certainly has been plenty to talk about. These ‘black swan’ events are certainly becoming more and more commonplace these days; almost to the point where they can’t even be called black swans anymore. What would previously have been considered ridiculous is now normal, and what was normal is now considered ridiculous. Such is the way of things as empires unwind. Our circumstance today is no different.

The Dollar – The Ultimate Opportunist?

It should not be lost on even the most casual of observers that the US Dollar is dead. How can I say this when it is in the middle of yet another ‘rally’? And aren’t the folks in Washington telling us how strong the Dollar is more and more vapidly and with greater frequency? The fact of the matter here is that the Dollar has, for quite some time now, not been able to rally itself based on its own merits. Remember that currencies are essentially a zero-sum game. Their value is measured in terms of other currencies. One goes up, another must go down. Taking a look at recent Dollar rallies, they’ve happened essentially because bad things have happened in Euroland or elsewhere, whether it is the latest debt crisis with the PIGS (an unfortunate acronym, but who wants to be called a BRIC anyway?) or the massive liquidation of 2008. These were not exhibits of the Dollar’s strength, but rather of a mental model that still hasn’t adjusted to the fact that the Dollar’s run is over. Add to that the lack of an available substitute and voila – instant dollar ‘strength’.

Think of it this way: if our currency were strong for fundamental reasons, say for example gold backing, genuine budget surpluses free of accounting chicanery, trade surpluses, and similar positives, then countries wouldn’t be sneaking around backrooms around the globe forging agreements to sidestep it. Foreigners wouldn’t be twisting their brains trying to figure out how to get out from under their pile of US Treasuries without upsetting the apple cart. Put mildly, a wheelbarrow full of plutonium would be received better in most financial centers these days than one filled with US Dollars.

Beware of Greeks bearing Debt?

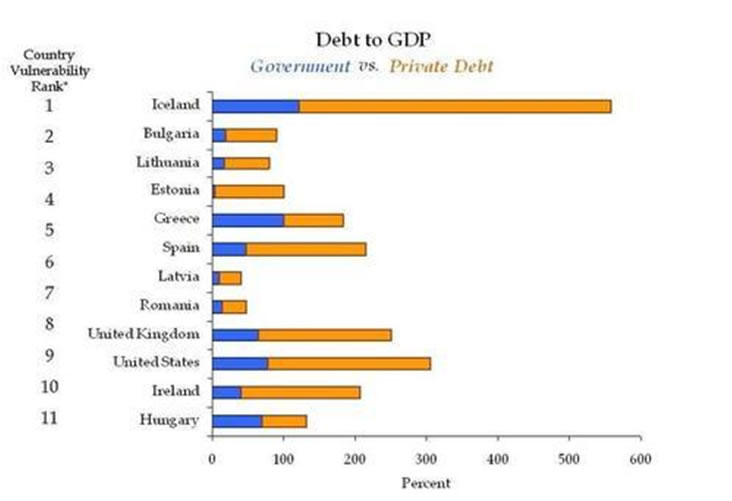

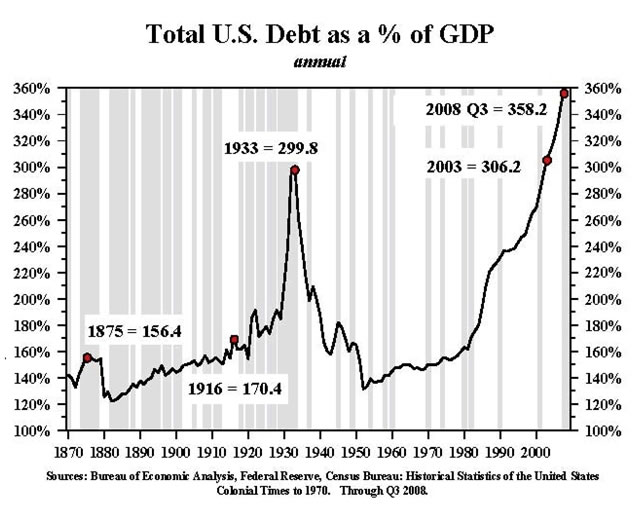

If anyone here in the US still has doubts about what ultimately happens when a nation abuses credit and engorges itself with debt, all they need to do is look at Greece. The small Mediterranean nation needs to raise about $73 Billion in new money this year. While that seems like a mere pittance, it constitutes about 20% of Greek GDP. Greece also faces bond redemptions of $8 and $9 billion in April and May respectively. While Greece has by far the worst debt problem (at the moment) in the EU, it doesn’t stand alone. Portugal, Italy and Spain are also having issues of their own and the whole mess is threatening Euro stability, and by function helping the US Dollar.

These are real problems for sure, but what is amazing is the continued complacency by media and policymakers alike when it comes to the US and our debt levels. Our level of official borrowing will tally around 12% of GDP in 2010, however, if you look at the GAAP deficits and the resultant borrowing, it is always much higher than advertised. There is an important distinction to be made between Greece and the US, however, and that is the fact that Greece is essentially a hostage of the European Central Bank where the USGovt has a bank willing to issue as much rope as we can possibly need to hang ourselves. We’re hostages of the Fed, but most people aren’t easily inclined to look at it that way. We’ve been trained to believe that when we run deficits we’re borrowing from ourselves. Back in the era when we used US savings bonds to fund government activities, there was at least a modicum of truth to that. However, since we’ve gone overseas and to the internationally-owned Fed for more and more help, we’ve been slowing ceding our national sovereignty to foreigners much in the same way Greece et al have given themselves over to Brussels.

This is why every freedom-loving person should have a healthy fear of global central banks and even regional currency blocs. The very survival of the PIGS now rides on the whims of Merkel, Sarkozy, and Trichet. Flashback to the weekend of September 13th 2008 when Lehman Brothers here in the US was in the same shoes as Greece is today and then ask yourself how much we’ve really learned over the last 18 months. This is what happens when you globalize and intertwine the fortunes of nations and then base it on the fraud of a fiat currency system, the casino mentality, and a healthy dose of public ignorance.

So now the Europeans are left in a pickle. They have to come up with the right words to soothe the markets. They’ll need to offer words that promise all sorts of coordinated actions and large applications of money while actually doing nothing because they can’t afford it. Their economies are now stumbling out of recovery because there never was a recovery, just a shell created by inflation and debt.

America should take heed. It was easy to ignore when it was Argentina, Zimbabwe, and Iceland. However, we’ve done the same thing here. Our government believes that borrowing and saber rattling will force the economy to grow. Europe is the latest shining example of the utter failure of such thinking.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.