Gold Set for First Monthly Close Above $700 Since Jan 1980

Commodities / Gold & Silver Sep 28, 2007 - 09:43 AM GMTBy: Gold_Investments

Gold

Gold

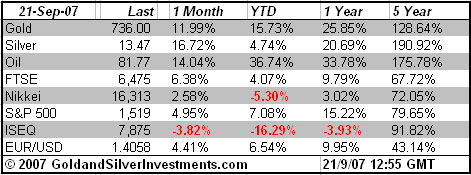

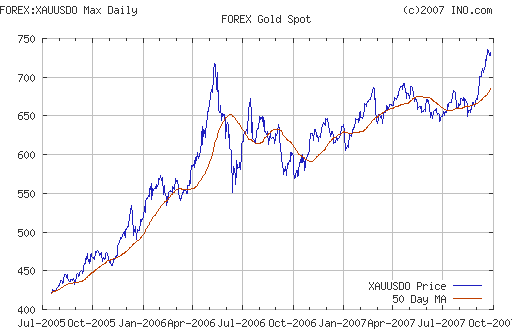

Gold made a new 28 year high close on the COMEX in New York yesterday. It was up $4.70 to $732.50 at the close. In overnight trading in Asia and Europe gold has continued to rally and has risen to $738.00/738.50 per ounce as of 1130 GMT. There seems to be strong support now at $726.

If gold closes over $700 today it will be the first time since 1980 that we have had a monthly close above $700. In January 1980 gold closed at $681.50 after its speculative blow off. Prior to this month there had only been four days when gold has closed higher than the $731.40 .They were on the January 21st, 1980 top and the three previous days before that record high. The first monthly close for gold above $700 is very significant.

It is important to keep an eye on this big picture which is showing that gold is again in the early to middle stages of a new multi year bull market which is based on a very solid foundations unlike it's counterpart in the late 1970's which ended in a speculative blow off. This bull market will also witness a speculative blow off in a few years time when gold is likely to be valued at above $2000 per ounce.

The euro hit a new all time high against the pummeled dollar overnight at 1.4182. This is the dollar's seventh straight record daily low against the euro which is very unusual and highly supportive of the gold price. Oil rallying to new record highs overnight and remaining at a higher plateau will likely make any possible gold correction shallow and short. The Reuters/Jefferies CRB Index rose 1.44 percent to a new record high. With oil, wheat and many other commodities at all time highs there is clearly growing inflation in the global economy and this will likely manifest itself in higher inflation in the coming months.

Increasing global macroeconomic and systemic risk is leading to many respected analysts ratcheting up their gold price forecasts. The Time of London reported that Christopher Wood, chief strategist at Hong Kong broker CLSA (whose largest shareholder is France's Credit Agricole, the world's 7th largest bank by asset value) feels that "market ructions and a collapse of the dollar could send gold prices to $3,400 an ounce or more in the next three years."

Citigroup, have acknowledged that central banks have been suppressing the price of gold. The acknowledgement came in a long report on the prospects for the metals and mining industry, "Gold: Riding the Reflationary Rescue." which endorses GATA's contention. It was written by Citigroup analysts John H. Hill and Graham Wark, who, in a section titled "Central Banks: Capitulating on Gold?," write: "Official sales ran hot in 2007, offset by rapid de-hedging. Gold undoubtedly faced headwinds this year from resurgent central bank selling, which was clearly timed to cap the gold price. Our sense is that central banks have been forced to choose between global recession or sacrificing control of gold, and have chosen the perceived lesser of two evils."

There was a shock drop in German retail sales and consumer morale in UK fell sharply in the wake of the Northern Rock crisis, hitting its lowest level in almost two years, a survey showed on Friday.

Signs that the credit crunch has not gone away was seen in the FT reporting that Northern Rock borrowed another £5bn from the Bank of England. This brings its indebtedness to the central bank close to £8bn since it was given access to emergency funds nearly two weeks ago.

Forex and Gold

The trade weighted USD index traded as low as 78.204. It is now a fraction above it's the all-time low of 78.19 struck on its trade-weighted index in 1992. A close below this level could lead to further dollar selling and a sharper decline. With the US housing market in considerable difficulty and the US economy beginning to slowdown, there will likely be further interest rate cuts which will put even further pressure on the USD.

There is a raft of economic data today and this will determine the USDs short term movements and help evaluate the affect of the sharply slowing housing market on the 'Main Street'. The Chicago PMI, final Michigan sentiment reading for September, August personal incomes, consumer spending for September and core PCE inflation are released today. A number of Federal Reserve officials will also offer their assessment of the slowing US economy.

Further dollar weakness will create increasing demand for gold and ensure that gold prices remain elevated.

Silver

Spot silver was trading at $13.63/13.65 (1130 GMT).

PGMs

Platinum was trading at $1362/1368 (1130 GMT).

Spot palladium was trading at $342/348 an ounce (1130 GMT).

Oil

London Brent crude surged to a record high 80.49 dollars per barrel on storm concerns. New York's main contract added 12 cents to $83, having earlier hit $83.38 - just below its record of $84.10 of last week.

| Gold Investments 63 Fitzwilliam Square Dublin 2 Ireland Ph +353 1 6325010 Fax +353 1 6619664 Email info@gold.ie Web www.gold.ie |

Gold Investments Tower 42, Level 7 25 Old Broad Street London EC2N 1HN United Kingdom Ph +44 (0) 207 0604653 Fax +44 (0) 207 8770708 Email info@goldinvestments.org Web www.goldinvestments.org |

Mission Statement

Gold and Silver Investments Limited hope to inform our clientele of important financial and economic developments and thus help our clientele and prospective clientele understand our rapidly changing global economy and the implications for their livelihoods and wealth.

We focus on the medium and long term global macroeconomic trends and how they pertain to the precious metal markets and our clienteles savings, investments and livelihoods. We emphasise prudence, safety and security as they are of paramount importance in the preservation of wealth.

Financial Regulation: Gold & Silver Investments Limited trading as Gold Investments is regulated by the Financial Regulator as a multi-agency intermediary. Our Financial Regulator Reference Number is 39656. Gold Investments is registered in the Companies Registration Office under Company number 377252 . Registered for VAT under number 6397252A . Codes of Conduct are imposed by the Financial Regulator and can be accessed at www.financialregulator.ie or from the Financial Regulator at PO Box 9138, College Green, Dublin 2, Ireland. Property, Commodities and Precious Metals are not regulated by the Financial Regulator

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. Past experience is not necessarily a guide to future performance.

All the opinions expressed herein are solely those of Gold & Silver Investments Limited and not those of the Perth Mint. They do not reflect the views of the Perth Mint and the Perth Mint accepts no legal liability or responsibility for any claims made or opinions expressed herein.

Fair Use Notice: This newsletter contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of issues of financial and economic significance. At all times we credit and attribute the copywrite owner and publication.

We believe this constitutes a 'fair use' of any such copyrighted material as provided for in Copyright Law. The material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for economic research purposes. If you wish to use copyrighted material from this site for purposes of your own that go beyond 'fair use', you must obtain permission from the copyright owner.

Gold Investments Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.