Wiping Out All of 2011's Stock Market Gains!

Stock-Markets / Financial Markets 2011 Jun 09, 2011 - 03:15 AM GMTBy: PhilStockWorld

S&P 1,260. That's the line we need to hold.

S&P 1,260. That's the line we need to hold.

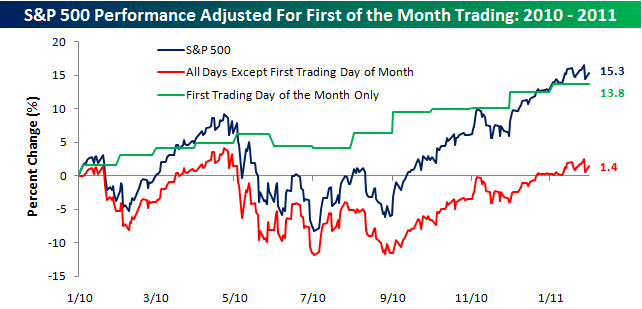

That's where we started the Year on January 3rd and we finished that day at 1,271, beginning a fine tradition of making almost all of our gains on the first day of the month, continuing a very disturbing (and very fake) year-long trend that I am calling "sell the next day (of the month) and go away." (chart by Bespoke).

Notice that this trend became very disturbing at the same time Uncle Ben announced his fabulous QE2 plan that showered money on his fellow Banksters according to a nice, predictable schedule that allowed them to lever up their investments to inflate stocks and commodities, trapping index fund investors (especially the working poor who make monthly contributions to IRA and 401K accounts in a nice, predictable and controllable fashion). It's a simple plan, index fund managers get your pension money at the end of the month, they are required to buy baskets of stocks to balance their funds and that action can be manipulated by clever bankers who jack up the prices and then sell into the fake demand they created - effectively stealing tens of Billions each month out of the paychecks of working Americans. Just another one of those great crimes they commit where they steal a little bit of money from everyone, every day.

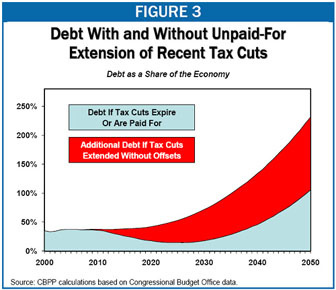

Speaking of robbing from the rich to give to the poor (see "The Dooh Nibor Economy"), it's time we said happy 10th anniversary to the Bush/Obama tax cuts that have, as Barry Ritholtz put it: "driven the balanced budget he inherited from President Clinton deep into the red." So deep in the red, in fact, that even now Congress is still debating about extending the $14.5Tn deficit that the Congressional Budget Office says will double over the next 10 years if these cuts remain in place.

That's right, those same tax cuts that are "off the table" in negotiations in Congress are, other than war spending, the sole cause of our nation's deficit. This country does not have a spending problem, it has a collecting problem! As Mike Konczal, a research fellow at the Roosevelt Institute, noted: "It's not like this has unleashed a wave of productivity, or better incentives, or increased work output. It's mostly just rich people got a lot more money."

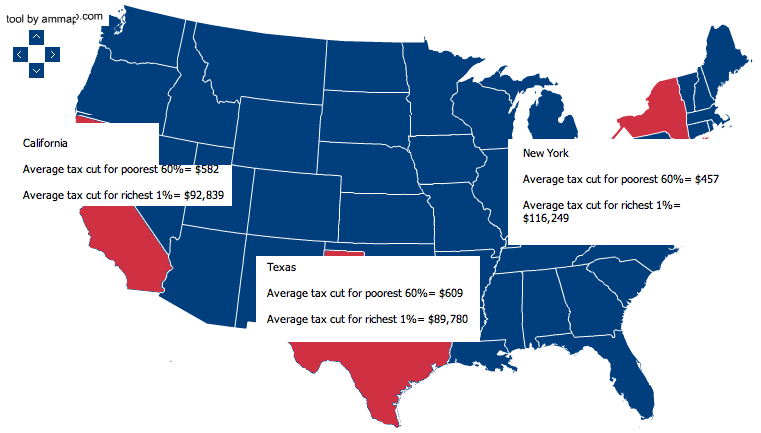

According to Citizens for Tax Justice, in 2013 the tax cuts would give the richest 1 percent of West Virginians $30,000 a family (see chart above for all states). The bottom three-fifths would get less than $400. With high unemployment and a budget fight in Congress, Republicans want to extend the tax cuts again, arguing they would trickle down to working people. Republicans say Medicare and Medicaid should be cut to pay for the deficits and extending the tax cuts. Konczal says that, in spite of the rhetoric, that won't put people to work:

It's textbook economics. That was a lot of the logic in 1937, when we caused a second wave of the Great Depression.

There is no lack of effort here on behalf of the working class. Since 1973, productivity is up 100% but the MEDIAN (not average) income for American Workers has fallen by 5% over that same period. Workers are, in fact, working twice as hard for less wages. CEO pay during that same time-frame, has gone up 1,000%, with the average CEO earning 250 times as much money as the average production worker in his own company. Out of 310 Million people in this country just 135M of us have jobs yet we only consider 13.9M (of the people "in the labor force") to be unemployed and we are only paying benefits to 4M of those people. The rest are "discouraged workers," who don't count as they took to long to find jobs so we have written them off according to schedule.

Why does this matter today? Because yesterday, the head of the Federal Reserve reiterated his stance yesterday that he feels that falling wages and falling housing prices offset "transitory" inflation (what those unemployed people need to pay for food and energy) and allow him to proceed as if inflation is somebody else's problem as it's certainly not his and not a problem for anyone he hangs out with in his top 1% bubble life. (Word Cloud by Zero Hedge)

What does Bernanke care about? Well, like any good Bankster, he only cares about whether or not the bottom 99% have more blood to give to the top: "Developments in the labor market will be of particular importance in setting the course for household spending... As is often the case, the ability and willingness of households to spend will be an important determinant of the pace at which the economy expands in coming quarters... Increases in household wealth--largely reflecting gains in equity values--and lower debt burdens have also increased consumers’ willingness to spend."

A full one half of Bernanke's speech was spent deflecting the blame for higher commodity prices away from Fed action. Not the "I'm sorry, we made a mistake" of Fisher's CNBC appearance in the morning - quite the opposite! Ben was like a 5-year old standing in front of a TV with a cracked screen holding a baseball bat saying "the dog did it" or his sister, or ghosts or those evil emerging markets (blaming brown and yellow people for our problems is always popular in America). Even worse than the denial is the Fed's criteria for measuring future inflation - it will only be inflation if prices go UP MORE from here. If prices simply STAY this high, Ben is already telling us he will consider that a victory. Listen to the master:

Besides the prospect of more-stable commodity prices, two other factors suggest that inflation is likely to return to more subdued levels in the medium term. First, the still-substantial slack in U.S. labor and product markets should continue to have a moderating effect on inflationary pressures. Notably, because of the weak demand for labor, wage increases have not kept pace with productivity gains. Thus the level of unit labor costs in the business sector is lower than it was before the recession. Given the large share of labor costs in the production costs of most firms (typically, a share far larger than that of raw materials costs), subdued unit labor costs should remain a restraining influence on inflation.

Another argument that has been made is that low interest rates have pushed up commodity prices by reducing the cost of holding inventories, thus boosting commodity demand, or by encouraging speculators to push commodity futures prices above their fundamental levels. In either case, if such forces were driving commodity prices materially and persistently higher, we should see corresponding increases in commodity inventories, as higher prices curtailed consumption and boosted production relative to their fundamental levels. In fact, inventories of most commodities have not shown sizable increases over the past year as prices rose; indeed, increases in prices have often been associated with lower rather than higher levels of inventories, likely reflecting strong demand or weak supply that tends to put pressure on available stocks.

That second paragraph is DEEPLY disturbing as it indicates the Chairman of the US Federal Reserve either doesn't understand the mechanism of commodity speculation(in which churning speculative contracts drive prices higher EVEN as actual demand DECREASES)OR he is just a lying son of a ***** who is willing to f*ck the bottom 99% of the World over to advance the agenda of his masters. We report, you decide...

Speaking of our Corporate Masters and our Government's unwillingness to tax the top 1%, thereby impoverishing the bottom 90%, destroying the American way of life and plunging our nation on an unsustainable path to fiscal ruin that will make Greece look responsible... Have you seen the Citizens for Tax Justice Report?

They analyzed the taxes of a dozen corporations: GE, AEP, DD, VZ, BA, WFC, FDX, HON, IBM, YHOO, UTX and XOM and it turns out that, over the past 3 tax years, those 12 companies earned $171Bn of pre-tax profits and, in total, paid NEGATIVE $2.5Bn in taxes. That's right, WE GAVE THEM $2.5Bn! In fact, if it wasn't for XOM and HON actually paying $3.7Bn over 3 years (on $25Bn in profits), then the other 10 would have been paid $6.2Bn by those of us who do pay taxes to thank them for making an additional 146Bn tax-free Dollars while using our roads, our water, our sewers and our power grid and our transportation network - benefiting from our military protection and the hiring of workers who were educated in our school systems at the taxpayer's expense.

At the 35% rate us mortals pay, that's $60Bn that was not paid in taxes on the Federal level (we need another study to figure out how much they are screwing the states over for)by just 12 of the Fortune 500 who, in total, earned over $2Tn in 2010 and paid less than $200Bn in taxes (10%)with that missing $500Bn accounting for 1/3 of our total deficit.

This is not even getting into the depreciation scam, which is another MASSIVE tax break taken by Big Business that is even larger than the tax avoidance scam we are discussing in this study. XOM alone booked $39Bn of "losses" from depreciation in those same 3 years, allowing them to avoid another $16.7Bn in taxes, which is more money than 1M American workers collect in ANNUAL unemployment - if the workers can even afford the gas to go pick up their checks, that is...

OK, I got that out of my system - now back to work!

We have the Fed's Beige Book today (2pm) and that's probably not going to look pretty but that doesn't stop them from running yesterday's playbook again and driving the futures back up (off a terrible drop last night - still down from yesterday's close) even as they let the Dollar drift higher (74.25) so they have room to pound it back down and goose the markets to make things look pretty for the retail schmucks while the Big Boys run for the exits. Also moving the markets this morning will be an OPEC output decision (any moment) where an increase in supply is expected and an oil inventory report at 10:30 that should show a draw-down as imports were curtailed by a pipeline outage in Canada - but that won't stop them from spinning it as "proof" of demand in the face of high prices on CNBC.

We had another fabulous day shorting oil from $99 to $98 twice yesterday AFTER my call to short at $99.60 in the morning which hit our $98.50 target for a $1.10 gain. So that's a total of $3.10 in speculator punishment we doled out yesterday for another $1.038Bn for anyone who was able to short all 335,000 contracts (I'm still waiting for the $3Bn I need to cover the margin!). We had a little fun last night and this morning scalping quarters in Member Chat and our last bet was UP from the $98.25 mark as we felt an increase in OPEC supply was already baked in and up was more likely than down. Oil should head higher into inventories and then we will be very happy to short it again at around $100 or whatever they manage to take it to on the expected draw in crude stockpiles.

We can thank B-B-B-Bennie and the Fed for setting up a boost in oil (and it costs Americans alone $1.5Bn per penny increase in the price of gas) - as I mentioned above, he spent half his speech discussing energy prices, declaring them transitory and "not his fault" anyway and laying out the case for demand driving prices and not the Trillions of Dollars of speculative contracts that are being bought by the same IBanks he is funneling Trillions of Dollars of loans to. Gasoline was $2.92 (wholesale) before Ben's speech and it shot up to $2.98 after so that's $10Bn out of our collective pockets already. Now OPEC gets to disappoint us this morning by not increasing supplies adequately to squash speculation and we should be back over $3 and the bottom 99% are right back on the road to bankruptcy, where they will lose their homes to the Banksters - MISSION ACCOMPLISHED!

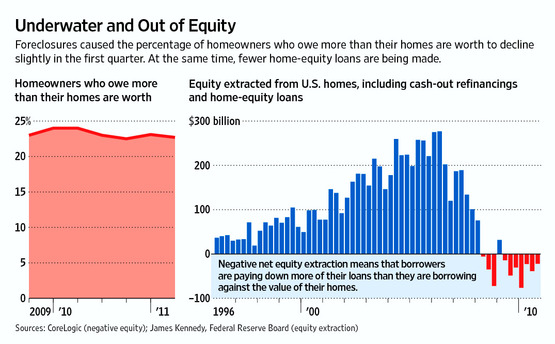

According to Corelogic, 38% of the people who took second mortgages in America are underwater on their homes with an average debt of $83,000. $2.69 TRILLION in second mortgages are out there so we're talking about over $1Tn worth of loans that SHOULD be written down by US banks if they were marking to market so thank goodness we completely ignore basic accounting rules in this country or things would look bad, right?

Overall, the CoreLogic report found that the percentage of underwater homeowners declined slightly in the first quarter. About 10.9 million Americans who borrowed to buy their homes, or 22.7% of all homeowners with a mortgage nationwide, were underwater in the first quarter, down from 11.1 million, or 23.1%, in the fourth quarter of 2010. The modest decline wasn't a sign of an improving market. Rather, the change reflected completed foreclosures, which reduced the total number of homeowners in the market, CoreLogic said.

Needless to say, we'll be looking for opportunities to short into this morning's rally, hopefully we can sell oil at $100.60 again - that's our magic number and we'll see if we can stick the speculators for another Billion.

After all, it's only US Dollars!

Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2011 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.