Gold at $1500/oz Forecast by Gold Analysts on Sovereign Debt and Currency Concerns

Commodities / Gold and Silver 2010 May 13, 2010 - 06:56 AM GMTBy: GoldCore

Gold has consolidated near record highs in Europe today as concerns about eurozone debt default and sovereign debt contagion remain. Gold rose to $1,246/oz early in the afternoon in New York yesterday before closing with a gain of 1.92%. It then rose to a new all time nominal high of $1,248.20/oz after New York closed. It has range traded from $1,233/oz to $1,239/oz in Asian and early European trading this morning. Gold is currently trading at $1,234/oz and in euro and GBP terms, at €982/oz and £837/oz respectively.

Gold has consolidated near record highs in Europe today as concerns about eurozone debt default and sovereign debt contagion remain. Gold rose to $1,246/oz early in the afternoon in New York yesterday before closing with a gain of 1.92%. It then rose to a new all time nominal high of $1,248.20/oz after New York closed. It has range traded from $1,233/oz to $1,239/oz in Asian and early European trading this morning. Gold is currently trading at $1,234/oz and in euro and GBP terms, at €982/oz and £837/oz respectively.

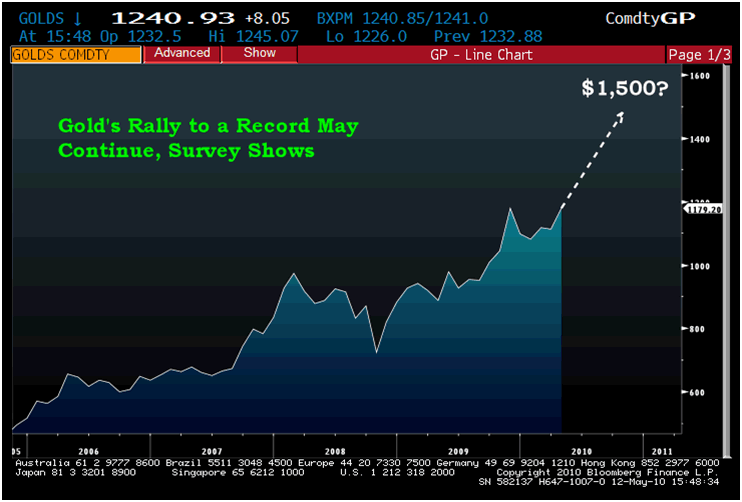

Gold analysts polled by Bloomberg believe that gold could reach $1500 per ounce in the coming months. Gold may extend gains to a record $1,500 an ounce this year as investors seek an alternative to currencies amid the European sovereign-debt crisis, according to a Bloomberg News survey of traders, analysts and investors (including GoldCore). Gold, climbed to an all-time high yesterday on speculation an almost $1 trillion loan package for indebted European nations will devalue the euro. Prices have climbed 13 percent this year. The Bloomberg Chart of the Day above shows gold may climb another 21 percent this year to $1,500/oz, the median estimate of 23 respondents surveyed yesterday.

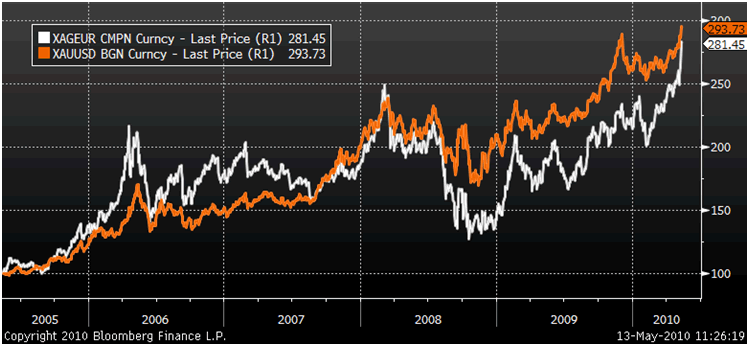

The white line and the red line in the chart below show previous resistance and closes above resistance led to rapid price moves up of some $200/oz to $300/oz. A similar move up today would take us to over $1,400 per ounce.

The €750 billion bailout and the fact that the ECB are buying and will likely have to keep buying government bonds for a long time before investors' confidence is restored is leading to concerns that this massive debt monetization will ultimately lead to a weaker euro, higher inflation and ultimately to higher interest rates.

European investors are concerned that the ECB's independence is badly compromised and the ECB may now be subject to political meddling. Markets and central banks trusted the euro before as the ECB inherited the credibility of the inflation wary Bundesbank. This has all changed and is leading to real concerns about whether the euro will remain a store of value, a hard currency and a world reserve currency.

Hence, the huge demand for gold coins and bars seen in Germany and throughout the eurozone in the last few weeks. Bullion premiums have begun to move up in Europe and premiums on Krugerrands and one ounce gold bars are up by more than 1% in the last 2 weeks. Not surprising given growing supply issues with some of the mints. Incredibly, the Austrian Mint sold nearly 20% more gold Philharmonics in the last 3 weeks than they did in the first 12 weeks of the year. The mint sold 243,500 ounces since April 26 compared with 205,300 in the first quarter.

While all the spotlight has of late been focused on the fiscal challenges in the eurozone, the UK and US also have fiscal challenges. The incoming Conservative - Lib Dem coalition faces serious economic challenges - specifically the worst peace time deficit in British history.

While the US is faced with its own deficit issues. Yesterday came news that the trade deficit in March widened to the highest level in more than a year as imports climbed faster than exports. This would suggest that the dollar needs to fall further in order to restore competitiveness. The US Treasury Department announced that the Federal budget deficit for April soared to $82.7 billion, the largest imbalance for that month on record. The latest data brought the deficit for the first seven months of fiscal year 2010 to $799.68 billion. Unlike eurozone countries, the US can print money to fund liabilities but this can only continue for so long prior to the US' AAA credit rating coming into question.

Gold in Euros and US Dollars - 5 Year (Daily)

Silver

Silver too continues to consolidate above previous resistance which is bullish technically. Silver has range traded from $19.36/oz to $19.54/oz this morning in Asia and Europe. Silver is currently trading at $19.40/oz, €15.43/oz and £13.14/oz.

While silver has outperformed gold in recent months, it has massively underperformed gold over the long term. Gold is now nearly 50% above its nominal high in 1980 (1235/850) while silver remains less than 60% (19.4/50) of its nominal high in 1980. In the historic financial and economic times we are living through, it is prudent to have a historic perspective and not get caught up solely in the noise of daily and weekly figures.

Investors continue to view silver as gold's ugly sister and it is rarely covered in the media. There has been no talk of retail investors, pension funds, HNW's or large hedge funds investing in silver as of yet. This will change in the coming months and this is when silver is likely to really move up in price. The US Mint and Canadian Mint continue to experience very high demand for silver eagles and silver maple leafs and premiums for these coins are beginning to move up again.

Platinum Group Metals

Platinum is trading at $1,738/oz and palladium is currently trading at $547/oz. Rhodium is at $2,825/oz.

News

Muenze Oesterreich AG, the Austrian mint that makes the best-selling gold coin in Europe and Japan, said sales have spiked in the last three weeks on fears that Greece's debt problems will hurt the euro."We sold more than in the first quarter of the year," Vienna-based Marketing Director Kerry Tattersall said in a telephone interview. "It represents panic buying."The mint sold 243,500 ounces since April 26 compared with 205,300 in the first quarter, according to Tattersall.

Holdings in the SPDR Gold Trust, the biggest exchange-traded fund backed by bullion, have advanced 6.7 percent this year to a record. The fund's assets increased 17.35 metric tons to 1,209.5 tons yesterday, its website showed.

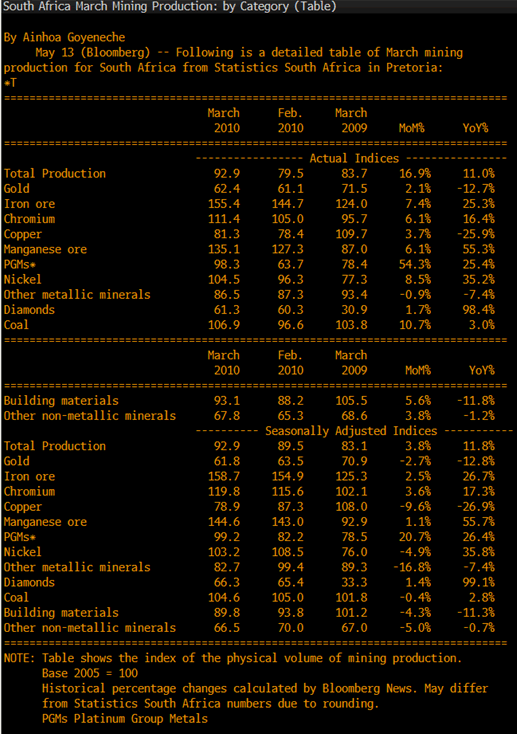

Gold mining production in South Africa continues to fall despite higher prices in recent years.

Following is a detailed table of March mining production for South Africa from Statistics South Africa in Pretoria:

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.