Rise in Jobless Claims Takes Shine Off of Stocks

Stock-Markets / Stock Markets 2010 Oct 14, 2010 - 10:38 AM GMTBy: PaddyPowerTrader

The QE trade is alive and well and risk assets are firing on all cylinders. Gains in stocks and commodities, in particular, are now accelerating. It seemed to me that QE2 talk would prove bullish for risk assets. And the lack of a cooperative stance within the G20 on currency matters – as the IMF meetings over the weekend showed – is now adding fuel to the fire.

The QE trade is alive and well and risk assets are firing on all cylinders. Gains in stocks and commodities, in particular, are now accelerating. It seemed to me that QE2 talk would prove bullish for risk assets. And the lack of a cooperative stance within the G20 on currency matters – as the IMF meetings over the weekend showed – is now adding fuel to the fire.

To recap U.S. stocks rose Weds, sending benchmark indexes to five-month highs (but failed to close above the key 1175 level), as better-than-estimated results at CSX Corp. and China’s record currency reserves boosted optimism in the economic recovery. CSX, the second-largest publicly traded U.S. railroad, rallied 4.2 percent after also saying it’s seeing improvements across almost all markets,

Alcoa added 1.3 percent and Freeport-McMoRan Copper & Gold advanced 3.8 percent leading a measure of raw materials producers to the biggest gain among 10 industries in the S&P’s 500 Index, amid speculation that Chinese demand will improve after the world’s fastest-growing major economy announced $2.65 trillion in currency reserves. But JP Morgan which had opened up 2 percent after beating the Street by 13 percent, later turned offered as on second glance the figures were flattered by a higher reserve release and lower provisions and finished the day down 1.5 percent.

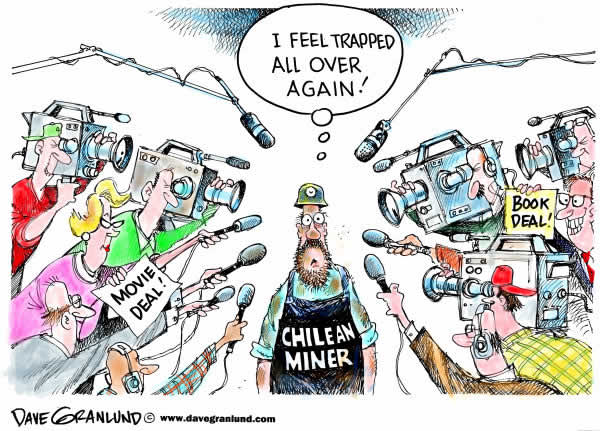

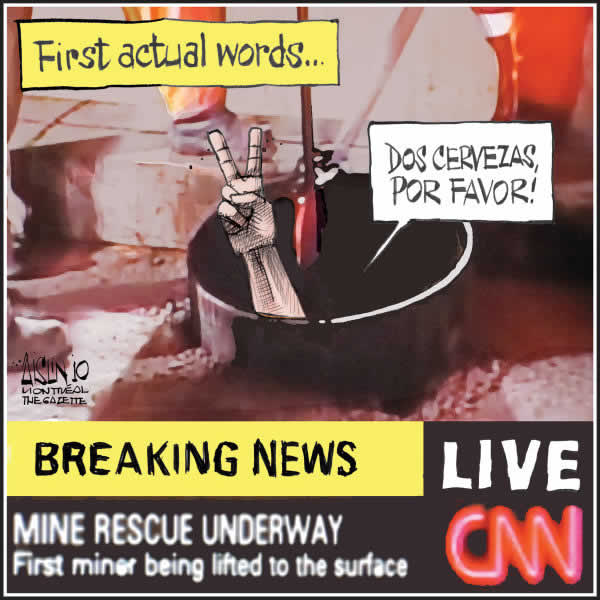

I think those Chilean miners have become too mainstream…I preferred them when they were underground !

Today’s Market Moving Stories

•The seemingly friendless USD slid across the board overnight following the decision of the Monetary Authority of Singapore to widen the band of the Singapore Dollar and thus allow more strength against the USD. So they have effectively tightened policy by slightly raising the speed of

SGD appreciation against a trade weighted basket and widening the managed band. This in response to an economy which has eaten into all its spare

capacity and is at risk of inflation. Clearly Singapore is at the opposite end of the economic spectrum to the US. And the move contrasted with the recent attempts by Emerging Markets central banks to prevent further appreciation of their currencies. Importantly, there was also little to suggest that other central banks in the region are following suit in the immediate aftermath of the MAS decision. The fact that freely floating currencies like EUR and SEK were among the top performers against USD overnight also indicates that there was little to suggests that investors are anticipating more burden sharing and less unilateral FX interventions to come going forward.

•Richmond Federal Reserve Bank President Jeffrey Lacker said a Fed policy devoted primarily to reducing unemployment risks damaging the central bank’s credibility in containing inflation. “With inflation reasonably close to any plausible definition of price stability, and all expectations measures pointing in the right direction, making unemployment a policy imperative poses clear risks to the credibility of our long run inflation goals,” Lacker said yesterday in a speech in Chapel Hill, North Carolina. The Fed is considering the purchase of more Treasury securities and efforts to boost inflation expectations to stimulate the economy and reduce unemployment persisting near 10 percent, according to minutes of the Sept. 21 meeting of policy makers released this week. The central bank was prepared to ease monetary policy “before long,” the minutes said. “Inflation is now on target, as far as I’m concerned,” Lacker told business leaders in the region. “I do not see a material risk of deflation — that is, an outright decline in the price level.”

•More than 100,000 U.S. homes were seized by lenders in September, a record number that probably will decline in coming months as major banks halt repossessions and review their foreclosure practices. Lenders took over 102,134 properties last month, RealtyTrac Inc. said in a report today. That was the highest monthly tally since the company began tracking the data in 2005, surpassing the August record of 95,364. Foreclosure filings, including default and auction notices, rose 3 percent from the prior month to 347,420. One out of every 371 households received a notice. Sales of properties in the

foreclosure process accounted for almost a third of all U.S. transactions in the month, a sign that a prolonged delay in repossessions may hurt the housing market, RealtyTrac said.

•The Bank of England must combat inflation if it is to remain credible, senior policy-maker and resident hawk Andrew Sentance has warned. Mr Sentance, an external member of the Bank’s Monetary Policy Committee (MPC), has repeatedly voted for the base rate to be raised, but has been overruled by his other committee members who want to keep it at the current record low of 0.5pc. Maintaining such a low rate could damage confidence in the Bank’s ability to steer the economy and lead to “self-fulfilling” expectations of above target inflation, he argued in a speech in London on Wednesday. In recent years monetary policy and the MPC’s actions have created confidence that stable inflation will be maintained, he said. He also said somewhat curiously that the record drop shown in the Halifax house-price gauge last month may show “volatility” instead of heralding a renewed property-market slump.

•Bank of England Deputy Governor Paul Tucker said he is “more balanced’ than he expected to be about inflation and removing expansionary policies, the Daily Mail reported, citing an interview. Until recently Tucker regarded inflation as being ‘‘uncomfortably high,’’ the newspaper said. The key is the labour market, which is ‘‘a slight amber light’’ while the decline in house prices isn’t ‘‘terribly surprising,’’ Tucker said, the Mail reported.

•In other comments the BOE MPC member Adam Posen said the global economy needs more monetary stimulus and restraint in deficit reduction to avert a repeat of mistakes made by European policy makers in the 1930s. Monetary policy that doesn’t do enough to stimulate the economy risks provoking low growth and deflation if governments at the same time execute strict spending cuts, Posen said in a commentary published in Handelsblatt newspaper.

•According to the FT two Norwegian day traders have been handed suspended prison sentences for market manipulation after outwitting the automated trading system of a big US broker. The two men worked out how the computerised system would react to certain trading patterns – allowing them to influence the price of low-volume stocks. The case, involving Timber Hill, a unit of US-based Interactive Brokers, comes amid -growing scrutiny of automated trading systems after the so-called “flash crash” in May, when a single algorithm triggered a plunge in US stocks. Svend Egil Larsen and Peder Veiby had won admiration from many Norwegians ahead of the court case for their apparent victory for man over machine. Prosecutors said Mr Larsen and Mr Veiby “gave false and misleading signals about supply, demand and prices” by manipulating several Norwegian stocks through Timber Hill’s online trading

platform. Anders Brosveet, lawyer for Mr Veiby, acknowledged that his client had learnt how Timber Hill’s trading algorithm would behave in response to certain trades but denied this amounted to market manipulation. “They had an idea of how the computer would change the prices but that does not make them responsible for what the computer did,” he told the Financial Times. Both men have vowed to appeal against their convictions. Messages posted on Norwegian internet forums on Wednesday indicated widespread sympathy for the defendants. “It is the trading robots that should be brought to justice when it is them that cause so much wild volatility in the markets,” said one post. Mr Veiby, who made the most trades, was sentenced to 120 days in prison, suspended for two years, and fined NKr165,000 ($28,500). Mr Larsen received a 90-day suspended sentence and a fine of NKr105,000. The fines were about equal to the profits made by each man from the illegal trades. Christian Stenberg, the Norwegian police attorney responsible for the case, said any admiration for the men was misplaced. “This is a new kind of manipulation but it is still at the expense of other investors in the market,” he said. Interactive Brokers declined to comment. Irregular trading patterns were first spotted by the Oslo stock exchange and referred to Norway’s financial regulator.

•The earnings season so far has been broadly positive. S&P 500 companies’ earnings are expected to rise 23.6 percent from a year ago and according to Thompson Reuters data, 81 percent of the S&P 500 companies that have already reported have surpassed expectations. According to Thomson Reuters, the long-term average for beats for an entire reporting period is 61 percent.

•Datawise today we’ve just had the US weekly jobless claims numbers & they have disappointed rising to 462k against expectations from them to stand pat at 445k and the PPI numbers have come out with a higher print than expected & taken some of the early doors shine off the S&P futures.

•There was a rumour in the market this morning that the US and China have agreed a deal on Chinese Renmimbi (yuan) valuation higher, in turn US will hold back QE2 ? This may not be as far fetched as it seems as though the earnings season has got off to a good start with both JP Morgan and Intel beating market expectations. But the broader QE theme is what continues to drive risk higher and the USD lower. Gold has made fresh highs; and the AUD is approaching parity with the Greenback; EUR traded through 1.41, while CAD finally broke the 1.00 level in Europe. However the QE theme is providing Asian policymakers with an increasing headache. Intervention to stem currency appreciation has added over USD 250bn to Asian FX reserves over the past quarter, with about 120bn of that in September alone. Diversification flows continue to push the EUR higher. But as interest rates rise in Asia, so too do the costs of sterilisation. Chinese PBOC 3m bills yield over 1.5 percent; for a similar yield from US Treasuries, the central bank must go out beyond six years. As such the market pressure on Asian Central Banks to allow currency appreciation continues to mount. In response, Singapore’s MAS has signalled a steeper pace of currency appreciation over the next six months. In a different approach, the Bank of Korea has refrained from raising rates, willing to risk higher inflation to avoid further yield-chasing inflows. And China continues to allow slow appreciation of the Renminbi, but at a cost of increased inflows of hot money as evidenced by the USD 100bn jump in reserves in September. In this environment, I watch for triggers that might shift market expectations for QE. While inflation is a key input for the Fed, tomorrow’s US CPI is unlikely to change the outlook. More important will be Bernanke’s Boston Fed speech, also tomorrow – it will be watched for potential discussion of more unorthodox measures. But at this stage I believe the major risk is that markets are overpricing QE. Today’s trade balance numbers from the US may augment the current anti-China sentiment. The Chairman of the Senate finance committee said that the US Senate is poised to follow the House in passing legislation on China. The compromise for China and the US would be less aggressive QE from the US in return for RMB appreciation. The currency implication would be a stronger Asia, and a fall in EUR/ USD.

•Meanwhile the USD /JPY cross has marked a new 15-year low despite further official jawboning. While there remains some nervousness as we approach key levels at 80.65 and the all-time lows of 79.75, markets see Japanese condemnation of Korean intervention as raising the bar to further intervention, particularly ahead of the G20 finance ministers’ meeting at the end of next week. Intervention looks unlikely while the move is a broad USD one, and while yen crosses remain relatively elevated. Accordingly a drift lower towards the 80 level looks likely.

Company / Equity News

•Today in Europe the fallout from the surprise rights issue by Standard Chartered continues to cause ripples. The FTSE 350 Banks Index has lost 4.5 percent since the beginning of August amid concern that new requirements under the Basel III accord will require banks to raise more capital, diluting shareholder value. And Barclays lost 3.1 percent today partially down to a broker downgrade at Execution Noble who downgraded the shares to “neutral” from “buy.” French bank Societe Generale wre also feeling the chill down 2.3 percent and Royal Bank of Scotland fell 3.2 percent again reflecting the nervousness amongst investors to financials.

•Other notable movers included African Barrick which has shed 8.3 percent Thursday on news that the company suspended about 40 percent of employees in the site’s mining department due to allegations of widespread theft & infiltration by criminal gangs . The miner will produce about 30,000 ounces less this year as a result of the theft. The company had already cut production by 10,000 ounces in the third quarter.

•Vodafone has risen 1.3 percent to 166.1 pence. Nomura lifted its recommendation on the world’s second-largest mobile-phone company by market capitalization to “buy” from “neutral.” Separately, hedge-fund manager David Einhorn said that analysts may have undervalued Vodafone shares by disregarding the U.K. company’s 45 percent stake in Verizon Wireless because it doesn’t pay a dividend.

•WH Smith Plc advanced 5.4 percent this morning after the U.K.’s biggest seller of magazines said it will return as much as £50 million of cash to investors through a “rolling share buyback.” WH Smith said full-year profit before tax and exceptional items rose 9 percent to £89 million in the 12 months through August.

•In Germany preferred shares of Hugo Boss have advanced 4.4 percent after Germany’s largest clothing maker raised its sales and profit forecasts. Earnings before interest, taxes, depreciation, amortization and one-time items will rise about 20 percent for the year, according to the Metzingen-based company, which previously forecast growth of 10 percent to 12 percent.

•French luxury goods company LVMH Moet Hennessy Louis Vuitton Thursday expressed confidence for this year as it reported a 23 percent jump in third-quarter sales with all divisions growing at a double-digit rate. Sales for the third quarter were €5.11 billion, compared with €4.14 billion a year earlier, beating analysts’ expectations of €4.83 billion, according to a Dow Jones Newswires poll. The group’s performance so far this year has “confirmed its confidence for 2010,” the company said in a statement, signalling that the owner of fashion house Fendi and jewelry brand Chaumet is entering the all important end-of-the year period with new-found assurance. Luxury goods executives have been cautious in calling a return to their sector’s growth after the economic crisis abruptly ended years of fast growth. LVMH shares have risen 23 percent over the past six months, largely outpacing the Paris CAC-40 index, which declined 6 percent over the same period. Investor confidence in the sector has gathered speed in recent months.

•Germany’s Demag Cranes may be open to a takeover bid if it involves a comprehensive offer that benefits all parties, the Financial Times Deutschland reported Thursday, citing people close to the company. Last week, the crane builder rejected overtures from rivals Konecranes Oyj of Finland and Terex Corp. of the U.S., although no concrete bids were made, the report said. Demag has said its strategy centres on independence, the report said.

•There is current news focus on the foreclosure process by the big US banks. Loan document procedures in particular are under scrutiny. Wells Fargo , Bank of America, JP Morgan are probably most exposed in this story. JP Morgan has set aside $1.3 billion in litigation reserves, a chunk of which is for potential cases in mortgages. In the meantime it has halted foreclosures. BoA also stopped foreclosing from last week while it reviews the accuracy of its docs. Wells and BoA took some beating in CDS yesterday although the share prices were not really punished. This is one of those shadows on the banks that they could do without, certainly in the current bank-bashing society we are in and will probably cost them to some extent (e.g. litigation reserves)

•Visa and MasterCard ., the world’s biggest payment networks, climbed in New York trading yesterday after JPMorgan Chase & Co. reported a 6.6 percent increase in credit-card spending. Visa advanced 3.6 percent and MasterCard, rose 3.9 percent.

•Bloomberg reports that AOL Inc. and several private-equity investors are exploring a mega deal for Yahoo! Inc., the Wall Street Journal reported, citing unidentified people familiar with the matter. Yahoo isn’t involved in the deal yet, the Journal said. Silver Lake Partners and Blackstone Group LP are among the firms interested in a potential deal, the newspaper said. Unidentified spokespeople for AOL, Yahoo and Blackstone declined to comment, the Journal said, adding that Silver Lake didn’t immediately respond to requests for comment. Elsewhere Yahoo is reported to have hired Goldman Sachs to advise it on how to fight any potential takeover.

•Clearwire Corp., the high-speed wireless carrier, is seeking to raise $2.5 billion to $5 billion in a wireless-spectrum auction that has attracted telephone and cable companies, said people with direct knowledge of the sale. AT&T Inc., Verizon Wireless, Deutsche Telekom AG, Time Warner Cable Inc. and Clearwire’s majority owner, Sprint Nextel Corp., are among potential buyers of the spectrum, said the people, who declined to be identified because the process isn’t public. The bidding is in its second round and being managed by Deutsche Bank AG, they said. Clearwire shares surged as much as 11 percent.

•Vodafone Group Plc’s shares may be undervalued as analysts are disregarding the U.K. company’s 45 percent ownership in Verizon Wireless because it doesn’t pay a dividend, according to hedge fund manager David Einhorn. “We have a lot excitement relating to Vodafone,” Einhorn, who profited from bets against Lehman Brothers Holdings Inc. in 2008, said today at the Value Investing Congress in New York. “Eventually they will begin to collect a dividend, perhaps as early as next year, and then we will get a revaluation of that stock from there.” Vodafone, the world’s biggest wireless operator, hasn’t received a dividend since 2005 from its stake in Verizon Wireless, whose head Lowell McAdam was promoted to president and chief operating officer of New York-based Verizon Communications Inc. in September.

•Iraq is in the final stages of agreeing on a draft of its $12 billion gas contract with Royal Dutch Shell PLC, the country’s oil minister said Wednesday, allaying fears the project was mired in a legal dispute. Speaking upon his arrival in Vienna for a meeting of the Organization of Petroleum Exporting Countries, or OPEC, Hussein al-Shahristani also said a planned bidding round for three major gas fields would go ahead as planned on Oct. 20 after being delayed twice before. Asked about the reported delay of the Shell deal, Shahristani said: “We are in the final stages of agreeing on the draft before we take it on the cabinet again,” adding “There has been no dispute” over the deal.

•Rio Tinto Group, the world’s third- largest mining company, said third-quarter iron ore production rose to a record. Output rose to 47.6 million metric tons in three months ended Sept. 30, from 47.0 million tons a year earlier, the London-based company said today in a statement. Rio, the world’s second-biggest exporter of iron ore, approved $1.3 billion of spending on expansions at its Australian iron ore assets in the quarter. The company also set production records for alumina and coking coal.

•Where the first round of 3Q10 corporate earnings reports overall build on the strong 2Q10 earnings trend, the 7 percent YoY 3Q10 revenue decline reported by Roche Holding this morning confirms the challenges facing the pharmaceutical sector. The virtual cessation in demand for Tamiflu, that was boosted last year due to the swine flu pandemic, was the main reason for the negative revenue growth. In the meantime patent expirations and the consequent M&A activity remain the order of the day in pharmaceuticals. Pfizer’s AA- rating was put on a negative outlook at Fitch at the beginning of October as patent expirations are expected to erode revenues, according to that rating agency. Earlier this week Pfizer also announced its acquisition of King Pharmaceuticals for $3.6bn in cash, which is just a fraction of the $62bn linked to the company’s acquisition of Wyeth in 2009. According to S&P, the acquisition will be negligible in terms of the company’s leverage, and therefore Pfizer’s AA rating remains unaffected by the acquisition. Also Moody’s and Fitch do not expect that Pfizer’s rating will be affected by the acquisition. Pfizer will report its 3Q10 earnings on 2 November.

By The Mole

PaddyPowerTrader.com

The Mole is a man in the know. I don’t trade for a living, but instead work for a well-known Irish institution, heading a desk that regularly trades over €100 million a day. I aim to provide top quality, up-to-date and relevant market news and data, so that traders can make more informed decisions”.© 2010 Copyright PaddyPowerTrader - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PaddyPowerTrader Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.