Global Stock and Financial Market Confidence Meltdown

Stock-Markets / Financial Markets 2011 Aug 14, 2011 - 01:29 PM GMTBy: George_Maniere

I have never been big advocate of conspiracy theories. Most of these theories are information that is reported in the media circus to incite anger towards one group of people. Meanwhile the real stealth culprits go unnoticed.

I have never been big advocate of conspiracy theories. Most of these theories are information that is reported in the media circus to incite anger towards one group of people. Meanwhile the real stealth culprits go unnoticed.

Let’s use the mortgage crisis as an example. There can be no doubt that the mortgage crisis and subsequent collapse of our financial system was an unprecedented nightmare. Upon a closer look, however, the people involved were not part of a conspiracy; they were looking for immediate gratification. The people that were involved have no idea of the collateral damage that they caused nor do they have clue about the international global ramifications that were caused. These people had no idea that the fraud they were perpetrating in the mortgage market would bring down the entire financial system. They were simply looking at the two feet in front of their face and were seduced by the specter of the easy buck. These people see only easy money in front of them and I don’t think most were capable of connecting the dots and seeing the collateral damage that their actions would wreak on future generations.

What was done in the name of greed was far more insidious than shilling for an easy dollar. The real crime was that they were pulling the bricks out of the foundation of the Global Financial System. Indeed, far more telling was the meltdown of global confidence. The lack of global confidence is the cause of higher volatility in the markets. Confidence in the global markets is collapsing. Herbert Hoover said that “capital is acting like a loose cannon on the deck of a ship in the middle of a storm.”

For a moment, let’s forget about the stock market. Would you go into a grocery store if you were not confident that the food you were buying was fresh and safe? I don’t think so. The most fundamental issue that supports all markets is confidence, be it your local grocery store, the local butcher or the stock market. In the stock Market you can’t possibly invest unless you understand what you are buying and have confidence in what is happening. A trader must have the belief that his understanding of what is driving the market is correct. Our politicians do not and will never fix the real problems; they only react to them after it is too late.

If history has taught us anything it is that as institutions and policy makers grow, there will always the temptation to stretch the rubber band. Just as individuals can go bankrupt no matter how rich they are, financial systems can collapse under the pressure of greed, politics and profits no matter how well regulated they seem to be. A careful study of history will reinforce the lesson that governments continually mismanage financial markets, a recipe for the debasement of currencies and the loss of confidence in our financial markets.

Summer roller coasters are supposed to be fun but last week's stomach-turning ride on the stock market (which was the first time in the 115-year history of the Dow Jones Industrial Average that it moved more than 400 points for four consecutive days) was more like a terror ride on an out-of-control roller coaster.

Oddly, with the VIX hitting a high of 48, the market ended the week just about where it started. The Dow ended the week off just 1.5%, only 175 points from where it began. The Standard & Poor's 500-stock index and the Nasdaq Composite ended down just 1.7% and 0.96%, respectively. All three of the major indexes are down for the year: 2.7% for the Dow, 6.3% for the S&P 500 and 5.5% for NASDAQ.

This leaves investors torn between worries of another recession and hope that stocks are at bargain-level prices. And that means a further loss of confidence.

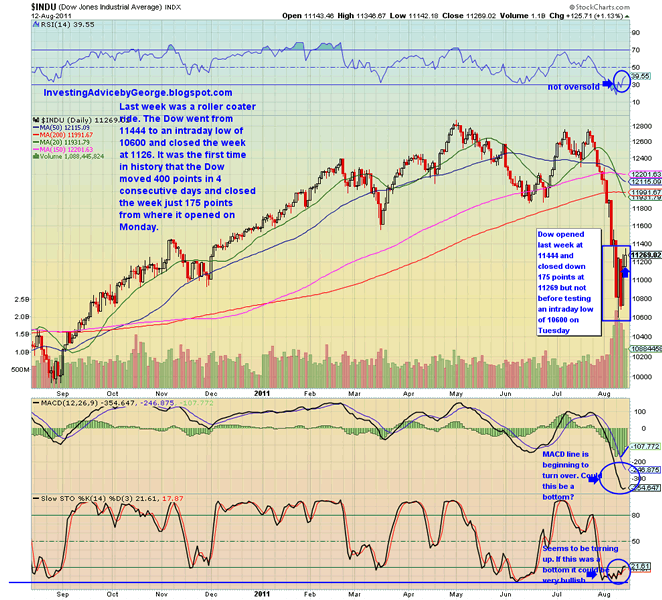

Please see a chart of the DOW from last week.

A study of this chart tells me two things. There has been a complete breakdown of confidence in the market. We can see a drop of 400 points followed by a gain of 400 points followed by a drop of 600 points followed by a gain of 400 points and 160 points respectively. In a week we went absolutely nowhere, except that we did manage to further meltdown any confidence there might have been in the markets. I was shocked to see anyone go long into last weekend. The two signs to look for in the DOW are a close under 11114 as a bearish sign and a close below 10053 as capitulation. On the other hand a close above 12327 (a very unlikely scenario) would be a signal that the market has turned bullish.

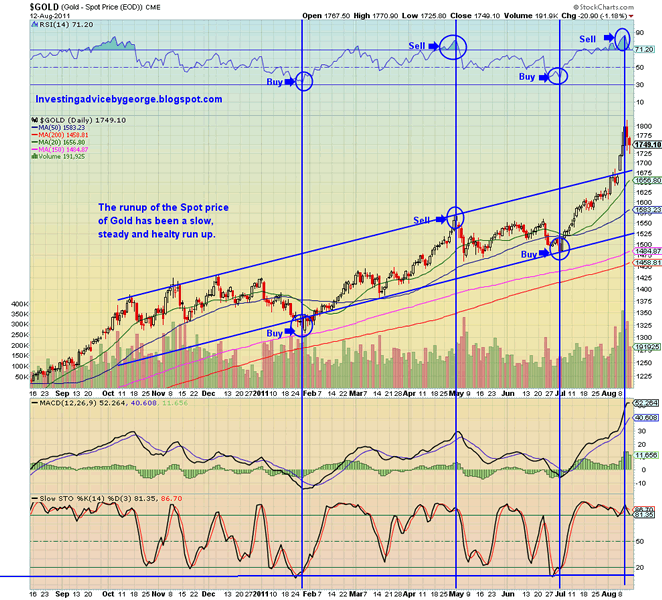

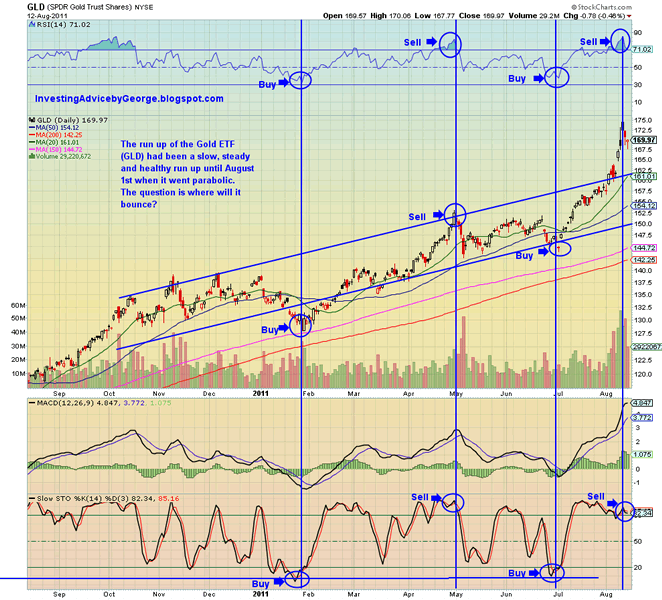

A look at the two charts of our old friend Gold below tells a similar story.

Both of these charts tell the same the same thing. The long awaited correction in gold has begun. With the parabolic run gold has experienced since August 1st I felt it was prudent to take some profits and did so twice in 15% increments. The question that has everyone completely confused and confounded is this a real correction? If it is and history is our guide we should see a bounce at the 150 day moving average or about $145.00 for GLD or $1485 for the spot price of Gold. However with the complete loss of confidence that our leaders have shown us and the markets it seems that healthy or not gold will continue its run up. I mean where are you going to run for a safe haven? U.S. 10 year treasury’s paying 2%?

Given that discouraging backdrop, I would advise that you maintain a long position in gold and silver. If gold continues to sell off don’t fight it, slowly take profits. I would also advise that it's prudent to keep ample cash on hand, hold investments that could do well if things deteriorate, and focus on companies and investments that can prosper in a weak environment.

As I write I am long GLD, SGOL, PHYS, SLV, PSLV, AGQ, XOM, ED, VZ, T, JNJ, LMT, KMP, CAT and AAPL.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.