Stock and Commodity Market Investors Heading for Six Months of Hell

Stock-Markets / Financial Markets 2010 Feb 16, 2010 - 08:17 AM GMTBy: Larry_Edelson

In last week’s column, I reviewed the profits you should have bagged the week earlier. Total now, since March of last year, assuming you followed all of my suggestions: 11 closed out trades, including 9 winners — with gains of as much as 91.7% — one breakeven trade, and one loser. Not bad for just over 10 months.

In last week’s column, I reviewed the profits you should have bagged the week earlier. Total now, since March of last year, assuming you followed all of my suggestions: 11 closed out trades, including 9 winners — with gains of as much as 91.7% — one breakeven trade, and one loser. Not bad for just over 10 months.

I also reviewed with you three major reasons why the bull market in natural resources is still very much intact. More on that in a minute.

First, a warning: For the next three to six months, the markets will be shifting into a period of extreme volatility. It will be characterized by wild swings that will spook even the savviest and most professional of traders.

So you’re going to need nerves of steel. I’ll be sure to give you the extra guidance that you’ll need.

After all, not only are the cycles in the markets themselves shifting — but so are the underlying fundamentals. I’m not talking about any particular economic statistic. On a case-by-case basis, they don’t mean much.

That’s important to understand, because even when taken together, most economic data is not very helpful for investing because they are backward looking.

Stats such as unemployment, layoffs, manufacturing data, inventories, payrolls, even gross domestic product — tell you what happened, not what’s going to happen

For a forward-looking perspective that can help you anticipate what the markets are likely to do, you have to use the study of the science of cycles. That’s what I do, and I’ve been doing it extensively for almost thirty years.

And right now, the main cycles affecting all markets are shifting from strongly upward trending … to short-term, violently choppy patterns.

So you are bound to see …

![]() A multi-month period of very large swings, in almost all markets. I’m talking several hundred points up and down in the Dow … $100 to $200 trading ranges in gold … $20 to $30 trading ranges in oil … and violent moves in just about everything publicly traded.

A multi-month period of very large swings, in almost all markets. I’m talking several hundred points up and down in the Dow … $100 to $200 trading ranges in gold … $20 to $30 trading ranges in oil … and violent moves in just about everything publicly traded.

Importantly, you are also about to see …

![]() Mass confusion in society at large. You will see mixed economic data streaming out. Many stats good; many terrible. For those who follow the fundamental forces impacting the economy and markets, you will be in a state of utter confusion.

Mass confusion in society at large. You will see mixed economic data streaming out. Many stats good; many terrible. For those who follow the fundamental forces impacting the economy and markets, you will be in a state of utter confusion.

You will also see tremendous swings in politics, both domestically and internationally. Obama’s popularity sinking like a rock … then surging … only to sink again. Crises in Europe, like that of Greece, will burst onto the scene, only to be resolved a few days later, then re-emerge in another country.

You will see increased trade tensions between countries … accusations … bickering, and more.

And, you will see investors swing from extreme optimism … to severe pessimism, and back.

But most of all, the majority of investors will get chopped to pieces in the markets.

Make No Mistake About It: You’re Entering Six Months of Investor Hell.

The best way to handle it …

A. Do NOT overtrade. Overtrading in general tends to lead to losses, no matter what the markets are doing.

In periods where the markets are swinging wildly, overtrading is often disastrous.

B. When you trade for speculative purposes over the next six months, be especially keen to try and buy on weakness and sell on strength … and always use a protective stop to limit your risk.

Moreover …

C. Don’t let emotions or the news get to you! I don’t know a single successful investor or trader who watches CNBC or Bloomberg, or listens to any business radio show.

They’re great entertainment, and ok to watch or listen to when you are not making investment or trading decisions.

But no matter what you do, never, I repeat never, invest based on the news. And never let any news or any kind of business media allow you to become emotional. It’s a sure fire way to lose money.

Most of all …

D. Keep the long-term in perspective for your core investment positions.

Long-term trends do not change that often. They span years, even decades. So to maximize your profit potential from them, you simply can’t let the short-term sway you.

Consider the natural resource bull markets. Last week, I gave you three undeniable long-term fundamental forces that are driving those markets higher.

Now consider the following research, released late last year by the think-tank, the Global Footprint Network …

It now takes almost 18 months for the Earth to regenerate what humanity consumes in one year.

Put another way, just to sustain current natural resource consumption levels — 1.4 planet Earths are needed, RIGHT NOW.

|

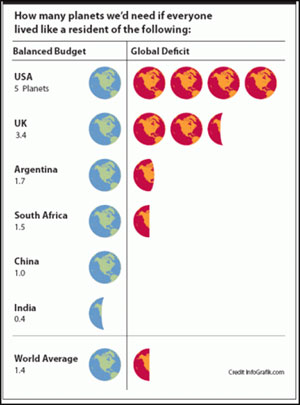

Even more shocking from the institute’s research is the new data it published projecting what the world would consume if everyone on the planet lived like a resident of various emerging and developed countries.

You can see the data graphically displayed in the table to the right.

On the low end, if everyone in the world used natural resources at India’s very low rate of consumption, an additional planet equal to 40% of the Earth’s size would be needed, RIGHT NOW.

At China’s higher level of consumption, one full additional planet would be needed, RIGHT NOW.

If everyone consumed natural resources at the rate U.K. citizens are, an additional 3.4 planets would be needed.

And if everyone consumed resources at the rate U.S. citizens are, an additional FIVE MOTHER EARTHS WOULD BE NEEDED RIGHT NOW JUST TO BALANCE SUPPLIES WITH CONSUMPTION!

Naturally, consumption levels in the rest of the world are not likely to climb to the U.S. level of use.

But even if they were to rise to just half of U.S. consumption levels, you would still need 2.5 Mother Earths to balance the growing demand with consumption.

More from the institute …

![]() The average American uses a whopping 23 acres worth of biocapacity, while the average European uses only about half that.

The average American uses a whopping 23 acres worth of biocapacity, while the average European uses only about half that.

![]() The U.S. represents just 4.5% of the world’s population, but consumes more than five times as much natural resources, a full 23% of world biocapacity.

The U.S. represents just 4.5% of the world’s population, but consumes more than five times as much natural resources, a full 23% of world biocapacity.

![]() China now consumes about the same level of resources that the U.S. does, but with its population more than four times larger, per capita resource consumption in China is less than one-fourth that of an American.

China now consumes about the same level of resources that the U.S. does, but with its population more than four times larger, per capita resource consumption in China is less than one-fourth that of an American.

But that’s today. Five, 10, 20 years from now, China (and India) will likely be consuming far more natural resources, while I doubt U.S. or any other Western economy’s consumption will fall very much.

Bottom line to all this: The world is facing a massive shortage of basic natural resources that will, in just a few years, reach crisis levels.

Stay tuned, and as always, best wishes …

Larry

P.S. Uncommon Wisdom has teamed up with the Red Cross to help bring in donations for the earthquake victims in Haiti. If you’d like to make a contribution, just click here now.

This investment news is brought to you by Uncommon Wisdom. Uncommon Wisdom is a free daily investment newsletter from Weiss Research analysts offering the latest investing news and financial insights for the stock market, precious metals, natural resources, Asian and South American markets. From time to time, the authors of Uncommon Wisdom also cover other topics they feel can contribute to making you healthy, wealthy and wise. To view archives or subscribe, visit http://www.uncommonwisdomdaily.com.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.