U.S. Housing Market Starts Show Small Recovery

Economics / Economic Recovery Dec 17, 2010 - 06:23 AM GMTBy: Asha_Bangalore

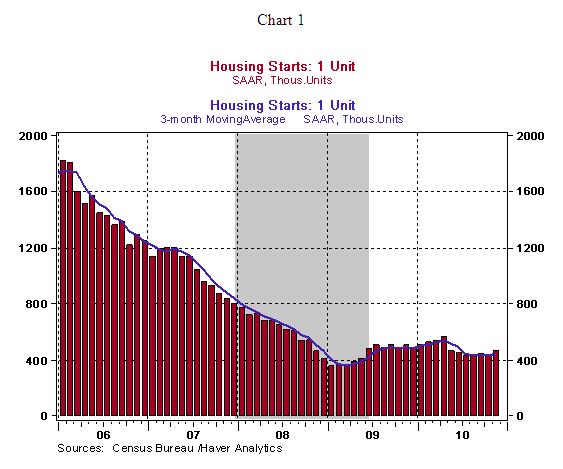

Construction of new homes increased 3.9% to an annual rate of 555,000 in November, following an 11.1% drop in the previous month. Starts of single-family units advanced 6.9% in November to an annual rate of 465,000. The November level of single-family starts is marginally above the three-month moving average of single-family starts (see Chart 1), which suggests that stronger gains are necessary before we declare that home construction activity is out of the woods. Multi-family starts fell 9.1% in November, marking the third consecutive monthly decline.

Construction of new homes increased 3.9% to an annual rate of 555,000 in November, following an 11.1% drop in the previous month. Starts of single-family units advanced 6.9% in November to an annual rate of 465,000. The November level of single-family starts is marginally above the three-month moving average of single-family starts (see Chart 1), which suggests that stronger gains are necessary before we declare that home construction activity is out of the woods. Multi-family starts fell 9.1% in November, marking the third consecutive monthly decline.

Regionally, housing starts advanced in the Midwest (+15.8%), South (+2.3%), West (+2.1%) but fell in the Northeast (-2.5%). Permit extensions, the precursor of future home building activity, fell 4.0% to an annual rate of 530,000 reflecting a mix that is favorable for single-family starts; permits issued for multi-family homes fell 23% but that of single-family homes moved up 3.00%.

Initial Jobless Claims Break Away From Stagnating Trend

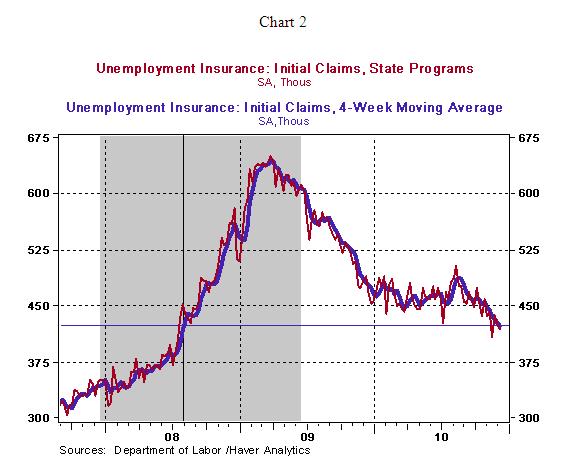

Initial jobless claims fell 3,000 to 420,000 during the week ended December 11, which puts the four-week moving average at 422,750, the lowest since August 2, 2008 (Chart 2). Initial jobless claims have dropped in four of the last six weeks; the definitive declining trend of initial jobless claims represents an end to the stagnating trend in place in the first ten months of the year.

Philadelphia Survey Results Point to Continued Growth at the Region's Factories

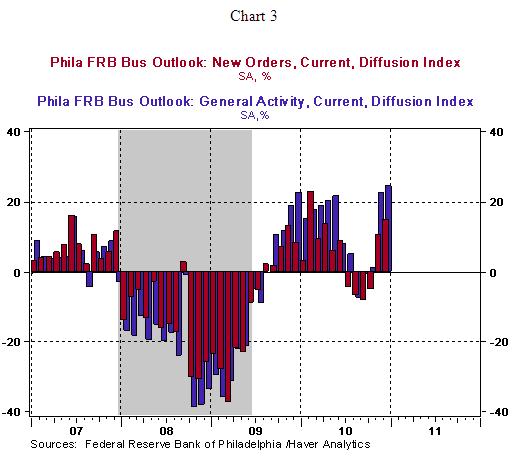

Factory conditions in the Philadelphia region improved in December with indexes of general business conditions and new orders moving up (see Chart 3). The index measuring general business conditions rose to 24.3 in December from 22.5 in the prior month. However, the employment indicator (5.1 vs. 13.3 in November) remained positive but fell from the prior month. The Empire State survey results showed an improvement in factory activity in the New York region with both general business conditions and new orders both turning positive in December after negative readings in November. The bullish regional indicators suggest a possible increase in national ISM survey, to be published on January 3. The ISM manufacturing index in November stood at 55.2 vs. 54.6 in October.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2010 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.