Stock Markets Boosted by Corporate Earnings

Stock-Markets / Stock Markets 2010 Apr 20, 2010 - 08:54 AM GMTBy: PaddyPowerTrader

After a fairly see-saw session Monday, US equities shrugged off earlier weakness in Asian markets (especially in China) to close higher, with a 1% rebound in the financials leading the S&P 500 to a 0.5% gain. Shares in Goldman Sachs rose 1.6% after declining 12.8% on Friday (after newswires report SEC vote to sue was by 3-2 split). The standout performer was Citigroup, whose shares rose 7% (albeit merely erasing losses over the previous two trading sessions). The bank reported adjusted per-share earnings of 14 cents compared to expectations of a flat result. And encouragingly, Citigroup set aside less money to cover bad loans and marked up the value of its Special Asset Pool (its problematic legacy loans and trading positions).

After a fairly see-saw session Monday, US equities shrugged off earlier weakness in Asian markets (especially in China) to close higher, with a 1% rebound in the financials leading the S&P 500 to a 0.5% gain. Shares in Goldman Sachs rose 1.6% after declining 12.8% on Friday (after newswires report SEC vote to sue was by 3-2 split). The standout performer was Citigroup, whose shares rose 7% (albeit merely erasing losses over the previous two trading sessions). The bank reported adjusted per-share earnings of 14 cents compared to expectations of a flat result. And encouragingly, Citigroup set aside less money to cover bad loans and marked up the value of its Special Asset Pool (its problematic legacy loans and trading positions).

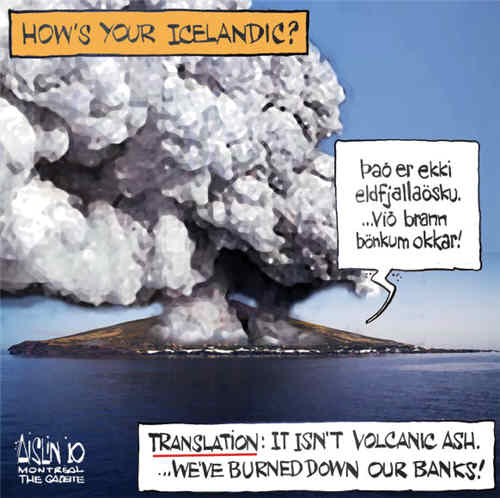

The prospects for a gradual resumption of European air travel from later today have also improved a little with Iceland’s problematic Eyjafjallajoekull volcano (maybe Bjork will pen a tune) now sporting an ash plume that extends just 2kms skywards, rather than the 11km plume seen over the weekend. IBM beat the street and raised guidance after hours, but the EPS increase was less then the market had hoped and the stock sold off 2%.

In Europe this morning, equities stage a bounceback, buoyed by positive earnings and positive noise (from Tesco, Safran, ASOS, Associated British Foods, SAB Miller, Novaritis Reed Elsevier, Daimler and Burberry) and unconfirmed reports that Fiat is to announce a spin-off of its auto unit. Meanwhile in data today, the German ZEW came in higher than expected (53.0 Actual vs. 45.1 Consensus), while UK CPI and RPI both came in higher than consensus. Although these are ahead of consensus, economists still expect a significant decline for both measures in the second half of the year. Finally, in fixed income, the Greek Government bond auction went better than expected, printing €1.95bn at 3.65% with bid-to-cover at 4.6 times.

Stateside it’s hard to keep them out of the news! Yes predictably Goldman Sachs crushed estimates this morning, notching earnings of $5.59 per share, higher than the projected $4.14 per share. While strong earnings results should take some of the pressure off the firms share price, Goldman Sachs is now under investigation in the UK (by the FSA over its CDO dealings) as well as the US. And AIG is researching whether or not it can file charges against Goldman Sachs to recoup come of the losses it endured by insuring CDO deals. The company would be seeking potential damages of up to $2 billion. In other US earnings news Coca-Cola reported first quarter sales that were below expectations while United Health is up 4% premarket after topping earnings estimates. Apple reports earnings after the closing bell today. The company is calling for up to $2.18 earnings per share, while street estimates point higher, at $2.45.

Today’s Market Moving Stories

•Overnight China has ordered developers not to take deposits for sales of uncompleted apartments without proper approval, intensifying steps to prevent a property market bubble after record home price gains. Developers must disclose to the public all apartments available and prices, and start selling within 10 days of getting pre-sale approval, the Ministry of Housing and Urban-Rural Development.

•While we continue to bobble about the river Styx in Charon’s boat wondering how expensive a coin the EU shall have to pay we read that Greece may require financial assistance of as much as €80 billion to avoid default, Bundesbank President Axel Weber told a small group of German lawmakers. The remarks suggest that Greece’s financial situation may be worse than many observers have realised. Greece is already expected to receive a total of €45 billion in loans from European countries and the International Monetary Fund if it needs a bailout. Mr. Weber, a leading candidate to succeed Trichet as ECB president next year, said that Greece’s situation was worsening and that “the numbers are changing all the time”.

•Airports across Europe remain closed as the ash crisis continues. Most UK flights remain grounded, but flights in Italy, France, Switzerland, and Hungary have partially resumed. Germany has also maintained its closure until at least 7PM CET today. The potential for closures to be extended remains high, as a second ash plume is now moving towards the UK. This second plume could continue to delay the reopening of Heathrow and Gatwick airports around London, stranding those needing long haul flights to the US and Asia.

•In the UK the latest YouGov poll in The Sun puts the Conservative Party on 33% (up one percentage point), the Liberal Democrats on 31% (down two points) and Labour on 27% (up one). While the Sky News Poll of Polls suggests that Labour could win 281 seats (-68), the Conservative Party 257 seats (+47), the Liberal Democrats 79 seats (+17) while other parties would take 33 seats (+4).

•The ECB’s annual report tried to strike a balance between the need to maintain support while the recovery process remains fragile and the need to maintain a focus on inflation. The ECB said it will continue the gradual phase out of extraordinary liquidity steps, warning that maintaining liquidity measures for too long could foster bank dependence while at the same time weaken the incentive to restructure. However, it was acknowledged that the state of the Eurozone’s banking system remainscloded by significant risks. Certainly caution is required on the durability of the recovery in banking sector profits.

•The Fed’s doves were back out late Monday, with both Evans and Duke reminding investors that the recovery and indeed the financial system remain vulnerable and as such support needs to be maintained. Evans said the US recession was definitely over and that the possibility of double dip was now only small. However, he said it will still take a long time for the jobless rate to fall. In fact with inflation remaining so low and jobless so high, Evans said monetary accommodation was very important. Fed’s Duke, meanwhilke, said there was no evidence of a substantial improvement in hiring rates. She said the outlook for commercial property was not very favourable and that small businmesses were still finding it hard to obtain credit.

•US Treasury secretary Geithner, speaking to the Lehman enquiry, said he will close regulatory loopholes within the derivatives sector. Opting out will not be an option, he said. He said the repo markets demand particular attention. Geithner said there also needs to be much better tools to deal with bank failures in an orderly manner. At the moment the government does not have any good options, he said.

More On European Economic Data Released This Morning

The German ZEW numbers for April released today surprised on the upside. The expectations index rose 8.5 points to 53.0, the higher level in six months. And the figures are even more impressive on the current situation, which rose 12.7 points to -39.2, a level not seen since October 2008. Interestingly, the people surveyed appear not have worried about the consequences of a bailout of Greece, even though Germany would bear the lion’s share.

Inflation in the UK rose more than expected in March, increasingly putting in question the relatively sanguine view that the Bank of England has been adhering to. The CPI rose 0.6% MoM, double what the market expected and enough to take inflation up four notches, to 3.4%, the second time in three months that inflation moves north of 3%.Funny how nobody seemed to care much about the decline in the pound, but now everybody is talking about the inflationary potential of the lower pound. Inflation might stay higher than anticipated for longer than anticipated, and this might eventually force an earlier rate hike by the BoE. In the meantime, the governor will have to keep writing letters to the Chancellor of the Exchequer, so he better get a replacement cartridge for the printer.

Company News

•Stocks on the move in Europe today include SABMiller is up 3.2% to its highest level since it started trading in London in 1999. The company said beer volume excluding acquisitions or disposals rose 2% in the 1st 3 months through March, the first increase in more than a year.

•Stocks on the move in Europe today include SABMiller is up 3.2% to its highest level since it started trading in London in 1999. The company said beer volume excluding acquisitions or disposals rose 2% in the 1st 3 months through March, the first increase in more than a year.

•AB Foods is better by 5.4% to its best level since November 2008, after reporting a 79% increase in first-half net income to £249 million as Chinese sugar prices increased and customers demanded more baking goods.

•But Thorntons is off 12% marking it’s the biggest drop since 2004 after the chocolate maker said it had disappointing Easter sales at its own outlets, with revenue at stores open at least a year falling 4.6% in the fiscal third quarter.

•After the bell last night IBM showed further evidence of a recovery in technology spending, posting a 13% rise in profit for the first quarter driven by growth in the company’s software business and emerging markets. The outlook reflects some optimism about the business environment and the company’s long-running shift into higher-margin activities and faster growing areas of the globe. The company posted a profit of $2.6 billion, or $1.97 a share, up from $2.3 billion, or $1.70 a share, a year earlier. IBM also boosted its full-year profit outlook to $11.20 a share, up from a previous forecast of at least $11 a share. Shares were down 2% after hours.

•Apple’s next iPhone will feature a front-facing camera, metallic rim and boxier design, according to technology blog site Gizmodo.com, which said it obtained a prototype a company engineer had left at a bar. The device, disguised as the current 3GS model, was found in a bar in Redwood City, California, the Gawker Media-owned blog said yesterday. The handset, which ran an unreleased version of Apple’s operating system, is also equipped with a camera flash, higher-resolution screen and larger battery.

•French power operator GDF Suez has joined its French rival, EDF among the top five electricity suppliers to British business. The energy group will announce Tuesday a five-year deal to supply electricity to five of Britain’s biggest water companies.

•Novartis confirmed its full-year outlook Tuesday as it beat forecasts with a 49% rise in first-quarter net profit, as the Swiss pharma giant benefited from strong flu vaccine orders, a positive currency impact and growing demand for cancer drugs. The company said net profit for the three months to the end of March jumped to $2.95 billion from $1.98 billion, beating analyst forecasts of $2.42 billion. Novartis said that its plan to fully acquire eye-care company Alcon was on track.

•Supermarket giant Tesco Tuesday posted a forecast-beating 9.3% rise in fiscal full-year net profit on higher revenue boosted by sales growth in the US and Asia, and said it is well-placed for sustained profitable growth. Full-year fiscal net profit for the 52 weeks ended February 27 rose 9.3% to £2.34 billion from £2.14 billion a year ago, beating a consensus forecast of £2.32 billion.

•Daimler offered a more optimistic full-year outlook Monday, as the German auto maker released first-quarter numbers that put the closely watched earnings before interest and taxes, or Ebit, of its core Mercedes-Benz Cars division at €806 million. Daimler had reiterated that guidance last week at the company’s annual general meeting. Daimler looks cheap relative to its main peer BMW.

•M&T bank reported a Q1 GAAP diluted EPS of $1.15, an increase of 135% year-on-year and 11% on the linked quarter. The result was also ahead of consensus expectations of 99c as the bank reported stable operating profit quarter-on-quarter, but credit losses showed a marked deterioration, falling 28% qoq. This result is a positive for AIB and should help with its intended disposal of its 23% stake in the bank. It is estimated that a disposal at current market values would generate over €900m of capital towards the targeted €7.4bn that AIB has to raise this year. When pushed on the conference call on AIB’s intentions about disposal, M&T’s CFO commented that M&T is ready to help AIB execute a transaction in the most efficient and orderly way to the extent that it wants to do that but acknowledged that the timing is up to it.

•Tullow Oil released a disappointing well result this morning with the Dahoma-1 exploration well in the West Cape Three Points licence encountering water bearing reservoirs. This was a high risk well; therefore the disappointment won’t have a significant impact on Tullow’s NAV. This drilling was the first of 12 wells in its Deepwater Ghana exploration and appraisal campaign not to encounter hydrocarbons.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.