Higher U.S. Treasury Bond Yields, Lower Equities?

Interest-Rates / US Bonds Mar 26, 2010 - 08:38 AM GMTBy: Guy_Lerner

For the longest while, my mind set has been to expect higher yields accompanied by higher equity prices. After all, wouldn't higher yields be a sign that the economy is expanding and on the track to recovery? Or to put the relationship between bonds and equity prices in another light: if the equity markets would ever sell off, wouldn't bonds catch a bid as there is a flight to safety? But the technicals have me rethinking these relationships. Is it possible that we could have higher yields and lower equities?

For the longest while, my mind set has been to expect higher yields accompanied by higher equity prices. After all, wouldn't higher yields be a sign that the economy is expanding and on the track to recovery? Or to put the relationship between bonds and equity prices in another light: if the equity markets would ever sell off, wouldn't bonds catch a bid as there is a flight to safety? But the technicals have me rethinking these relationships. Is it possible that we could have higher yields and lower equities?

Let's start by giving you some background. I have been bullish on Treasury bonds for some time. I was betting with the "smart money" and against the "dumb money", and after much consternation, I felt this was the correct play. I had identified key support levels, and although Treasury bonds could not breakout higher, support was holding. I was becoming increasingly bearish on equities, so I thought that it was only a matter of time before bonds caught a bid. Equities would fall and bonds would move higher at they are seen as a safe haven.

But I don't think it is going to work out that way. I still remain bearish on equities, but it is becoming increasingly difficult to remain bullish on bonds. In fact, the technicals now have me bearish on bonds.

Figure 1 is a weekly chart of the 30 year Treasury Bond Interest Rate (symbol: $TYX.X). Key pivot points are identified with the yellow dots, and these are areas of support and resistance. Negative divergence bars, which tend to act as inflection points as well, are the pink labeled price bars. We note that there is a cluster of 2 negative divergence bars (inside the gray oval). It appears that the 30 year yield will close over 3 key pivots at 46.91 and above the cluster of negative divergence bars. This is very bullish for higher yields, and in all likelihood, this could be strong move higher - think short covering with closes above negative divergence bars -that could see yields on the 30 year Treasury eventually reach 5.282%.

Figure 1. $TYX.X/ weekly

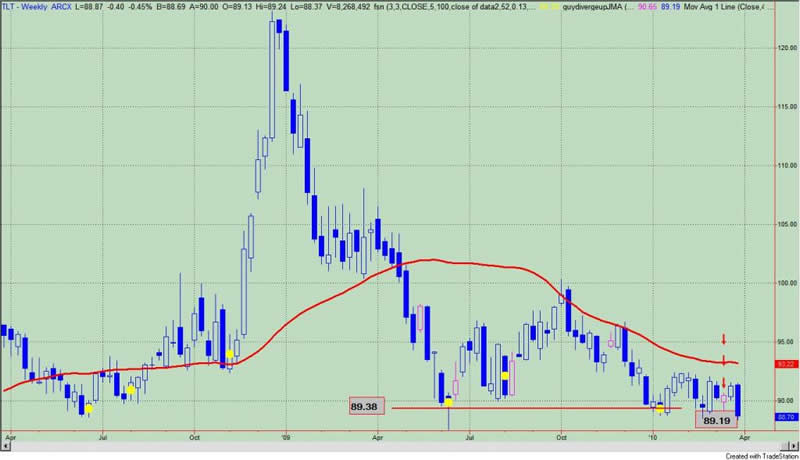

Let's look at this from another perspective. Figure 2 is a weekly chart of the i-Shares Lehman 20 + Year Treasury Bond Fund (symbol: TLT). This is a bond fund that moves opposite to yields. Key pivot points are in yellow; the pink labeled price bars are positive divergence bars. The important area of support is formed by the key pivot point at 89.38 and the low of the positive divergence bar (see price bar with red arrows) at 89.19. A weekly close below these levels, which seems likely, should lead to a much lower TLT. Once again, closes above or below divergence bars tend to lead to accelerated price moves.

Figure 2. TLT/ weekly

For now, TLT has breached support rather convincingly. However, the fake out or reversal needs to be considered. A weekly close back above the high of the positive divergence at 90.65 would be a sign that TLT is going higher (yields lower).

Now let's take a look at the daily chart for TLT. See figure 3. Key pivot points are in red, and today's closing price is below 3 consecutive pivots, and this is bearish. Price has yet to close below the lowest key pivot at 88.64, but this is a couple of cents away.

Figure 3. TLT/ daily

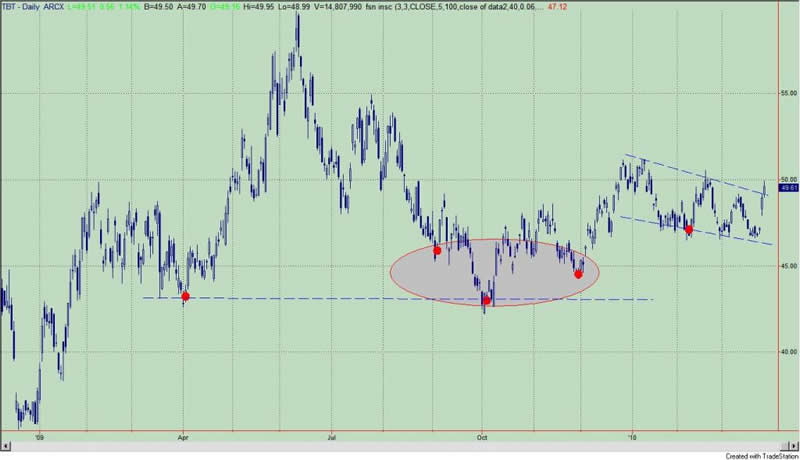

How about the daily chart for Ultra Short Lehman 20 plus Year Fund (symbol: TBT). This is a 2x leverage product that tracks yields or is inverse to TLT. Key pivot points are in red, and a close above 3 key pivots is bullish; TBT is now breaking out and has a price target of $55.

Figure 4. TBT/ daily

Let's address several things before wrapping this up.

Could this be a fakeout? Absolutely. TBT and TLT have been very tricky. Just last week I wrote that TLT was my best looking position - it looked poised to move meaningfully higher. So we have our points where I will be wrong again - if I am wrong again!

Why are yields moving higher? Most would agree that deflation, not inflation, is in our immediate future. How about higher yields and better economic growth? The data doesn't really support it. My belief is that is has to do with debt issuance and supply and demand. I believe Moody's downgrade of Portugal's debt reminded the markets that the coming year is going to filled with a lot of sovereign debt offerings. Who is going to buy that debt? Which debt is going to be the most attractive? Higher yields seems inevitable.

Lastly, does this mean equities will rise? After all, aren't rising yields a sign of economic expansion? In this instance, this is not the case; this is all about supply and demand. Furthermore, extreme bullish sentiment plus yield pressures is a bad combination for equities. See "Danger, Danger Will Robinson".

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2010 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.