Gold Bullish Breakout to New Highs, Miners Exhibiting Massive Accumulation

Commodities / Gold and Silver 2010 May 12, 2010 - 07:38 AM GMTBy: Toby_Connor

Gold’s break out to new highs has very bullish connotations going forward. It puts the odds squarely in favor of a C-wave continuation.

Gold’s break out to new highs has very bullish connotations going forward. It puts the odds squarely in favor of a C-wave continuation.

I will go over expectations and cyclical structure for a second leg of the C-wave in tonight’s report for subscribers.

For those of you thinking about getting side tracked by a meaningless daily cycle low that is coming due, let me tell you from bitter experience the one thing you don't want to do is lose your position at the beginning of a C-wave or C-wave second leg.

At this point the daily cycle corrections aren't profit taking opportunities. That will come as we near the end of the C-wave.

At this time a daily cycle low is a last chance opportunity to get invested.

Don't forget in bull markets and especially during aggressive C-wave advances the surprises come on the upside. Daily cycles can and often do run exceptionally long as a C-wave starts to gain momentum so losing one’s position in an attempt to "time" a short term correction can potentially cost one many percentage points. It's just not worth the risk. It’s time to heed "OldTurkey" advice.

I have no doubt this will be the greatest bull market that any of us will ever see in our lifetime. Since November of `08 the precious metal sector has been doing everything but hit investors over the head with a pipe to let us know this is the leading sector of this bull.

Miners are the only sector exhibiting massive accumulation.

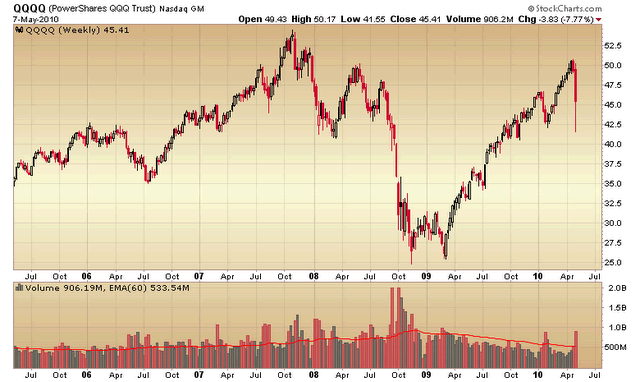

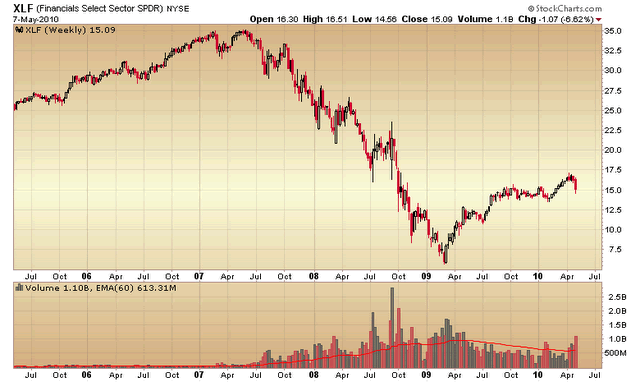

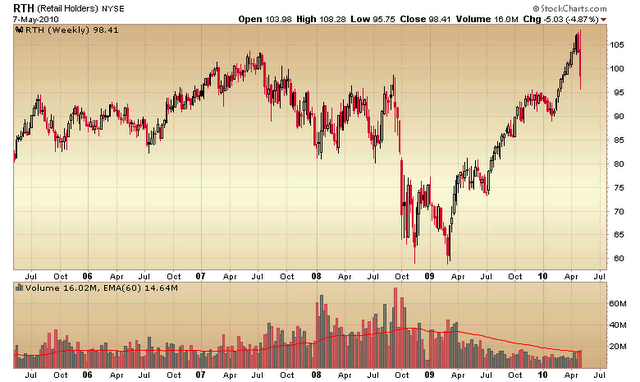

Compare the above chart to other sectors during this bull and you will see where the smart money has been positioning.

These are just a few sectors, but the picture is the same no matter where you look. Steadily declining volume. Only miners are showing heavy accumulation.

I’m even seeing analysts touting the energy sector as the place to be. It’s not unusual to see traders flock back into the leading sector of the prior bull, but if history is any indication energy will not lead this bull. You can see from the chart of XLE that energy, just like every other sector, is showing no signs of accumulation. Let’s face it the supply and demand fundamentals for the energy sector are now impaired and will be for years as the world cycles through multiple on again off a gain recessions and stubbornly high unemployment levels.

The only sector with improving fundamentals is the precious metal sector, which will benefit from governments ongoing attempts to “print” prosperity. It will not work, but the blizzard of paper will drive the secular gold bull to amazing heights before it’s finished.

Once the HUI & silver join gold, platinum and palladium at new highs the entire precious metal sector will move into a vacuum with no overhead resistance.

That is going to be incredibly bullish for the sector.

Toby Connor

Gold Scents

A financial blog with emphasis on the gold bull market.

© 2010 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.