U.S. Economic Recovery, Only It Didn’t

Economics / Economic Recovery Aug 13, 2010 - 10:07 AM GMTBy: Andy_Sutton

The powers that be are now starting to be shown what should be a very important lesson in the old saying: “You can fool all of the people some of the time and you can fool all of the people some of the time, but you can’t fool all of the people all of the time”. For a year and a half now, starting at a rather well defined point in time during early March 2009, the govermedia switched gears and pronounced that the shattered American economy was in recovery.

The powers that be are now starting to be shown what should be a very important lesson in the old saying: “You can fool all of the people some of the time and you can fool all of the people some of the time, but you can’t fool all of the people all of the time”. For a year and a half now, starting at a rather well defined point in time during early March 2009, the govermedia switched gears and pronounced that the shattered American economy was in recovery.

The perceptive ears on Wall Street picked up on this rather quickly and the markets reversed and headed higher. Consumers bought it not only because they’d bought almost anything that moved for nearly a decade and a half, but frankly, because they wanted to. The doomsday talk was really putting a damper on the consumption party, and well hey, let’s pass out the credit cards and get it rolling again. It would have seemed as if the powers that be had created another blowout, profited from it, bailed themselves out at taxpayer expense, then with a few crafty words and graphics on the telescreen kick start the next phase. It was all set up to happen perfectly.

Only it didn’t.

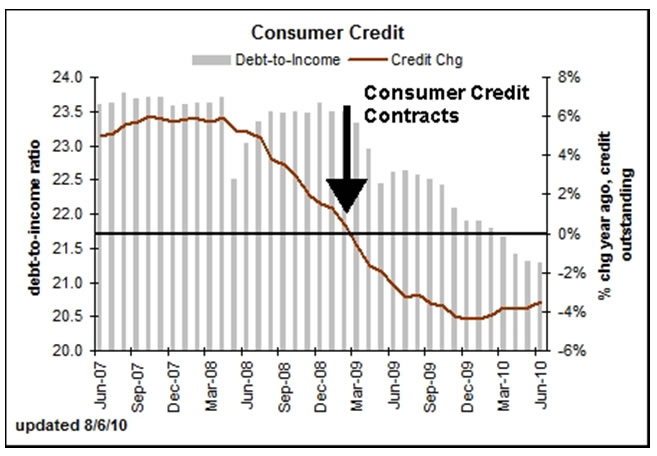

The consumer bit for a while, but never fully embraced the idea of the jobless recovery. Many times over the past year, these pages were filled with wonderment at the unmitigated gall of an establishment that would think that a man without a means to make a living, unable to support his family, would hike out his credit card and march off to the store and forget about it all. It defied logic. Yet that was what was supposed to happen.

Only it didn’t.

In early 2009, the federal government handed out cash to consumers and instead of spending it, consumers saved it, paid down debt, bought Gold or any number of a hundred things other than doing what they were ‘supposed’ to do with it, namely spending it. I joked at the time that because of non-compliance, the next stimulus would be store gift cards. While we haven’t gotten there yet, there has been zero talk of another round of checks.

This should send a very clear signal that our government, a miserable failure in doing anything to help our economy, STILL thinks it can spend your money better than you can. Look at recent actions this week as our government decided to pull the ultimate robbing of Peter to pay Paul when it swiped $12 Billion from the food stamps program to give bailouts to the teachers’ union and other state and local employees.

And even this will not last. States are still broke. What happens when this money is spent? The same thing as when the last stimulus money was exhausted. We’re right back where we started with nothing to show except more kicking of the can down the road and a hefty bill for our children and grandchildren. Larry Kotlikoff’s article on Bloomberg this week nailed it – We’re broke and we don’t even know it. The fiscal gap, now at $202 trillion, is up roughly $17 trillion in the last 6 months.

The debt function is going parabolic and yet there are still people on TV on a daily basis screaming that America has the strongest economy in the world. If a fiscal gap that represents almost 15 years of GDP is considered the strongest, then I’d hate to see what the weakest looks like. It is repeated like Newspeak in the hopes that some of it will stick.

Yet there truly is a dichotomy going on in America. Take a trip to the local shopping mall and you’ll see people snapping up the latest iGadgets, consumer electronics, and other ‘necessities’. Yet retail sales are flat. Granted, much of the spending is being done on deeply discounted items, but there is something worth mentioning here. There is a silver lining in all this. If you are one of those people who have been responsible (and fortunate) and have savings and some extra cash for discretionary spending, there has never been a better time. America is on sale – literally, and in more ways than one. Don’t get too excited though; the silver linings pretty much end right there.

In recent weeks, almost on perfect cue, the mainstream press started playing up the ‘Double Dip’ card. They even trotted out the relic Alan Greenspan for a few sound bytes. The buzzword is now deflation. M3 is contracting (albeit bouncing somewhat in the past few weeks). M1 growth is falling, and M2 is hovering very close to the zero-growth area. The banks are being blamed for hoarding bailout dollars and not lending to consumers and businesses. Funny thing though, it is the Fed who is incentivizing this behavior by paying the banks to keep their money there and it is the same Fed who is working on a ‘bank CD’ system to pay the banks an even higher return for not lending.

Something ought to ring patently false then when Ben Bernanke gets up on his soapbox and talks about the need for lending by banks. Yet no one in Congress has the fortitude to ask these tough questions save for Ron Paul and perhaps one or two others. The Fed knows our economy is built on inflation, credit, and increasing money supply, yet in similar fashion to the 1930’s, the Fed is actually encouraging deflation through a number of its policies while talking about overall easing through its pursed lips and crossed fingers.

I realize that this is heresy to the many people who talk about quantitative easing and hyperinflation as being a certainty. The truth is that the banking system creates much more inflation than the Fed, and right now the banking system isn’t doing it. Granted, the Fed is doing QE through a variety of channels – if it were not, we’d have crashed a long time ago. But to be fair, most of that QE has been for the purposes of saving banks and related institutions rather than helping consumers and the economy. I think everyone can agree on that point.

Again, one must ask serious questions about the Fed and its true purposes. The latest talk is that the Fed is worried about the recovery. The last time I checked, the Fed’s ONLY two mandates were price stability and maximum employment, not micromanaging the economy. They’ve done a lousy job on both counts, but have painted a picture of a slow, but steady recovery that would get fuel from borrowed money, stimulus, and the last of the age of consumer largesse. It was all supposed to happen just like that.

Only it didn’t.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.