Tactical View of the Financial Markets: A Little Help From Our Friends

Stock-Markets / Financial Markets Sep 06, 2007 - 12:56 AM GMTBy: Justice_Litle

Tactical View of the Financial Markets: A Little Help From Our Friends

What would you do if I sang out of tune,

Would you stand up and walk out on me?

Lend me your ears and I'll sing you a song

And I'll try not to sing out of key...

-- Joe Cocker, A Little Help From My Friends

IN BRIEF

- George Bush and Ben Bernanke gave a helping hand to the market last week with their accomodative talk. Lucky perhaps, but also part of the expected market script.

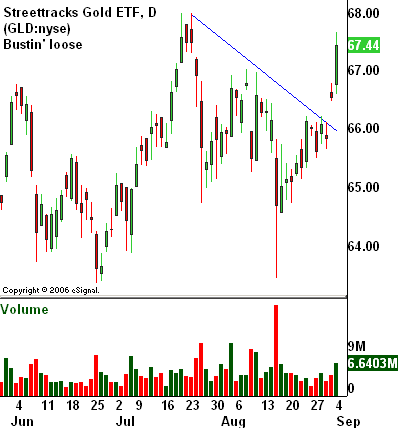

- Gold is back in positive mode once again, as the light bulb goes on for investors and traders as to what is most likely ahead.

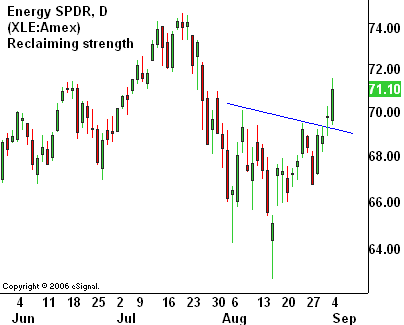

- The remarkable thing about the run in energy stocks , in tandem with the rise of crude oil, was the way $70 a barrel oil seemed to put no meaningful damper on demand. We're still seeing that combo work its magic...

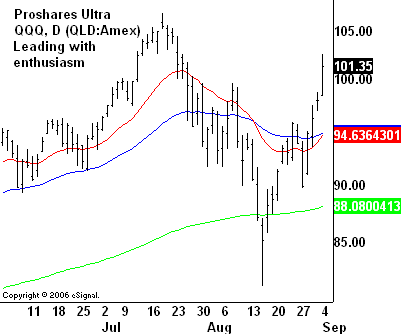

- Tech stocks are the new black in a sea of subprime red. While the rest of the country frets, Silicon Vally dreams of "Web 2.0" profits...

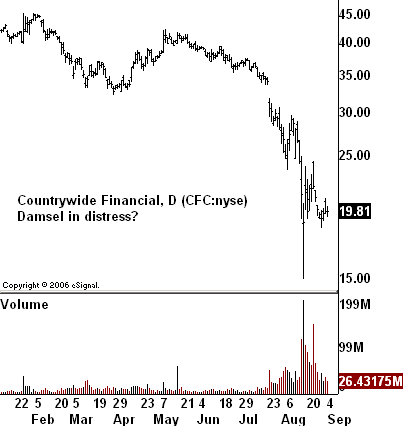

- Countrywide Financial still has potential to be a "damsel in distress." While one white knight has already stumbled, another, bigger one could be waiting in the wings...

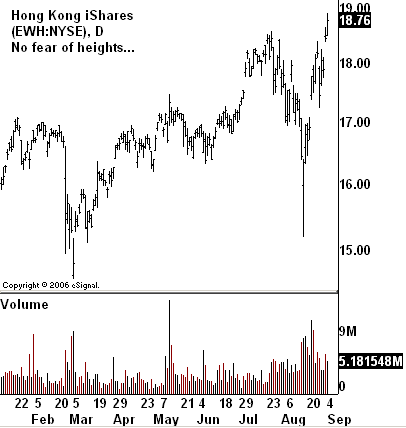

- EWH, the Hong Kong iShares ETF , has gone on to new heights even as many of its peers lag far below previous highs...

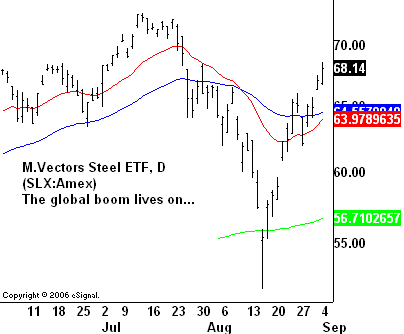

- The Market Vectors Steel ETF reminds us that the global boom may yet survive, and not get knuckled under by supbrime...

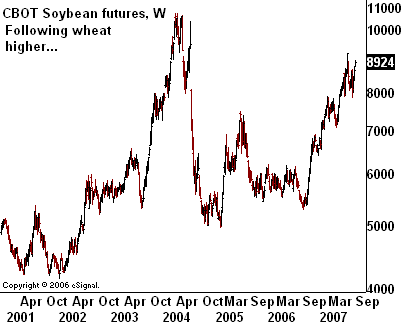

- As soybean futures follow wheat futures higher, it seems clear Wall Street is still oblivious to the perfect storm brewing for grains.

IN THE MIDDLE OF LAST WEEK or so, the Consilient trading portfolio added three new long trades -- the Energy Select SPDR (XLE:amex), the Pro Shares Ultra QQQ ETF (QLD:amex), and the Streettracks gold ETF (GLD:nyse).

Things were looking hairy at first, but soon turned around quite nicely... thanks to a little help from our friends, George Bush and Ben Bernanke. The President and the Fed Chief sang an accommodative tune, hinting loudly at rate cut possibilities and distressed homeowner largesse.

The rapid turnaround might be classified as a bit of luck (which every wise trader welcomes). And yet, an indulgent helping hand has always been a part of our market script. When Macro Musings pounded the table for gold stocks a few weeks ago, a key piece of the argument was the return of stimulative, i.e. inflationary, monetary policy with a clear "rescue" bias.

As with all our trades, these three had reasons technical and fundamental behind them; it's just harder to be chronologically precise on the fundamental side. Kudos to George and Ben for their timing.

GOLD IS BACK in positive mode once again, as the light bulb goes on for investors and traders as to what is most likely ahead.

A combination of stimulative monetary policy and accommodative (read: not horrible) corporate profits is a recipe for ongoing inflation creep and a continued trend of paper asset inflation. Except now, with a good bit of hot air sucked out of the financials, there is more room for safe haven niches and inflationary plays, as efforts to bail out Joe Homeowner wind up helping Joe Goldowner by accident.

ENERGY STOCKS, as we have mentioned more than once, have been a major market driver these past few years. Escalating crude oil prices allowed energy companies -- oil majors, refiners, drillers, service companies and the like -- to reap eye-popping profits. (And even now those profits do not seem to be fully discounted by the street.)

The remarkable thing about energy stocks' run, in tandem with the rise of crude oil, was the way $70 a barrel oil seemed to put no meaningful damper on demand. We are still seeing that combo work its magic as crude makes its way into the mid $70s once again. Energy stocks can arguably be seen as an inflation hedge, a global growth play, and a peak oil play all at once.

TECH STOCKS ARE THE NEW BLACK in a sea of subprime red.

While the rest of the country frets over mortgage meltdowns and credit downgrades, the Silicon Valley boys and girls are dreaming of all the profits to be made from "Web 2.0."

Private companies like Facebook dream of going public and becoming the next Google; gadgets like the iPhone have the world clamoring for endless consumer bandwidth; and hardware companies like Cisco are hitting 52-week highs on the prospect of selling all the internet plumbing required to make "web 2.0" possible.

EMERGING MARKETS have taken a nasty beating and bounced back smartly since. As noted in a previous Tactical View , the chart patterns have looked similar across the board. While looking much better on the whole, few emerging market ETFs have surpassed their previous highs.

One exception is EWH, the Hong Kong iShares ETF, which has gone on to new heights even as most others have lagged. Top holdings of EWH include Asian stalwarts like Hutchison Whampoa, Cheung Kong holdings, and Sun Hung Kai Properties.

Many pundits have pooh-poohed Asian equities as a place to take shelter, but they haven't been a bad place to hang out so far...

COUNTRYWIDE FINANCIAL still has potential to be a "damsel in distress"... a tongue-in-cheek term we deployed in an essay on the great investment fortunes, Fortune Building 101 .

Unfortunately for current Countrywide shareholders, one white knight has already been rebuffed. Bank of America heroically threw $2 billion at the bleeding mortgage lender, expecting its vote of confidence to be rewarded with a sustainably higher share price.

No such luck...Wall Street is still worried about the darker corners of Countrywide's books, not to mention its ability to weather further damage if the credit storm intensifies. But if things get much uglier for CFC, the original damsel-rescuer may yet step in.

Given CFC's size and general reputation (tarnished subprime activities aside), the company's woes bear at least passing resemblance to the "salad oil scandal" that hit American Express in the 1960s, after which Warren Buffett purchased a gigantic block of Amex stock at severely depressed prices.

Mr. Buffett, who currently sits on $50 billion in cash, has said he can "spend money faster than Imelda Marcos" when the opportunity is right. Presumably he isn't talking a closet full of shoes... and isn't the only distressed buyer watching the markets with a keen eye.

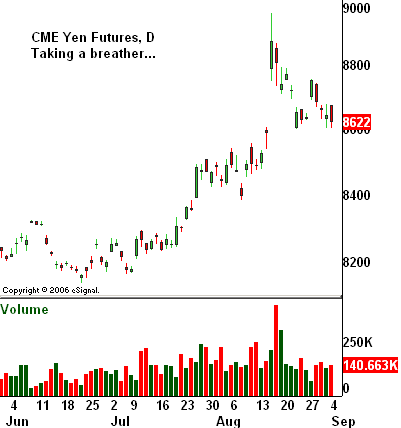

THE JAPANESE YEN has been unleashed. After a long stretch of sleepy movement, volatility is now the order of the day. The Yen exploded as credit markets imploded; as credit fears take a breather, so does the carry trade bottle-rocket.

Large and small speculators are now net long CME Yen futures, the latest Commitment of Traders report indicates. But the $64 trillion yen question is, whither the Japanese public? "Mrs. Watanabe," the Japanese reincarnation of the American day trader circa 1999, is still presumably betting hard against her own currency.

When the Japanese public start calling in their global forex bets, we could see the yen go into its next stage of orbit.

THE MARKET VECTORS STEEL ETF continues to show, uh, steely strength (groan), thanks to solid international holdings like Posco (PKX:nyse), Companhia Vale do Rio Doce (RIO:nyse), and Mittal Steel (MT:nyse).

Steel is a good reminder that the global boom will not necessarily be knuckled under by subprime woes. There are still a lot of dollars sloshing around -- trillions of them in Sovereign Wealth Funds and global central bank coffers -- and a lot of building to do. Steelmakers are benefiting from a long-term trend of consolidation (scooping up previously fragmented producers) and dampened volatility as global growth prospects, and construction projects, take hold on a broader scale.

AH, SOYBEANS. There are few things a grizzled commodity broker loves more than a raging bull market in grains. (Not that your humble editor, an ex-commodity broker himself, is all that particularly grizzled.)

"Beans in the teens!" is the old, if seldom heard, rallying cry. Perhaps we'll be hearing it again soon if wheat keeps leading the way.

For all the talk of a perfect storm in credit markets, the world still seems oblivious to the perfect (and potentially much bigger) storm brewing for grains: Dramatic increases in world food demand... alarming drop-offs in potable water supply... higher potential for drought due to unstable weather patterns... and, most disturbing of all, the growing trend of food vs. energy competition. (Every acre of corn planted for ethanol is potentially an acre of wheat or soybeans foregone.)

Profitably Yours,

Justice_Litle

http://www.consilientinvestor.com

Copyright © 2007, Angel Publishing LLC and Justice Litle

Justice Litle is the editor and founder of Consilient Investor. Consilient Investor is a broad ranging collection of articles ( written by yours truly) on markets, trading and investing... and big ideas related to such. It is also home to the Consilient Circle, a unique trading and investing service.

Justice_Litle Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.