Sales of New U.S. Homes Rebound from Historical Low

Housing-Market / US Housing Jan 27, 2011 - 02:11 AM GMTBy: Asha_Bangalore

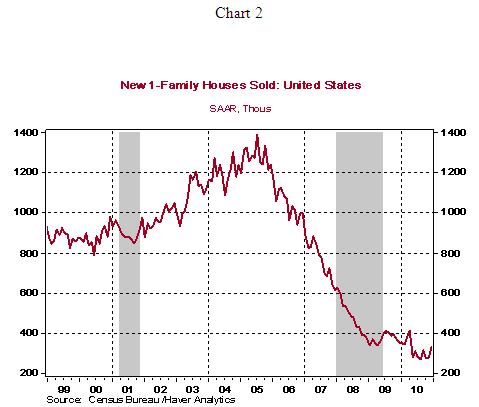

Sales of new single-family homes increased 17.5% to an annual rate of 329,000 in December after holding steady during November. The magnitude of the jump in sales of new homes is impressive but it is important to note that home sales are recovering from a historically low level. Sales of new single family homes stood at an annual rate of 280,000 in November, which is close to the historical low of 274,000 recorded for August 2010. Putting things in perspective, the peak of new home sales was 1.389 million home and it occurred in July 2005.

Sales of new single-family homes increased 17.5% to an annual rate of 329,000 in December after holding steady during November. The magnitude of the jump in sales of new homes is impressive but it is important to note that home sales are recovering from a historically low level. Sales of new single family homes stood at an annual rate of 280,000 in November, which is close to the historical low of 274,000 recorded for August 2010. Putting things in perspective, the peak of new home sales was 1.389 million home and it occurred in July 2005.

The median sales pace of new single-family homes during 1963-2010 is 655,000 homes; excluding the recent housing market boom, the median sales pace is 645,000 homes for the period 1963-2000. Relative to these measures, sales of new single-family homes in December were roughly 50% of the historical median.

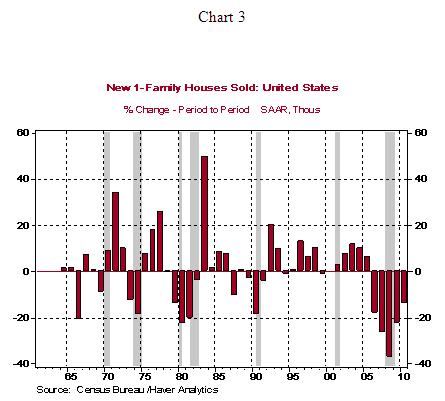

On an annual average basis, sales of single-family homes fell 14.2% in 2010 after 22.5% drop in 2009. Sales of new single-family homes have dropped for five straight years. Sales of new single-family dropped for five consecutive years during the 1980 and 1981-82 recessions but the size of the decline was noticeably smaller (Chart 3).

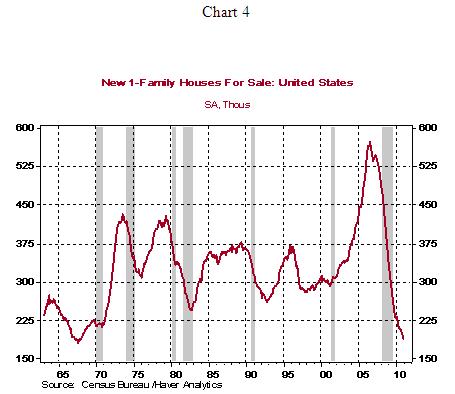

The number of new homes "for sale" stands at 190,000 (see Chart 4), which is close to the historical low of 184,000 in July 1967. Inventories of unsold homes relative to the pace of home sales during December fell to 6.9-month supply from 8.4-month supply in November (see Chart 5). These numbers are somewhat bullish for future home construction despite the enormous supply of unsold existing homes.

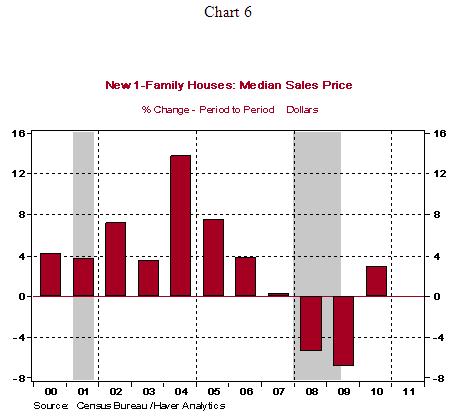

The median price of a new single-family home rose 12.1% to $241,500 in December from the prior month. On an annual average basis, the median price of a new single-family home advanced 2.9% in 2010 vs. declines in both 2008 (-5.5%) and 2009 (-6.9%) and a nearly steady reading in 2007.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.