LNG Export: A U.S. Natural Gas Game Changer?

Commodities / Natural Gas Jun 05, 2011 - 10:29 AM GMTBy: EconMatters

Unlike crude oil, which is traded globally via tankers and pipelines, natural gas trading remain primarily isolated within the producing regions and lacks the infrastructure to be a true global commodity.

Unlike crude oil, which is traded globally via tankers and pipelines, natural gas trading remain primarily isolated within the producing regions and lacks the infrastructure to be a true global commodity.

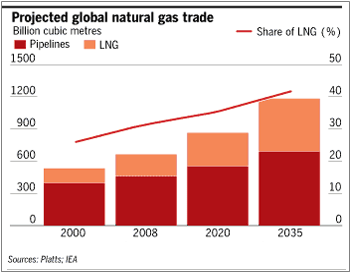

In the past few years, increased LNG (liquefied natural gas) trade is gradually transforming the global natural gas market. However, bustling U.S. shale gas production and weak demand due to recession have created a significant supply glut as the U.S., depsite nine LNG import terminals, has near zero LNG export capacity.

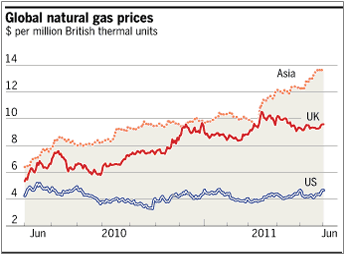

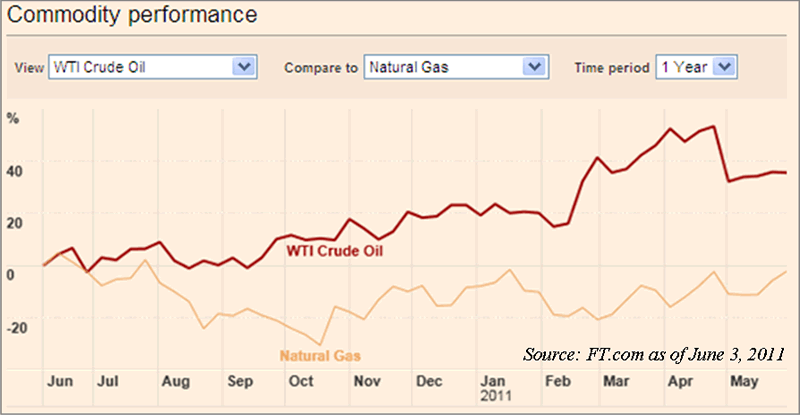

While crude oil prices have been climbing on trading activities and geopolitical tensions, domestic natural gas prices have remained stagnant in the $4 per mmbtu (million British thermal unit) range for the past year or so, practically immune to the effort by the Federal Reserve to inflate asset prices through two rounds of QE (See Chart).

10% LNG Export by 2015?

Despite a well-supplied market, Henry Hub has experienced a rare excitement spiking to a 10-month high partly on the prospect of increasing LNG trade (See Chart) and export after the U.S. Energy Department authorized Cheniere Energy (Amex: LNG) to export LNG from its Sabine Pass terminal.

Chart Source: FT.com |

Morgan Stanley has estimated that North American LNG export capacity may exceed 6 bcf/d by 2015, or around 10% of the current US daily production of 60 bcf/d. Morgan Stanley said it expects the ramp-up of the LNG export to ease the current stranded price environment as both the US and Canada have LNG export projects in the works targeting LNG export by 2015.

Separate But Not Equal

In most of Europe and Asia, the price of natural gas/LNG is typically linked to crude oil under multiyear contracts. The ratio of Brent crude to Henry Hub natural gas touched a record of more than 31-to-1 on April 8. The average during the past decade is about 10-to-1. So the recent spike in crude prices has also accentuated the international LNG price differentials to the U.S. Henry Hub….of up to 300%.

While Henry Hub gas in the U.S. is sitting at less than $5 per mmbtu, NBP gas in the UK costs more than $9, and the benchmark for east Asia which is liked to JCC, ‘Japanese Customs Clearing Price’, or ‘Japanese crude cocktail,’ is more than $13 per mmbtu, according FT.com based on Platts data (See Chart).

Chart Source: FT.com |

Logistic Disadvantage

However, realistically, U.S. gas cargos may have a hard time competing with other exporters such as Russia, Qatar and the up-and-comer—Australia--in the Asian and European markets due to logistic disadvantage.

From LNG World News:

“At $4 per million Btu, it would cost $9.15 to deliver U.S. gas cargoes to Japan, when taking liquefaction and transportation costs into account, according to Barclays. Delivery to Europe would cost $7.15 because of the shorter voyage, the bank said in the report. European importers currently pay about $10 per million Btu.”

Tricky LNG Economics

Moreover, for U.S. LNG exports to make economic sense, domestic gas price would need to stay low, with high enough international LNG prices, and if the LNG prices are still tied to crude oil (which could change depending on market development), then crude oil prices would have to remain elevated. That’s a lot of tricky variables clouding the seemingly rosy LNG export picture.

Some industry participant like Conoco Phillips is not completely sold on LNG exports either. Al Hirshberg, Conoco’s senior vice president of planning and strategy, said at a conference that he does not see the economic case for LNG export terminals being "overwhelming," and that LNG exports will unlikely ever scale enough to have a big impact on the domestic US gas market. CitiGroup also expects the U.S. could become a swing player in the global LNG market since all planned LNG facilities in North America are going to be two-way.

Booming Demand in Asia & Europe

Nevertheless, as a result of the Japan nuclear crisis, countries like Germany and China have either phased out nuclear power plants, or suspended approvals of new nuclear power plants. Natural gas, a cleaner burning fossil fuel, is next in line to fill the void left by the nuclear energy.

Natural gas currently accounts for only about 4% of China’s overall energy usage compared with a global norm of about 16%. The expected demand growth in China, coupled with fast declining conventional gas production in Europe and Asia will likely boost demand in the coming years.

Investment Thesis

On that note, I’d stay away from the US-centric gas producers such as Chesapeake Energy and Devon Energy, and instead look at companies such as Royal Dutch Shell, Chevron, Exxon Mobil, and Conoco Phillips, that have LNG and other gas production facilities close to the higher demand regions of Asia and Europe.

Manufactures supplying engineered equipment to LNG and other hydrocarbon construction projects like Chart Industries Inc. (nasdaq.GTLS), General Electric and Siemens AG, and engineering and construction companies such as Fluor Corporation, and Shaw Group would be two other sectors that could also benefit.

To many investors, Cheniere Energy might seem to be an obvious choice to ride the natural gas trend, as shares have climbed 40% since the export permission was granted on May 20. But remember Cheniere has gone through two rounds of heavy capital spending on Sabine Pass—in 2003 to build the import terminal, and now to retrofit the export facility.

High debt, low profitability, coupled with an uncertain natural gas outlook as discussed here, makes Cheniere Energy stock look risky on valuation and could even be a good candidate for shorts.

Disclosure - No Positions

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.