India reports Exports: Massive surge 36% and Current Account deficit slips to $2.5bn

Economics / India Jan 09, 2011 - 08:58 AM GMTBy: Justin_John

The country’s merchandise exports reached $22.5 billion, up 36.4 per cent in December from last year, highest in last 33 months, while imports topped $25.1 billion narrowing the trade deficit to $2.6 billion in December.

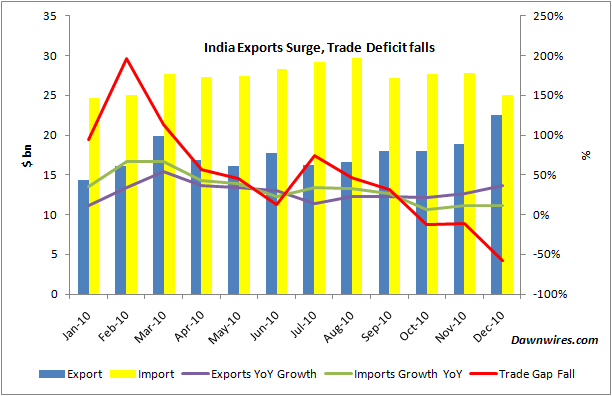

A quick look at the charts speaks about the surge in exports seen in the last 3 months.

■While exports have shown a double digit growth all through the year 2010, growth in imports dipped for three consecutive months from Oct 2010 to 7%, 11% and 11% respectively while exports growth outstripped imports growth at 21%, 27% and 36%.

■As a result, Trade Deficit was its lowest in 2010 at a deficit of $ 2.5 bn, 58% lower than Dec 2009. The main sectors that have really taken off in the last 3 months are Engineering products, electronics, yarn, man-made fibre, readymade garments, gems and jewellery, carpets, petroleum products, drugs and pharmaceuticals and leather.

■Export of tea, fruits and vegetables and iron ore performed poorly in December. During April-December, imports of oil, fertilizers, gold, pearls, machinery, coal, iron and steel, chemicals and edible oils recorded a huge growth.

The question to ask then is whether the rest of the world has decided to cut down its cost as it sways to cheaper Indian goods or is there a real recovery happening in Europe and US as indicated by the jump in exports data of India?

Total exports during the period April-December 2010 registered a growth of 29.5 per cent year-on-year reaching $164.7 billion and imports stood at $247.1 billion, up 19 per cent from the corresponding period last fiscal, indicated initial numbers released by commerce secretary Rahul Khullar today.

“This has been the highest monthly rise in the last 33 months. This is a huge jump … We may end the year now with the balance of trade at $118-$120 billion and not $130 billion as estimated earlier, with such a huge surge in exports,” said Khullar.

Trade deficit in December narrowed to $2.6 billion from $8.9 billion in November, which was the lowest in last three years. Total trade deficit during the period April-December reached $82.4 billion.

Khullar said, even with adverse pressure in the petroleum prices the country’s current account deficit will be less than 3.5 per cent of the gross domestic product (GDP) in the present fiscal. He also said, for 2010-2011 total exports would exceed the government’s set target of $200 billion.

The reason behind such a whopping growth in exports in December was mainly because of rise in the demand for India-made goods in the traditional markets such as the US and EU. Besides, exports have also started accessing newer markets like Columbia and Brazil, said Khullar.

Khullar indicated such a huge growth in the exports might prevent the government to announce another set of incentives to some of the exporters. “If everybody is doing well, what is the point in giving an incentive. The real problem right now is that there is very little room for fiscal maneuvres.”

Commerce and Industry Minister Anand Sharma had earlier mentioned the government might unveil yet another set of incentives for the exporters, especially in the labour-intensive sectors, post a sectoral study of all export sectors conducted last year.

By Justin John

Justin John writes for DawnWires.com and is a Director at a European Hedge Fund.

© 2010 Copyright Justin John - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.