Why Gold Is No Longer An Effective U.S. Dollar Hedge

Commodities / Gold and Silver 2011 Mar 21, 2011 - 05:26 AM GMTBy: Bob_Kirtley

During the first nine years of this gold bull market, gold prices moved with a near perfect inverse relationship to the US dollar. Indeed, in the early years gold was only really moving up against the greenback, it was only after a few years that it began to appreciate against all currencies. The game plan was simple; the dollar is going down, so gold in USD terms is going up with some leverage factor. Gold worked well as both a USD hedge and as a tool to speculate on a USD decline. This is no longer the case.

During the first nine years of this gold bull market, gold prices moved with a near perfect inverse relationship to the US dollar. Indeed, in the early years gold was only really moving up against the greenback, it was only after a few years that it began to appreciate against all currencies. The game plan was simple; the dollar is going down, so gold in USD terms is going up with some leverage factor. Gold worked well as both a USD hedge and as a tool to speculate on a USD decline. This is no longer the case.

Nothing lasts forever and over the past two years or so this inverse relationship has broken down significantly. The gold story is no longer simply a USD devaluation play.

As the above chart shows, although there are times when the inverse relationship remains intact, there are long periods where gold and the USD move together.

The most significant reason for this is that the Euros are a lot less desirable than they were a few years ago. Since all currencies trade on a relative basis, it doesn’t matter if the USD has poor fundamentals; if the picture for the Euro is worse relative to the USD, then the greenback will make gains against the Euro. During periods where the Eurozone debt crisis has been the focus of market attention, gold and US dollars have been bought since both are preferable to Euros and provided a safe haven.

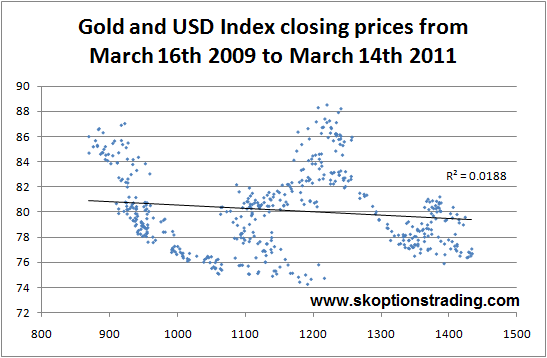

The key point of this article is not to say that gold will not rise is if the US dollar falls, it is to point out that gold is no longer as effective as a USD hedge. To show this we present a scatter plot of the closing prices for the USD index and gold over the last 2 years.

Although the trend line has a slightly negative slope it is hardly convincing, and the R-squared value of 0.0188 further diminishes the creditworthiness of gold as a USD hedge. For those unfamiliar with this, the R-Squared value is a statistic that indicates how good one variable is at predicting the other. For our purposes it is a measure of how good a decline in the USD index is at predicting a rise in gold. If the R-Squared value is 1 then given the value of one variable, one can exactly predict the value of the other. If R-squared is 0 that means that knowing the value of one variable does not help you predict what the other variable will be. So the higher the R-Squared value the better one variable is at predicting what the other may be and therefore the stronger the implied relationship is between them. An R-squared value of 0.0188 is extremely poor, and almost indicates no predictive abilities between the movements in the USD and gold.

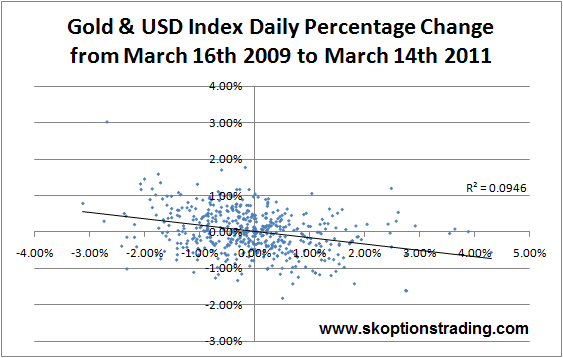

However to get a fairer picture we should look at the relative returns of the USD and gold.

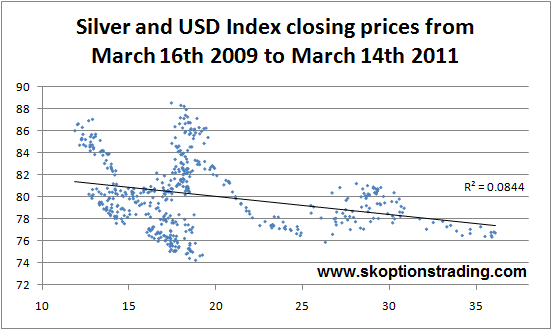

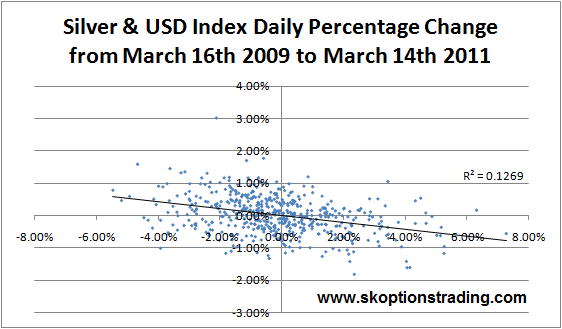

This does give us a higher R-squared value at 0.0946, but it is still very low and hardly convincing that gold has been an effective hedge against declines in the USD over recent years. Repeating the above exercise for silver and the USD index yields similar results, with R-squared values of 0.0844 and 0.1269. Although these are slightly higher than gold is it is still nothing to write home about, let alone base a trading or investment strategy on.

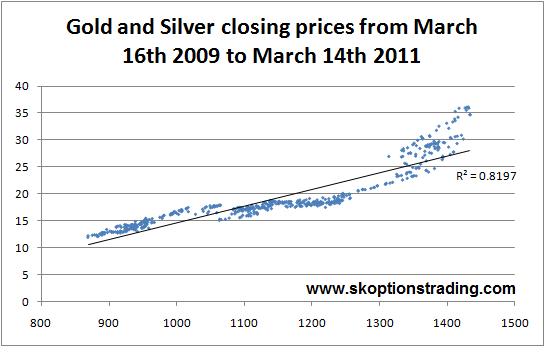

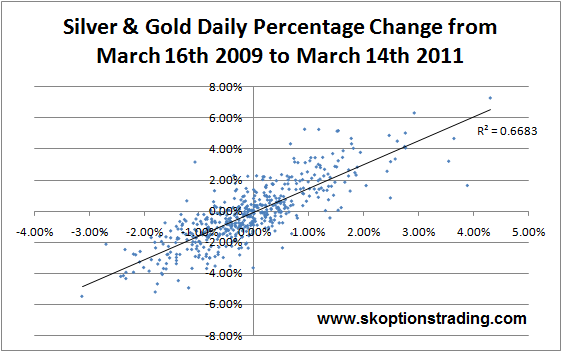

To give you an idea of what a strong relationship between two assets should look like, we have repeated the above exercise for gold against silver, a relationship which is much stronger.

Although gold and silver obviously have a positive correlation versus the negative correlation between gold and the USD and silver and USD, we are not looking at whether the relationship is positive or negative, we are only concerned with the strength of any such relationship.

Furthermore when we calculate the correlation coefficients for gold and the USD we get -0.137 and for the USD and silver we get -0.290; both of which imply a very weak negative correlation. Compare this with the very strong positive correlation between gold and silver of 0.905.

Therefore statically speaking, over the past two years gold has been a very poor hedge against a declining USD. Of course this situation may change, and just because the relationship has been weak over the last couple of years doesn’t mean that there were not periods where the USD and gold exhibited strong negative correlations. If the USD index were to fall out of bed we would be expecting gold prices to rise, however over a broader horizon or when moves are more moderate or contained within a range, don’t count on gold moving the opposite direction to the greenback.

In our opinion, if you hold a view that the USD Index is going to fall, then short the USD index rather that taking a long position on gold. You are running the risk that gold and USD could move together, and you are not being compensated for that risk by any leverage factor in gold. If you cannot trade futures, there are ETN’s that allow you to gain exposure to the USD index, such as the PowerShares DB US Dollar Bullish Fund (Symbol: UUP) and the PowerShares DB US Dollar Bearish Fund (Symbol: UDN). Options are traded on these funds as well if you wished to use options to play a move in the USD index.

In conclusion we hope to have shown that gold simply isn’t a clean hedge against the USD any more. When trading one should aim to tailor positions to match your view and optimize the risk/reward dynamics. If you think that the USD is going to fall, short it. If you think gold is going to rise, then buy gold. Taking a long position on gold purely since you think the USD index is going to fall is not really statistically justifiable due to the weakness of the relationship between the two. At SK Options Trading we are constantly refining trading techniques to ensure we are optimizing our risk/reward and tailoring our position using options to fit our view.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.