Stock Market Cycle Turning Points Analysis 27th August 2007

Stock-Markets / Cycles Analysis Aug 27, 2007 - 03:13 AM GMTBy: Andre_Gratian

Current Position of the Market.

SPX: Long-Term Trend - The 12-yr cycle is still in its up-phase but, as we approach its mid-point, some of its dominant components are topping and could lead to another correction in 2008.

SPX: Intermediate Trend - Climactic action followed by an immediate reversal suggests that the 4.5-yr cycle has bottomed, but the low will need to be tested.

Daily market analysis of the short term trend is reserved for subscribers. If you would like to sign up for a FREE 4-week trial period of daily comments, please let me know at ajg@cybertrails.com .

Overview

On July 16, the SPX traded at 1555. Exactly one month later, on August 16, it had declined 184 points to 1371, but by last Friday it had recovered nearly two thirds of its drop and stood at 1460.

Two weeks ago, I wrote the following: It is normal for the stock market to fluctuate between periods of order and chaos. The beginning and end of chaotic (corrective) conditions, small and large, are predictable with cycle analysis. Some of the indicators which gave warning of an approaching correction are now beginning to predict that this period is coming to an end. We should therefore be looking for the equity markets to stabilize and a resumption of the uptrend. The original estimate was that the correction could extend into September, but some preliminary signals suggest that the low may come sooner.

While that prediction was correct time-wise, the indices did not exactly "stabilize" before ending the correction. Instead, the last phase of the decline and its recovery had all the makings of a climactic bottom marking an important low, probably that of the 4.5-yr cycle.

Now that the cycle appears to have bottomed we can assume that the worst is over, but the low will need to be re-tested and this should take place over the next month or two. The re-test phase could begin soon as important retracement levels are close to being met. But it may also wait until after the next FOMC meeting of September 18 when the Federal Reserve is widely expected to lower the fund rates or take some other action to relieve a potential credit crunch that was caused by the sub-prime problem. Some think that the rate-cut could even come sooner.

What's Ahead?

Momentum:

The daily chart of the SPX (courtesy of StockCharts) is giving us several positive readings:

- The climactic action took prices below the 200-day moving average, but they have now rebounded above it and the MA is still rising.

- After showing some positive divergence, both indicators are now back in an uptrend, although the RSI (on top) has not yet risen above its downtrend line and will need to do so to confirm a trend reversal.

- The SPX has moved out of its down channel, and on Friday broke above its downtrend line.

These are all preliminary signs that a market low has been made, but for a confirmation that the index is back in an uptrend, it will have to rise above the important resistance level of 1503.

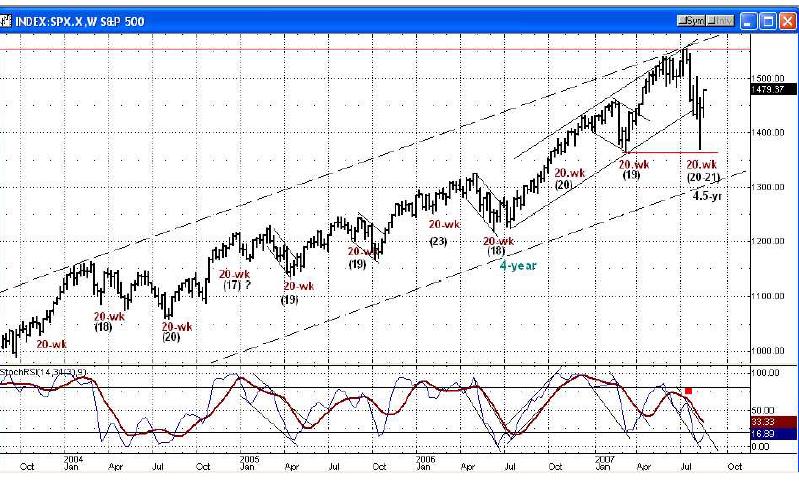

Now that we have a significant top in place, I have re-aligned the channel of the weekly chart to better represent the current trend. As you can see, in the context of the longer-term trend the recent correction does not look like anything very important. Two factors which are both positive particularly stand out: the first is that the decline did not go below the former 20-week cycle low before rebounding sharply. You cannot start a long-term downtrend unless you drop below a former support level. Could that still happen in the re-test phase? Yes, but only if the larger cycle has not yet made its low. The climactic action and subsequent recovery suggests otherwise.

The second positive is that if the 4.5-yr cycle has bottomed (which is probable), it made its high only 5 weeks ago -- a sign of extreme right translation. This means that the longer cycles are still pushing up and that the bull market is still intact. However, if the next 4.5-yr cycle were to top near its halfway mark, then we could expect a long, drawn-out bear phase.

One indication that the SPX is not yet back in a confirmed uptrend is that the momentum oscillator at the bottom of the chart, although it has turned up from an oversold position, has not broken out of its descending channel, and the thin line has not crossed the heavy line.

On the above chart, you may note that I make a distinction between the 4-yr cycle and the 4.5-yr cycle. The latter is a real cycle which, according to J.M. Hurst, is a subdivision of the 18-year cycle. The 4-yr, according to Bud Kress, is caused by an odd repetitive combination of the 2 and 3-yr cycles. If you want to hear the rationale behind his thinking, I suggest you read the following article by Cliff Droke. http://www.safehaven.com/showarticle.cfm?id=6743

In his writings, Edward Dewey also suggested that cycles that tend to appear and disappear are not true cycles but are caused by periodic combinations of other cycles.

Cycles

From last week: ...it may be at least 2 more weeks before we have strong evidence that it has reversed...Why 2 weeks? Because the week after next will see a nesting of several short-term cycles which should have some effect on the market. If the 4.5-yr low does occur next week (which it very well may) these short-term cycles will only provide a retracement after the initial lows. Or they may give us the final downward thrust of the larger cycle.

In fact, only the 6-week cycle appears to have made its low at the same time as the larger cycle. Two others were swept up in the uptrend and only produced brief pull-backs before the rally continued. The last one, the 20-day cycle is due early next week and could have a little more impact, but the important re-test period will be left up to the 12-mo cycle which usually bottoms in October.

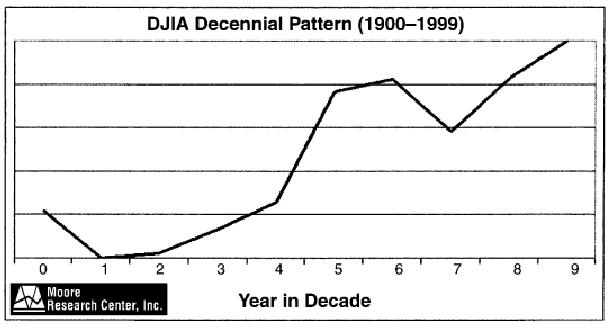

There appears to be a ten-year pattern of the U.S. stock indices which has been repeating itself for over a hundred years. I have reproduced (below) a ten-year average of this pattern from 1900 to 1999. As you can see, there is a tendency for stocks to be bullish or bearish during certain years of the decade. The year ending in 7 normally produces a decline before the long-term uptrend resumes and peaks in the 9th year.

If the correction is over, we have probably witnessed one of the shallowest 7th year declines since the beginning of the century -- another sign that we are in a bull market of exceptional strength. Note also that if this is so, the peak of the bull should not be expected until about the 9th year.

Projections

These projections for the market low were made 3 weeks ago in a Week-end Report to subscribers:

Finally, should the weakness continue in earnest, there is also a Fib projection to 1369. But other measurements suggest 1381-83 as a better bet.

In summary, look to one of these levels to be the low of the correction: 1426-28, 1413-16, 1381-83, 1369. Whichever one is either hit or re-tested by the end of next week is probably the one which will mark the low of the correction. Confirmation will come from price action, as stated above.

There was a significant re-bound from 1426, but the final low point of the decline was 1371.

The current rally is about to run into a plethora of Fibonacci projections and Point & Figure counts taken from the lows, former highs, and several other points along the way. The most obvious is that when it reaches 1484, just five points from where it closed on Friday, the SPX will have retraced .618 of its entire decline. This is reinforced by other Fib measurements taken from the low to 1480 and 1498, and two potential Point & Figure counts taken across the base to 1486 and 1498. There are also shorter term counts ranging from 1479 to 1482.

With another short-term cycle low due directly ahead, it's possible that we are ready to have a quick correction followed by a move to a higher level before beginning the test of the low.

Breadth

With the strong rally in prices, you would have expected the McClellan oscillator to perform equally well, and it has; it is currently trading at its highest level since 2004, just prior to the 10-yr cycle low. Does that mean that we have to go below 1371 before moving higher? No, but it does suggest that there will be a correction from this overbought level before we can.

In his "Technical Market Report" published on Safehaven this week-end, Mike Burk mentions that a week and a half ago, the NYSE recorded its 3rd highest number of new lows. When such an extreme number has occurred in the past, it has been followed by a re-test of the lows. This is what I expect as well.

Market Leaders & Sentiment

I have mentioned that the Russell 2000 and the Banking index have recently excelled at predicting short-term turns in the market. They both peaked before the market at the high and resisted the last phase of the decline. Now, after a good rally from their lows, they have gone flat for the past few days. Since the SPX has essentially reached its initial projection, I would expect that at least a shortterm pause is in the making.

We are at a stage of the market cycle whereby the sentiment indicators, after suggesting that the low was directly ahead a couple of weeks ago, are no longer useful. However, we might want to check them again for bullish readings around October.

Summary

There is every indication that the 4.5-yr cycle has made its low. The climactic sell-off followed by a strong rally is fairly typical. However, a re-test of the low is expected by October.

The fact that this cycle bottomed so close after making its high indicates that long-term cycles are still pushing up and that new all-time highs can be expected after a retracement into October.

The SPX is reaching a projection level, which signifies that it is ready for a few days' rest.

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. This service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5- wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

The following are examples of unsolicited subscriber comments:

What is most impressive about your service is that you provide constant communication with your subscribers. I would highly recommend your service to traders. D.A.

Andre, You did it again! Like reading the book before watching the movie! B.F.

i would like to thank you so much for all your updates / newsletters. as i am mostly a short-term trader, your work has been so helpful to me as i know exactly when to get in and out of positions. i am so glad i decided to subscribe to turning points. that was one of the best things i did ! please rest assured i shall continue being with turning points for a long while to come. thanks once again ! D.P.

Andre, I must say that your service is fantastic, since I have signed up for your 30 day free trial I have made two successful trades. When my 30 day free trial is up please let me know so I can sign up as a regular member. I have tried a lot of services out there and I must say yours tops everything. Please use this testimonial if you like. S.W.

But don't take their word for it! Find out for yourself with a FREE 4-week trial. Send an email to ajg@cybertrails.com .

By Andre Gratian

MarketTurningPoints.com

A market advisory service should be evaluated on the basis of its forecasting accuracy and cost. At $25.00 per month, this service is probably the best all-around value. Two areas of analysis that are unmatched anywhere else -- cycles (from 2.5-wk to 18-years and longer) and accurate, coordinated Point & Figure and Fibonacci projections -- are combined with other methodologies to bring you weekly reports and frequent daily updates.

“By the Law of Periodical Repetition, everything which has happened once must happen again, and again, and again -- and not capriciously, but at regular periods, and each thing in its own period, not another’s, and each obeying its own law … The same Nature which delights in periodical repetition in the sky is the Nature which orders the affairs of the earth. Let us not underrate the value of that hint.” -- Mark Twain

You may also want to visit the Market Turning Points website to familiarize yourself with my philosophy and strategy.www.marketurningpoints.com

Disclaimer - The above comments about the financial markets are based purely on what I consider to be sound technical analysis principles uncompromised by fundamental considerations. They represent my own opinion and are not meant to be construed as trading or investment advice, but are offered as an analytical point of view which might be of interest to those who follow stock market cycles and technical analysis.

Andre Gratian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.