Fed Announces QE2 to Make a Dent in the Unemployment Rate

Interest-Rates / Quantitative Easing Nov 03, 2010 - 04:07 PM GMTBy: Asha_Bangalore

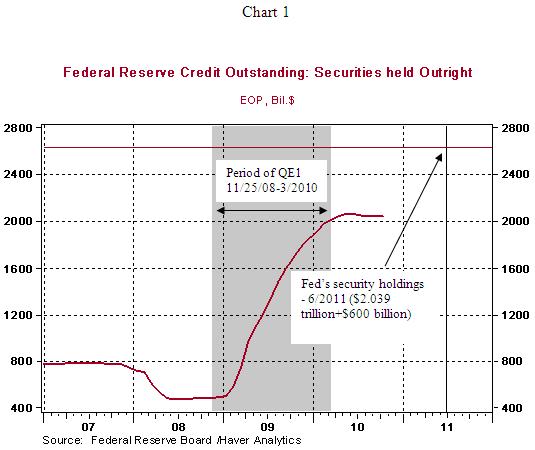

The FOMC policy statement, as widely expected, indicated the Fed's plan to purchase $600 billion of longer-term Treasury securities by the end of the second quarter of 2011. At the end of October 2011, the Fed's balance sheet stood at $2.278 trillion, with its holding of securities at $2.039 trillion.

The FOMC policy statement, as widely expected, indicated the Fed's plan to purchase $600 billion of longer-term Treasury securities by the end of the second quarter of 2011. At the end of October 2011, the Fed's balance sheet stood at $2.278 trillion, with its holding of securities at $2.039 trillion.

The second round of quantitative easing (QE2) should raise these holdings of securities to $2.639 billion by June 2011, given the Fed's notification that it will continue to "maintain its existing policy of reinvesting principal payments from its security holdings." The policy statement reiterated that the Fed's action is designed to "promote a stronger pace of economic recovery and to help ensure that inflation, overtime, is at levels consistent with its mandate."

The Fed plans to purchase these securities by the end of the second quarter of 2011, which works out to a pace of $75 billion each month. The following excerpt indicates the built-in flexibility of today's announcement:

"The Committee will regularly review the pace of its securities purchases and the overall size of the asset-purchase program in light of incoming information and will adjust the program as needed to best foster maximum employment and price stability."

This neutral statement allows the Fed to undertake either an increase or a reduction of its holdings of securities. The main message is that the central bank stands ready to raise the purchase plan if economic conditions weaken. Key economic data we, the markets, and Fed will be tracking in the months ahead - the Fed's balance sheet, bank credit, unemployment rate, and consumer price measures.

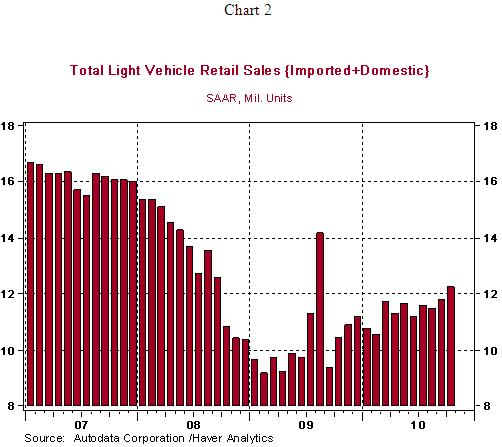

Auto Sales Advanced in October

Speaking of economic reports, auto sales kicked off the fourth quarter on a strong note. Auto sales rose to an annual pace of 12.26 million units during October, up from 11.76 million in September. The increase in auto sales gives a strong lift to consumer spending and real GDP in the fourth quarter. The October sales mark is the highest since October 2008, excluding the period when sales moved up from support under the "Cash for Clunkers" program.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.