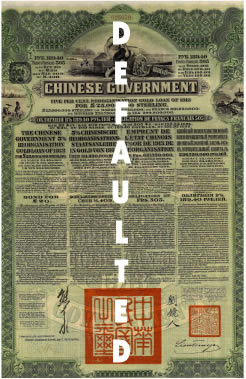

How China Stiffs Its Creditors, Debt Default

Interest-Rates / Global Debt Crisis May 23, 2011 - 06:14 AM GMTBy: Ian_Fletcher

I examined in a previous article the ethical case for America repudiating its financial obligations to China. While considering this tempting possibility—which makes for a better bargaining position if nothing else—we should recall the fact that China has, in fact, repudiated its own financial obligations to other nations.

I examined in a previous article the ethical case for America repudiating its financial obligations to China. While considering this tempting possibility—which makes for a better bargaining position if nothing else—we should recall the fact that China has, in fact, repudiated its own financial obligations to other nations.

The key here is that the formerly (and still nominally) communist government in Beijing refused, upon taking control of the country in 1949, to honor the debts incurred by the previous government, the Nationalists of Chiang Kai-shek.

That previous government, like all governments, had a substantial public debt, and just like the U.S. today, much of it was owed to foreigners.

The amount at stake? As these unpaid obligations have been accumulating for over sixty years now, it is now estimated to come to about $260 billion, mostly bonds. (Source)

This repudiation didn’t exactly come as a surprise. At the time, the new government was sincerely communist, and these debts were regarded as the debts of an evil capitalist regime. Furthermore, they were owed to evil capitalists abroad, and if refusing to pay them caused financial hardship or chaos overseas, so much the better.

Unfortunately, international law doesn’t work that way.

If nations were permitted to repudiate their debts due to ideological differences with the previous government, we could wipe out our national debt every time Republicans replaced Democrats in Washington, or vice versa. Indeed, this is why debts are considered “national” debts in the first place: they are obligations of the nation itself, not of any particular group of politicians who happen to be ruling it at a given moment.

If nations were permitted to repudiate their debts due to ideological differences with the previous government, we could wipe out our national debt every time Republicans replaced Democrats in Washington, or vice versa. Indeed, this is why debts are considered “national” debts in the first place: they are obligations of the nation itself, not of any particular group of politicians who happen to be ruling it at a given moment. The flip side of this principle is, of course, that not only liabilities but also assets carry over from one regime to the next. This includes everything from the typewriters in the nation’s embassy in Ruritania to the national territory itself. (And, of course, it includes the money owed to the nation by foreigners.)

Beijing should remember that its claim to the territories of Tibet and Taiwan are based (however dubiously in Tibet’s case) upon historical claims predating the Communists’ seizure of power. But are those who repudiate history entitled to base claims upon it? Hmm…

No nation is entitled to have things both ways. Either the People’s Republic of China is the successor state to Nationalist China, in which case it must honor the latter’s debts, or it isn’t, in which case it is not the legitimate government of the country, and we might as well go back to the curious era (1949-71) in which we regarded Taipei as the legitimate government of all China.

China is not, of course, the only nation to have welched on its international debts. Russia did it in 1917, Cuba in 1961, and North Korea in 1964.

Conversely, any number of nations have gone through wrenching ideological transitions without repudiating their debts. For example, South Africa’s government continues to honor the debts incurred by the apartheid state that preceded it. When the communist government of Russia fell in 1991, there followed a flurry of claims on its successor, which were worked out in various (not entirely satisfactory) ways.

There were partial settlements of some of China’s foreign debts in 1979, but this did not include the aforementioned $260 in bonds. In 1987, the British did a deal with China concerning their share of the outstanding obligations, but this deal did not cover non-UK citizens. But in 2006, the Chinese Ministry of Finance formally informed the U.S. government that it was not willing to repay the rest of China’s outstanding obligations.

China’s debt repudiation has not, as one might imagine, receded into ancient history. On July 17, 2008, the Subcommittee on Terrorism, Nonproliferation and Trade of the House Committee on Foreign Relations held hearings on the matter. So it remains a quiet but live issue. Bondholders seem to have long memories.

Distressingly, there is also another very contemporary angle to this issue. The very same credit ratings agencies that approved billions of bad mortgage securities stand accused of complicity in China’s attempt to run from its financial past. There is a formal legal complaint outstanding with the U.S. Department of Justice antitrust division (viewable here) accusing these agencies of colluding with each other and Beijing to do this.

The significance for the present day is that they stand accused of overstating the reliability of contemporary Chinese debt by, among other things, ignoring the government’s past unreliability. (As we saw in the Asian Crisis of 1998, these agencies are quite capable of mis-rating governments.) Given the scale of sovereign borrowing by the world’s second-largest economy, this may not remain an abstract problem forever.

Ian Fletcher is the author of the new book Free Trade Doesn’t Work: What Should Replace It and Why (USBIC, $24.95) He is an Adjunct Fellow at the San Francisco office of the U.S. Business and Industry Council, a Washington think tank founded in 1933. He was previously an economist in private practice, mostly serving hedge funds and private equity firms. He may be contacted at ian.fletcher@usbic.net.

© 2011 Copyright Ian Fletcher - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Paul

24 May 11, 16:50 |

repudiating?

America has no choice but to repudiate its unrepayable debt, but then that was always the plan. |