US Dollar Currency Expectations and Stock Market Cycle

Stock-Markets / Financial Markets 2011 Feb 14, 2011 - 03:54 AM GMTBy: readtheticker

The funny thing about cycles is they repeat, as expected, just like clock work. While the bull bear debate rages, eventually price aligns to the dominate cycle. Cycles gain respect when they statistically demand it. A market analyst also must give respect to inter market analysis for the same reason. Inter market analysis is the study of a market (say US Dollar) that has a high correlation or influence over another (say Stock Market). Therefore it is wise to do the same with cycles, one must consider the dominate cycle of each market to see if they concur or conflict with other markets that they correlate with.

The funny thing about cycles is they repeat, as expected, just like clock work. While the bull bear debate rages, eventually price aligns to the dominate cycle. Cycles gain respect when they statistically demand it. A market analyst also must give respect to inter market analysis for the same reason. Inter market analysis is the study of a market (say US Dollar) that has a high correlation or influence over another (say Stock Market). Therefore it is wise to do the same with cycles, one must consider the dominate cycle of each market to see if they concur or conflict with other markets that they correlate with.

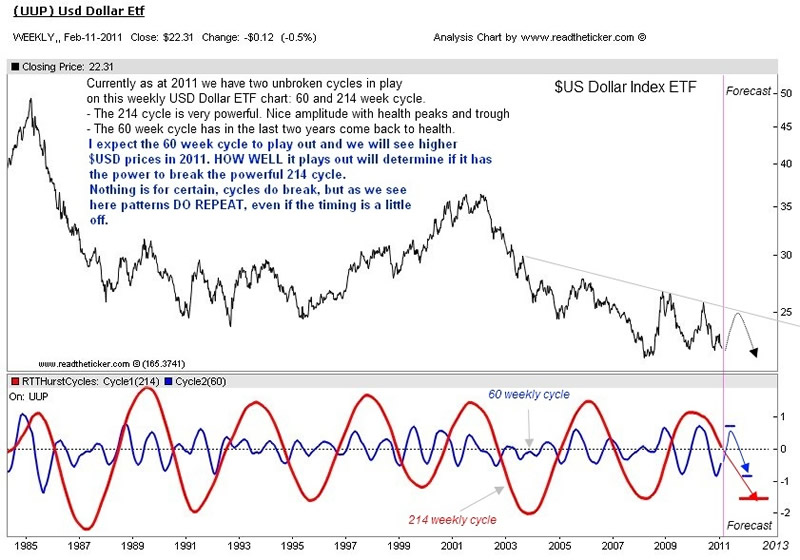

Lets review the US Dollar currency.

You can see the 214 weekly dominate cycle running for 25 years. Its looking very health. The only thing I would note is the latest peak at 2010 is not as high as the previous peak around 2006, the same is true for the trough at 2008 versus the trough at 2004. This suggests only ever so slightly that the cycle influence has diminished a little (not a lot, a little). The 60 week cycle has sprung back into life from 2008 to now. The 60 week cycle is swinging up and down between peak and trough with very good amplitude and phase, where as previously between 2003 and 2006 the 60 week lost statistical accuracy (are you lost with the terminology, check out our website and learn more about Hurst Cycle logic).

Note: The 214 and 60 week US Dollar cycle was found with our custom RTT Cycle Finder Spectrum.

Forecasting with cycles is best within the immediate time frame of the cycle period. Therefore as we have a 60 week cycle period, a forecast for 30 weeks (half cycle) would have a higher probability than that of 60 weeks. Forecasting with cycles requires periodic examination, we review cycles each week. Any forecast beyond your thumb must be confirmed and evaluated frequently.

Fundamentally the Euro zone have much ado between now and late March: Elections, meeting in Brussels, CDS prices breaking new highs, ECB buying stressed out Portugal bonds. We concur with Carl Weinburg, Chief economist at High Frequency Economics that the Europe debt crisis is a 'bomb that is about to go off'. This is why we like the probability of US Dollar price rise following the 60 week cycle up between now and May 2011. It is wise to waiting for price action to confirm solid buying (or short covering) of the US Dollar in the immediate near term. The 214 weekly cycle suggest that any price rally up the 60 week cycle in early 2011 should be shorted into for the long ride down of the US Dollar into 2013. The shorting of the US Dollar mid 2011 is on the table as you can see the last two rallies (2008, 2010) in the US Dollar sold off hard all the way back to origination level of $22.

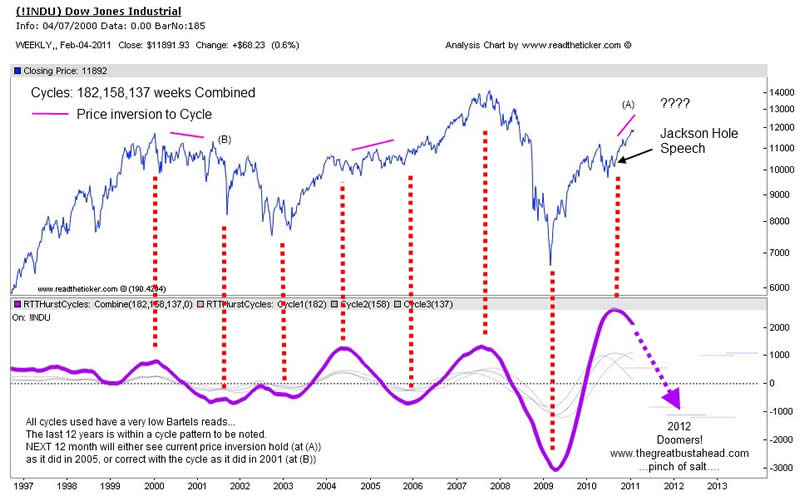

To quote the classic TV show Hill Street Blues "Lets be careful out there"..Why, please meet the other big gorrilla's in the room, the US Stock market. A respected cycle analyst, Charles Nenner has called for Dow 5000 by 2012. Please be aware that a falling stock market will bring into play the 'flight to safety' play, and massive buying of the US Dollar. You should not be surprised, the US Dollar has been the carry trade in recent years, thus their are billions of dollars around the world chasing risk and a risk off environment will see a liquidation of these carry trade investments and the buying back the US dollar as monies return to USA. Therefore accepting a long term bearish stance for the US Dollar is not a sure thing.

We believe Charles Nenner is looking at a cycle projection similar to our Hurst cycle projection.(Note, we have no idea how he calculates his projections).

The INDU cycle.

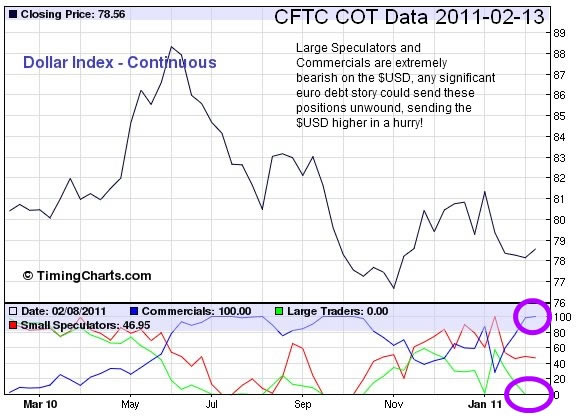

A quick review of the CFTC Commitment of Traders report for the US Dollar shows that the large speculators and commercials are extremely bearish. Therefore any significant euro debt story will most likely cause these positions to unwind, or buy US Dollars. The next three months will be very interesting. The $64,000 dollar question is 'Do you think the euro debt crisis will remain oh so very benign in the immediate months ahead?'

The flip side to the bullish US Dollar case is that the 214 week cycle crushes the 60 week cycle, the euro debt crises remains benign, and the US Dollar trends much lower without so much as 10% pullback. We think not, and are eagerly waiting for price action confirmation of the US Dollar bullish case.

Readtheticker

My website: www.readtheticker.com

My blog: http://www.readtheticker.com/Pages/Blog1.aspx

We are financial market enthusiast using methods expressed by the Gann, Hurst and Wyckoff with a few of our own proprietary tools. Readtheticker.com provides online stock and index charts with commentary. We are not brokers, bankers, financial planners, hedge fund traders or investment advisors, we are private investors

© 2011 Copyright readtheticker - All Rights Reserved

Disclaimer: The material is presented for educational purposes only and may contain errors or omissions and are subject to change without notice. Readtheticker.com (or 'RTT') members and or associates are NOT responsible for any actions you may take on any comments, advice,annotations or advertisement presented in this content. This material is not presented to be a recommendation to buy or sell any financial instrument (including but not limited to stocks, forex, options, bonds or futures, on any exchange in the world) or as 'investment advice'. Readtheticker.com members may have a position in any company or security mentioned herein.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.