Commodities Topping One by One, Silver Collapse Warning

Commodities / Agricultural Commodities May 03, 2011 - 12:37 PM GMTBy: Ned_W_Schmidt

Slowly the list of commodity prices that have topped out seems to be growing. Sugar was first. Now cotton follows as farmers are going to increase plantings fairly dramatically, and China has cancelled orders for the fiber(Financial Times, 28 April 2011). Have soybeans also done so? North American production of that miraculous yellow grain just might be somewhat better than the extremely bearish forecasts. On Chinese soybean demand, we note reports of over booking and second half 2011 imports likely being below year ago levels(Commodity News for Tomorrow, 11 April 2011). Could investors be ignoring this situation? Lastly, is the collapse of Silver perhaps a warning from the gods? (Note: Trading persistently below $44.69 confirms a Silver bear market.)

Slowly the list of commodity prices that have topped out seems to be growing. Sugar was first. Now cotton follows as farmers are going to increase plantings fairly dramatically, and China has cancelled orders for the fiber(Financial Times, 28 April 2011). Have soybeans also done so? North American production of that miraculous yellow grain just might be somewhat better than the extremely bearish forecasts. On Chinese soybean demand, we note reports of over booking and second half 2011 imports likely being below year ago levels(Commodity News for Tomorrow, 11 April 2011). Could investors be ignoring this situation? Lastly, is the collapse of Silver perhaps a warning from the gods? (Note: Trading persistently below $44.69 confirms a Silver bear market.)

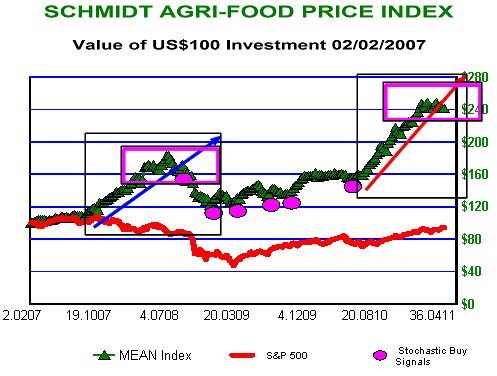

Plotted in the above chart is our Agri-Food Price Index. In that graph we have highlighted the similarities between current times and 2008. In both cases, the major up trend was broken. The index has moved into a trading range, just as it did in 2008. Warnings are sufficiently numerous to raise a yellow flag. Should our index break 240 a yellow card might be appropriate.

In previous comments we noted the rise of hedge fund assets to a new record. A higher percentage of the asset growth over the past year, ~$700 billion, by those speculators likely went into the commodity market than was the previous case. That view is reasonable as they have not been as active in the mortgage market. Their speculative activities certainly played an important role in the 2008 commodity bubble, and its bursting.

We remain a raging bull on the longer term prospects for Agri-Foods. That bullishness does not blind us to the reality that the long-term is comprised of multiple short-term experiences. Think of a giant, decade long Elliot Wave pattern. While the ending point may indeed provide a rewarding experience, included in it are several A-B-C corrections.

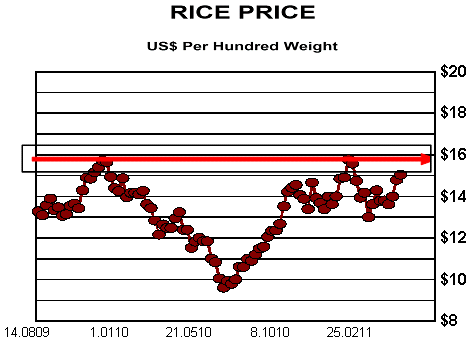

As with all markets, sectors within it show unique strength and developments. We noted hogs as one example last we talked. In general, meat prices need to rise by 50-100% to restore profit equilibrium in that sector. Rice, in the graph below, is perhaps the sleeping grain, and it could awaken in 2011.

Based on the strength of the trend, for some time rice has ranked either 14 or 15 out of the 15 Agri-Commodities on which we focus. Other three of the Big Four Grains, corn, wheat, and soybeans, have all moved higher. As commodity prices directly influence economic behavior, that condition usually causes responses that ultimately lead to higher prices.

Only about 7% of global rice production trades in the export market. For that reason, small production disturbances have a larger impact on price than might normally be the situation. Tsunami and radiation leaks from a nuclear plant may restrict severely production in an important rice growing region in Japan. Consumers there are worried about anything that comes into contact with water, rightly or wrongly. Japan may have to revise important restrictions on rice that have protected an inefficient farming sector.

Thailand, the Saudi Arabia of rice, represents one third of the global rice export market, and exports more than twice that of the U.S. With three crops a year there the ricehopper has thrived, and that pest is a serious threat to production. The third planting may be eliminated to break the life cycle of the ricehopper, and seriously reduce Thai exports. See "The Thai Rice Bowl May Get a Little Skimpier" by A. Bjerga & S. Suwannakaij from Bloomberg Businessweek, 11 April 2011.

In the U.S. we do not yet know how much the weather problems in the southern part of that country will reduce rice production there. Flooding in the entire Mississippi River system and delta along with infrastructure damage by the tornados will have some impact. Safe to assume that impact will not be in a positive fashion.

Above situation means that rice could be setting up for a material and unexpected price advance this year. Repercussion of such an event should not be minimized. Neither India nor China would be pleased with higher rice prices. In today's world, Agri-Food prices matter not just to the family budget, but perhaps to the global political situation.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2010 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.