QE Illustrates Why Investors Should Have Exposure to Agri-Equities

Commodities / Agricultural Commodities Jun 20, 2011 - 09:24 AM GMTBy: Ned_W_Schmidt

While thinking about corn and wheat and pork prices, we cannot help but note the importance of Wednesday, 22 June. On that day the Federal Open Market Committee of the U.S. Federal Reserve should read the eulogy for QE-2. As far as can be determined by impartial observers, that policy was a complete and utter failure. No positive economic benefits have been discernable. Rather, it created one great bear markets for the U.S. dollar that helped fuel one great run in commodity prices.

While thinking about corn and wheat and pork prices, we cannot help but note the importance of Wednesday, 22 June. On that day the Federal Open Market Committee of the U.S. Federal Reserve should read the eulogy for QE-2. As far as can be determined by impartial observers, that policy was a complete and utter failure. No positive economic benefits have been discernable. Rather, it created one great bear markets for the U.S. dollar that helped fuel one great run in commodity prices.

Easy money has now been found conclusively to only distort prices, with no positive benefit to employment and wages. Only Keynesian ideologues hang on to their delusions.

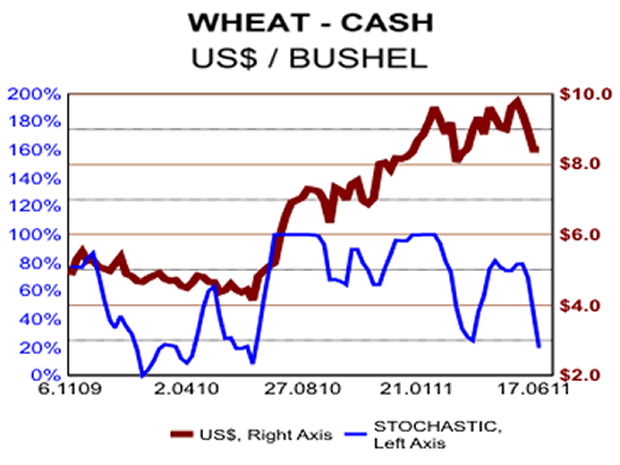

Almost a year ago the global wheat market was the catalyst for Agri-Food commodity prices staging a major move upward. Two events that occurred last Summer, the Russian wheat embargo and QE-2, coincided with the beginning of the move higher by Agri-Food prices. Those two factors are about to disappear. QE-2 should end, and Russian wheat exports should begin flowing next month.

Already U.S. cash wheat prices, as shown in the above chart, have started moving down, having fallen about 14% from the high. With the combines headed north in Kansas and China, the Northern Hemisphere wheat harvest is progressing well. Thus far, despite overall U.S. wheat production being less that "normal", the Kansas crop is better than expectations. Weights are good and protein levels perhaps above average. One of the oddities often of food production is that a better crop if often produced by less water rather than more. We expect US$8 price, formerly a support level, to now become a resistance level.

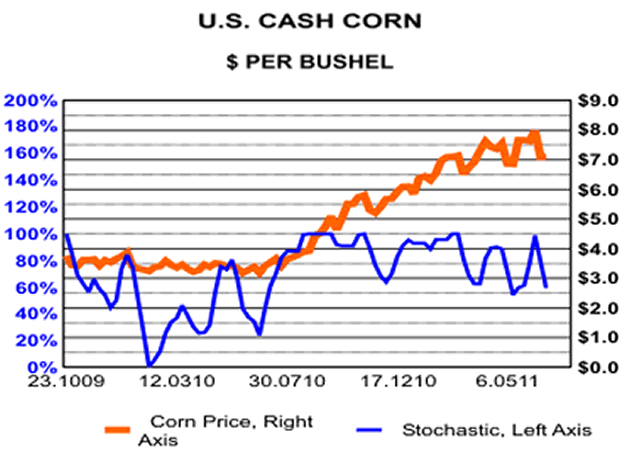

Corn, in the chart below, has also started moving lower. Corn prices are double those of a year ago. We need to remember that Agri-Food prices represent real economic transactions that influence real economic behavior. Farmers do react to higher prices. They have planted in the U.S. every square inch possible. Second, conditions for U.S. corn planted are extremely good. In all likelihood the per acre production of corn in the U.S. will be above recent expectations, offsetting some lost acreage.

On average, Agri-Food prices are now down about 15% from their highs, but with a wide range from -46% for eggs to only -4% for barley and butter. While the Northern Hemisphere harvest is still several months away, recent developments and extensive over buying in the past six months suggest buyers have little reason to be aggressive in their bidding. A continuation of the Agri-Food commodity price correction now in progress should likely continue through September.

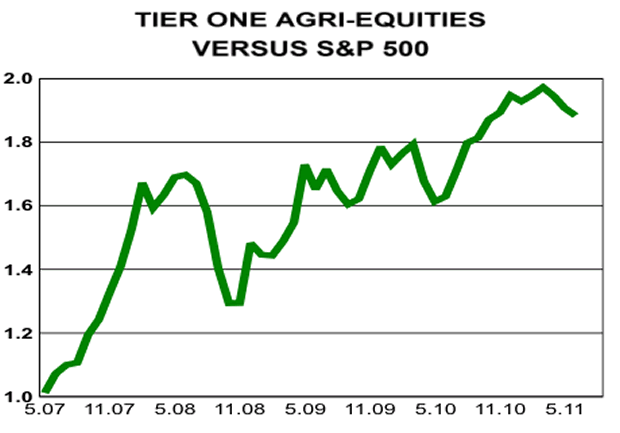

What might that all mean for Agri-Equity investors? To help answer that question let us use the chart below of ratio of a return index of large, multinational Agri-Equities to the S&P 500.

When the ratio portrayed in above chart is rising, Tier One Agri-Equities are performing better than the S&P 500. Over the entire period shown, that the Tier One Agri-Equities have substantially outperformed is readily apparent. Our attention, though, needs to focus on the correction in 2008, the last time Agri-Food commodity prices corrected.

In 2008, that ratio fell about 23%. Thus far, the ratio has fallen about 8%, or about a third of the 2008 experience. We do not believe that this correction will be as severe as that of 2008. Several factors support that view. Globally, Agri-Food supplies are indeed much tighter than during that period. For example, China is now a net importer of corn, and will likely remains so. Global meat demand is much higher and stronger.

We believe the Tier One Agri-Equity correction will also be less severe this time around. If it is half to two thirds of what occurred in 2008, then the current situation is about 50-75% of what might be expected. Combining that estimate with the normal seasonal doldrums during the Summer suggests a timely bottom for Tier One Agri-Equities might be August-September.

Given the longer term structural shortages in Agri-Foods, investors should have exposure to Agri-Equities. Given that June is rapidly fading, now is the time for investors to be doing their research on Agri-Equities. Understanding why the two strongest Agri-Equities thus far in June are SFD and Wilmar International may take some time, but be a place to start. Why might talk of hog exports and prices replace silly discussions of social networking fantasies in the years ahead? Which company controls about half of the retail vegetable oil market in China? (Hint: It starts with a W.)

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2010 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.