Buy Gold Price Dip With Both Hands

Commodities / Gold and Silver 2011 Aug 26, 2011 - 01:29 AM GMTBy: Jason_Hamlin

After making a new all-time high above $1,900, gold has plunged by $170 or roughly 9% in the past few days. Many factors have been blamed including the CME margin hike of 27%, money moving back into stocks or simple profit taking by funds to rebalance their portfolios after such a strong move. Others point to the routine take down of precious metals just prior to futures/options expiration.

After making a new all-time high above $1,900, gold has plunged by $170 or roughly 9% in the past few days. Many factors have been blamed including the CME margin hike of 27%, money moving back into stocks or simple profit taking by funds to rebalance their portfolios after such a strong move. Others point to the routine take down of precious metals just prior to futures/options expiration.

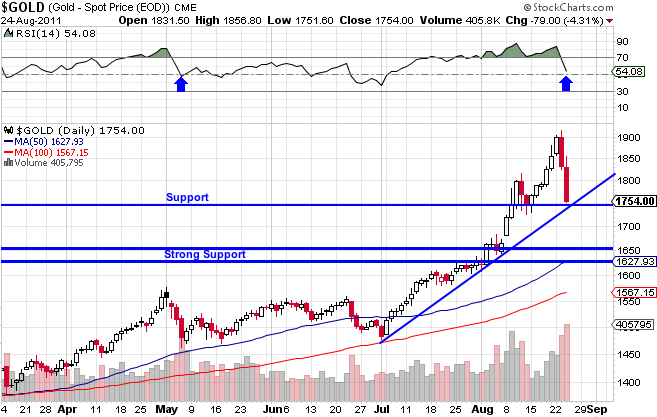

Whatever the cause, this dip is likely to be short-lived and I fully expect a quick rebound in the coming days. The fundamentals continue to improve, central banks continue buying huge amounts, China and India’s demand grows unabated and gold could find technical support around the $1,750 level. If it drops too far below this level, gold could easily test strong support at the 50-day moving average of $1,625.

Short term predictions are folly, but I tend to think gold will find support well before $1,625. After being in overbought territory since the start of August, the RSI has returned to the centerline. While technically there is still room to fall, the last time gold corrected this much following overbought readings, it found support at the centerline.

Growing demand has been creating dips that are both shorter and less severe. Many of the ‘weak hands’ have strengthened and the demand is coming increasingly from long-term investors versus short-term speculators. Many newbie gold bugs are learning what the old timers have known for some time – the dips are nothing more than buying opportunities in a long-term secular bull market that is far from over. When others panic and sell, smart money steps up and buys at discounted prices before the next upleg begins.

This has happened like clockwork for the past decade and the trend will continue for some time into the future. Participation in the gold market remains anemic and both metals are still far from their inflation-adjusted highs, which I view as a minimum price target before this bull is done running.

The debt crisis occurring worldwide is not happening by chance. The system has a built-in design whereby the debt burden grows increasingly painful to the point where the banks and money-printers are able to accumulate and concentrate much of the worlds wealth and resources in their hands. In short, the debt can never be repaid, so real tangible assets are pledged by desperate countries in exchange for worthless fiat paper or via threat of violent force.

It seems that the fiat money system is destined to end in either default or hyperinflation, while the middle class vanishes and the gap between the rich and poor mushrooms wider. While it is hard to predict exactly when the breakdown will occur, it feels more imminent each day. I would like to think that our leaders might suddenly realize that the great Keynesian experiment has gone horribly wrong and return to fiscal discipline and sound money, but I am certainly not holding my breath.

If you would like to see which mining stocks I am holding and which I am targeting to buy during the dip, sign up for the Gold Stock Bull Premium Membership. You will get the highly-rated monthly contrarian newsletter, real-time access to the model portfolio and email alerts whenever I am buying or selling. I also make myself available to premium members for questions via email.By Jason Hamlin

Jason Hamlin is the founder of Gold Stock Bull and publishes a monthly contrarian newsletter that contains in-depth research into the markets with a focus on finding undervalued gold and silver mining companies. The Premium Membership includes the newsletter, real-time access to the model portfolio and email trade alerts whenever Jason is buying or selling. You can try it for just $35/month by clicking here.

Copyright © 2011 Gold Stock Bull - All Rights Reserved

All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor’s investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.