Global Housing Markets Burst As Risk is Being Repriced - Fingers of Instability, Part 7

Housing-Market / Liquidity Bubble Sep 25, 2007 - 12:12 AM GMTBy: Ty_Andros

In This Issue – 6 Fingers

In This Issue – 6 Fingers

- Federal Reserve and G7 Central Banks See The “FACE OF GOD”

- Unintended Consequences

- The 11% Solution, aka “Locusts”

- Under The Stealth of The Headlines!

- China and The Dollar!

- Important Conclusions

What's unfolding in the world of finance and economics is extremely interesting. As financial authorities try and contain the growing financial turmoil, illusions abound and thus confusion reins supreme. Confusion and uncertainty are the markets' worst enemy. This week we witnessed many things which have occurred very rarely in history and the response to them set in motion a game of dominoes which will be interesting to watch unfold. The “Fingers of Instability” are cascading through the financial system and where they ultimately leave us is at an opportunity of epic proportions.

There is no shortage of money and the “Crack Up Boom” (see Ted bit archives at www.TraderView.com ) is front and center for the next 5 to 10 years, at least. Volatility is opportunity for the prepared investor, after years of low volatility we are now headed to the opposite extreme, so buckle your seatbelts and prosper. Are you prepared to be a winner and benefit, or a loser and be one of the victims of those who have done their homework and positioned the sails of their investments to thrive in the upcoming turbulence?

Federal Reserve and G7 Central Banks See The “FACE OF GOD”

This week saw an About Face of epic proportions in the Central Banking communities of the G7. Global systemic financial concerns have turned the printing presses into high gear as re-flation is now front and center. I shouldn't be surprised as I predicted it in the July and August editions of “Tedbits”. But the extent of the change is breathtaking, to say the least.

Last week we spoke about “Northern Rock”, a UK version of a Savings and Loan. We spoke about a “run on the bank” that continued even after the Bank of England (BOE) indicated they would bail them out. But the UK citizens noticed how empty some of the rhetoric was and continued to exit. Monday morning UK banks who had employed the same business model as Northern Rock went into freefall in the stock market. UK politicians saw the end of their tenures on the near horizon and acted decisively to secure their citizens' funds “Immediately”. Chairman of the BOE, Mervyn King, and the Chancellor of the Exchequer (treasury secretary), Alistair Darling, were brought onto the carpet and told in no uncertain terms to rescue the situation, and they did. They stepped forward Monday afternoon and wrote the most enormous check in history! THEY GARANTEED ALL THE DEPOSITS IN THE UK BANKING SYSTEM, EFFECTIVELY TURNING THE BANKS INTO QUASI GOVERNMENT GUARANTEED INSTITUTIONS, SUCH AS FANNIE MAE AND FREDDIE MAC, IN THE UNITED STATES!

The government nationalized the risks of banker's lending decisions but left the profits from operations in the hands of the shareholders. Talk about moral hazard, this is it. Now private shareholders in banks can engage in even more risky behavior and know that if it comes a cropper they needn't worry as the depositors are GUARANTEED. The bubbles in UK real estate are as enormous as many parts of the United States, and since any of the losses from the lending has been guaranteed by the government, it can now continue to even new heights of irresponsibility.

Well the Federal Reserve saw the near dead body of Northern Rock floating to the top from the securitized mortgage markets and what the BOE was FORCED to do and said to themselves “There, but for the grace of God, go I.” They acted with a shock and awe preemptive strike on re-liquefying the banking system from their irresponsible lending practices and product issuance. So the Federal Reserve went back to Greenspan's play book and the Bernanke put was born signified by a 50 basis point reduction in the fed funds and discount rates. This is only headline news as M3 money supply growth, since Bernanke became chairman has grown for approximately 8% year over year rate to its reconstructed nearly 14% at this time, and it's only accelerated since August. It's now inflation “who cares” inflate assets at any cost.

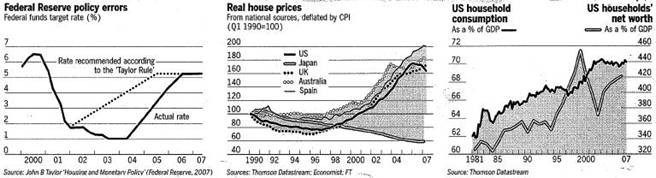

To illustrate the problem of were home and asset prices could be headed we will look at a recent set of charts from the esteemed Martin Wolfe of the Financial times:

These are SHOCKING charts when you think about them closely. As you can plainly see the bubbles in home asset prices is a worldwide affair (with the US headed downward!), and the bubble in consumption in the US has been ongoing for over 30 YEARS! Years of negative interest rates (rates below the REAL rate of inflation) have created the most distorted home values in history, but it extends to may other asset values as well - except when measured in GOLD (see: Is the stock markets on their Highs or Lows from last week's edition). And the financing of the over consumption by consumers has larded up their balance sheets with debt as never before seen. The absurdity of an economy based on “CONSUMPTION” and rising asset prices rather than the production of wealth is on plain display.

G7 Policies of wealth creation through inflation of asset values is about to undergo a stern test RIGHT NOW! Notice how the US home values have turned south? MOMENTUM is downward and as outlined last week in “FIRE SALES” (see Ted bit archives at www.TraderView.com ) accelerating to the downside. Those assets are the backing behind the CDO's, CMO's, MBS's, LBO's, (collateralized, mortgage and debt obligations, mortgage backed securities, Leveraged buyouts) etc. That consumer consumption is on borrowed money, and also sits in securitized debt and on the balance sheets of the biggest banks in the world as they fleece the “public” around the world with their credit card and consumer loan operations.

So its “man the fire hoses of hot money” as the G7 Ce ntral Banks pump the money into the monetary system. The Federal Reserve, BOE and the European Ce ntral Bank are pumping billions into their monetary systems to encourage lending, which has “Frozen” as no one wants to lend money to buy extended asset values. The velocity of money is plummeting; the Asset-backed commercial paper market resumed its plunge this week, as counterparties trust NO ONE! They ( Ce ntral Banks) are throwing everything including the proverbial “kitchen sink” at this effort to stave off deflation of those assets and securities.

Short-term interest rates are set to plummet to under pin the asset-backed economies of the G7, and we are about to see the that the Ce ntral Banks are not independent, as their political masters are about to emerge into the headlines to secure their re-elections. And because of this….

Unintended Consequences

While the short end of the G7 interest rates are on hold or declining, the long end of the interest rate markets are plummeting (moving higher), UK Gilts, German Bunds, US bonds, etc. are all rocketed higher in realization of the attack on the purchasing power of the currencies in which they are denominated. Signaling that a new chapter is commencing in madness known as “Fiat money and credit creation” as financial authorities try to “PAPER” over their past easy policies. This is complicating the underpinning of Asset-backed securities, real estate and stock markets, as the long end rises in yield it sucks the life out of lower-yielding investments and capital losses ensue.

Removing bidders by creating less demand for homes, low yielding corporate bonds, impossibly priced “Private equity” commitments, existing holdings of low-yielding bonds are plummeting in value. Capital losses are front and center for the holders of these supposedly-safe bonds.

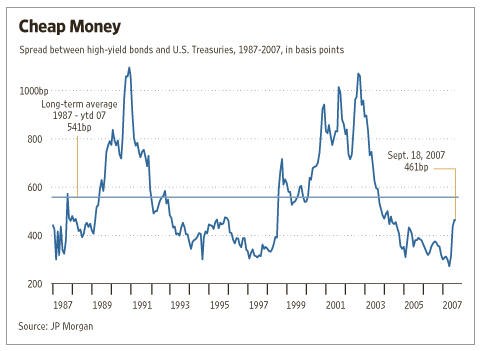

Risk is being re-priced, and it is an opportunity of gargantuan proportions as they will do so with a BANG! Are the sails of your investments set to catch the wind of these moves and put the gains into your portfolio? Take a look at this chart from a recent www.wsj.com article:

I urge you to read this article by Steve Ratner, “The Credit Crunch Continues”

It appeared in the Wall Street Journal dated September 20, 2007 and it details the mis-pricing and re-pricing of risk on the near horizon. If you have a s WSJ subscription, here's a link (you will need to log in to read the entire article):

See that average going back to 1987? High-yield bond spreads are headed there like a laser beam now and back to the old highs (probably over a several year period), as they do so, opportunities will present themselves to you in all sorts of inter-related markets. Stocks, bonds, currencies, commodities, raw materials and energy will all cascade higher or lower in price and present you with profitunities. Are you positioned correctly? Does your financial advisor even present these as opportunities rather than storms that must be ridden through? Depending on what they say, act accordingly!

There is nothing in this chart which can be construed as good for the major banks and wire houses (Morgan Stanley, Merrill Lynch, Bear Stearns, Lehman Brothers, Credit Swiss, Deutsche bank, Fimat, Bank of America, Countrywide, to name but a few). Everything they are involved, in except their proprietary trading in the markets, is set to crumble as that chart moves to the average and beyond. Poor banking and lending practices are about to bite them and the people that bought their “financial” alchemy big time. Everything bought by an investor at those lows since 2004 is set for large capital losses, this includes the banks' reserves and the investment banks' balance sheets that funded those asset purchases. Why would anyone with half a brain buy debt issued now when capital losses loom dead ahead as long-term interest rates are set to skyrocket? Money printing is front and center to rescue the banks. Lehman brother's earnings were a testament to their hubris in trying to hide the ugly truth: The money printing is not going into lending it is going into purchasing stocks and other asset classes.

Currency markets viciously resumed their powerful up trends and the dollar has plummeted to new 30-year lows. Oil set new weekly highs and confirmed projections to over 98 dollars a barrel. Gold impulses higher against “ALL Currencies” in reaction to the money printing that will be required to address the mess made by the Ce ntral Bankers, banks, investment houses and their public servants who wish to print and spend and be re-elected, rather than invest and grow in the future. Creating fiat currencies and unlimited credit expansion to create the illusion of growth-by-asset-inflation is coming home to roost.

The “Crack Up Boom” (See Ted bits archives at www.TraderView.com ) is moving into a higher gear as Ce ntral Banks print the money required to underpin the “overpriced” paper assets and banks balance sheets. The public will try to move it into something quickly to avoid the loss of purchasing power that will emerge every night it sits in the bank. Emerging markets are flush with G7 currencies in the hands of Ce ntral Banks and in the private accounts of their citizens. They are savers and their economies WILL decouple more and more as their consumers and savers emerge to buy hard assets and businesses in the G7. It is called repatriation and it is set to skyrocket. Every pullback in the stock markets of the G7 will be met with waves of buyers looking for bargains. Vicious slides are front and center right now

The 11% Solution, aka “Locusts”

Little noticed as the headlines are fairly benign with global stock market rallies is what's unfolding in Washington DC . It is a slow motion train wreck of stupidity, ignorance, hubris and fiduciary betrayal of their constituent's futures. Nothing gets in the way of their re-election, greed for power and vote buying operations. Alan Greenspan's book was released this week and of course he is the primary author of the unfolding mess along with this public-servant constituency. The money printing over the last 30 years was with their complete approval as re-election was a breeze and career politicians rode it to power and wealth over others. But he was right about several things, and one of them is that “republicans traded their principles for power and now have NEITHER”. We through the bums out! Unfortunately the democrats have interpreted this as an endorsement of their policies of tax, spend and destroy the private sector. It was nothing of the sort.

A pox on both their houses is front and center in the polls of congressional approval ratings and has now plummeted to 11%!!!! Barely 1 in 10 of their constituents approves of their machinations and plans for torture of the citizenry. Understand that this number is less than the percentage of the population that is government employees. They are proceeding as fast as they can with their plans before they can be stopped by public outrage when the facts of their actions become clear. Once passed, these laws will never be repealed as we can see from history.

Just as the world's biggest debtors in the G7 are in need of financing they are turning the bankers of their spending excesses with a spit in the eye. The government of Dubai is trying to buy 20% of the NASDAQ stock exchange and this is being attacked by the senators and representatives as being a threat to national security. This purchase allows the Dubai buyers only 5% of the voting rights which is hardly a recipe for control of this venerable institution of capitalism.

The Public Servants are picking a fight with China , our biggest creditor with over 4.8 Trillion dollars of reserves (public and private) that need to find homes in investments (see “Crack up Boom” in the Ted bits archives at www.TraderView.com ) . Proposing nationalization of the health care system, free lunches forever, higher taxes and fresh new mandates on already globally challenged domestic corporations and the most productive segment of the population known as “small businesses”, expansion of Fannie Mae and Freddie Mac balance sheets of poor assets. Obviously they have fooled the majority into thinking what every first year Economics student is taught on the first day of class: There ain't no such thing as a free lunch! Socialism and money printing is a recipe for the poor house and this is all that is on the Public Servant's agendas in the G7.

The G7 depends on these investors to FUND their vote buying and social welfare spending efforts when they issue debt. Who will fund the spending in the future if foreign currency holders go on a buying strike? Why, the G7 treasuries and Ce ntral Banks, aka fiat money and credit creation, where else?

Under the Stealth of The Headlines!

War looms in the Middle East as Iran is set to run into the buzz saw known as Israel , the United States and even France . Israel struck at a nuclear storage depot in Syria jointly run by the North Koreans, and the US and France are making ominous remarks. 100 dollar crude oil anyone?

China and The Dollar!

Here's a monthly chart of the Shanghai stock market, look closely 3 waves up are easily seen (five waves for you Elliot wavers): Just to keep the Shanghai Bubble in perspective, this is the 10-year chart of the Shanghai Composite.

Now let's look at the long-term breakdown in the dollar: The U.S. Dollar ... Longer Term ... Below is the Dollar's longer-term chart. You can see the declining channel for the Dollar going back to 2005.

Note where we are in the dollar channel right now. The Dollar fell below its 30-year support last week, and we should now see the Dollar move down to the lower channel's support in the coming weeks.

Those are 30-year lows in the dollar with trendline breaks lower!

Both of these markets are problematic to say the least. If China crashes can the G7 be far behind or vice versa? Fibonacci retracements cannot be unexpected at this point. The breakdown in the dollar spells higher interest rates, gold and huge currency realignments, to name a few. The carry trade funding currencies Japanese Yen and Swiss Franc are jumping higher, do you think it might affect the buy side of these trades? Are you prepared for these opportunities? They are unfolding right now, get your investment affairs in order to capture this emerging volatility and benefit from it.

In Conclusion: “Fingers of Instability” are here and offer huge potential for “profitunities”. Money printing is front and center as the G7 Ce ntral Banks gear up for re-flation efforts to prevent systemic monetary system calamities. Look for short-term interest rates to plummet and the long end to skyrocket. Looming shortages in grains caused by ethanol and bio diesel mandates are setting the stage to collide with emerging market demands for FOOD.

Grains are set to skyrocket as misguided, politically-correct G7 public servants' agricultural and energy policies are hitting your bank book and are set to do so in a manner which you cannot imagine. China froze food and the prices of many other items under their control this week, which is a recipe for empty shelves and food shortages as they will soon learn. The laws of supply and demand cannot be repealed by a piece of paper; they are not above the laws of nature. Crude oil is in short supply and war is approaching in the Middle East as the G7 sets it's sights on preventing a nuclear Iran .

Globally the economy is in good shape, there is more money than you can imagine available, but it is for purchases of things, not lending at this point. In the G7 there are banking problems and real estate bubbles which the authorities are determined to prevent from deflating. So they are accelerating the inflating of the money supplies and deflating your bank accounts at night with their printing presses. Got Gold? Silver? Oil? Wheat? Soybeans? etc.

International investors hold over $12,000 billion dollars ($12 trillion) of US debt of one type or another, if they decide to exit in any meaningful way, those bonds and securities, the dollar and stocks surely will suffer the brunt of the capital losses that can be expected. If the longer-term credit markets dive and interest rates rise you can expect stock markets to develop a bout of indigestion. Longer term they are NOMINALLY headed higher as they just re-price higher in the lower purchasing power currencies in which they may be denominated. Investments that are simple, liquid and understandable are increasingly in, and those that are opaque, complex, illiquid and obscure are increasingly OUT!

This unfolding turmoil is only a buffet table of opportunity, are you prepared ? As Warren Buffet says: “Be scared when investors are greedy and greedy when they are scared”. And investors are set to get the fright of their lives. LOL. Public Servants do not understand that Globalization is a fight that has been lost, it is “fait accompli”! 30% of Russell 2000 earnings are from abroad and over 50% of big cap earnings; if they destroy international trade they destroy themselves as the rest of the world will carry on without them. Are they that ignorant? Yes. Half the exports or more from China are coming from US subsidiaries, so to destroy trade with China is to destroy American business. American companies deal with recalls all the time, it is a fact of nature and manufacturing and is used to manipulate the “dumbest among Us” to get their votes by protecting them from the foreign devils. The public servants are the actual devils! We will all pay for their stupidity, greed for power and hubris, but many of us will profit from it because we did our homework which they will portray as being predators. They are the predators and the ignorant public is there prey.

As I have said many times “They will print the money” and this week's signals that NOTHING has changed. Is this the end of the world? No, absolutely NOT! In fact, at no time in recent memory have I seen more big opportunities spread out over so many markets and sectors (stocks, interest rates, currencies, commodities, raw materials, energy, grains and more). All offer huge prospects, long and short, as markets re-price risk and re-flation activities. The runaway liquidity provided by the unrestrained securitization of debt of one sort or another (CDO. CMO, CLO, MBS, etc.) has been severely constrained, so the markets which used to go up in synchronicity can be expected to decouple and head lower in some investment areas and remain strong in others. So, two-way volatility (bull and bear markets) can be expected to increasingly emerge across many markets. Volatility should continue for the foreseeable future, so turn volatility into opportunity and learn how to invest in UP and DOWN markets. Do your homework or find someone who does and benefit from them!

Ted bits is now its own Show on www.Commodityclassics.com and www.mn1.com (Market news 1 st ) every Wednesday at 4 pm cst (archived video casts are there as well) and we appear at 1:30 pm cst ( www.mn1.com only) on Fridays as well to discuss this week's commentary and unfolding news. Don't miss it! If you enjoyed this edition please send it to a friend and subscribe its free at www.TraderView.com . Don't miss the next edition of “Fingers of Instability” Thank you!

Additional announcement: We will be taking a one week break from writing Ted bits for the first week of October as we will be traveling and working on the forthcoming book we are writing with Clyde Harrison. Ted bits will return the second week of October. Thank You.

If you enjoyed this edition of Tedbits then subscribe – it's free , and we ask you to send it to a friend and visit our archives for additional insights from previous editions, lively thoughts, and our guest commentaries. Tedbits is a weekly publication.

Ty Andros LIVE on web TV. Don't miss Ty interviewed live by Michael Yorba from Commodity Classics. Catch Ty's interview every Wednesday at www.MN1.com or www.CommodityClassics.com at 4pm Central Standard Time .

By Ty Andros

TraderView

Copyright © 2007 Ty Andros

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.