Gold Stocks, the Best Business For An Inflationary Environment

Commodities / Gold & Silver Stocks Sep 03, 2011 - 03:49 PM GMTBy: Willem_Weytjens

Buffett has always said that you should find a company that has pricing power that can offer protection in an inflationary environment. What he means with this is you should find companies which can pass higher costs on to its customers. He once said that the ideal asset in an inflationary environment is a royalty on someone else’s sales.

Buffett has always said that you should find a company that has pricing power that can offer protection in an inflationary environment. What he means with this is you should find companies which can pass higher costs on to its customers. He once said that the ideal asset in an inflationary environment is a royalty on someone else’s sales.

If inflation is 3%, so if prices rise 3% per year, and you get a check based on the sales, your income goes up 3% a year without doing anything.

Now this is really interesting. Not that we are in an inflationary period right now (at least that is what the statistics in Fantasy land are saying), but gold prices are inflating. So the gold mining companies are in a favorable business right now. What about the Gold royalty companies? I personally think they are in an even better situation. Why? Because the costs for mining gold has increased dramatically over the years, as the easy gold has been mined, causing companies to dig deeper, which costs loads of money.

Basically, Royalty companies pay capital to a company which doesn’t have the means to expand. In return for this capital, the royalty company gets a percentage of the sales. Note that the rising costs don’t affect the royalty company’s results, as they get a % of SALES, and not PROFITS! So even if costs go up, bringing profits down for the mining companies, royalties can still increase if production and thus sales increase!

Let’s have a look at some royalty companies:

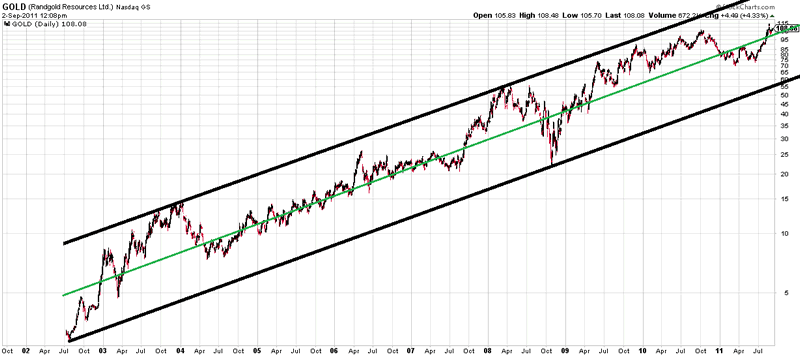

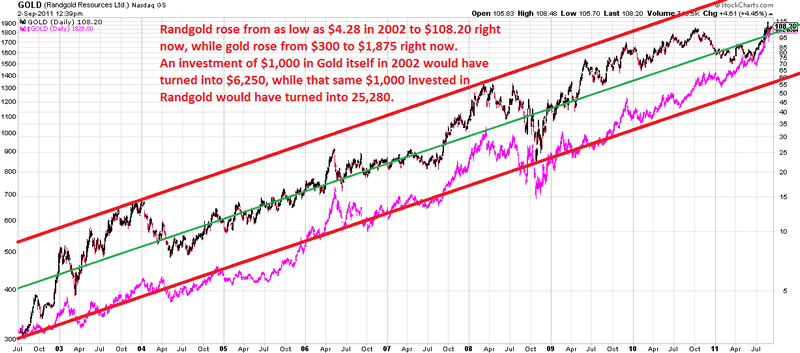

1) Randgold: Isn’t this a nice trend? (Please notice that RandGold (Ticker: GOLD) went higher in recent weeks, despite markets going down)

Chart courtesy stockcharts.com

Chart courtesy stockcharts.com

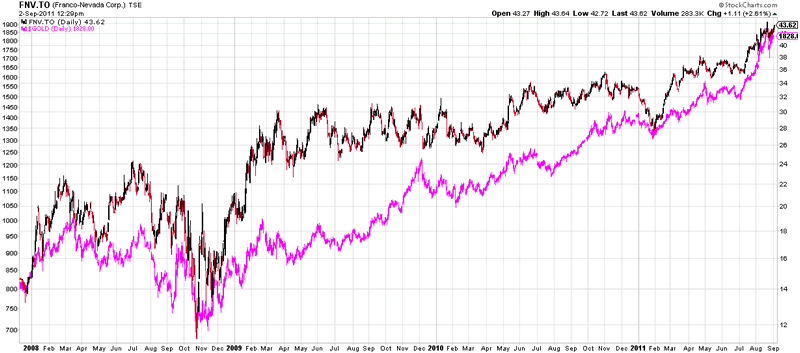

2) Franco Nevada (Ticker: FNV.TO)

Chart courtesy stockcharts.com

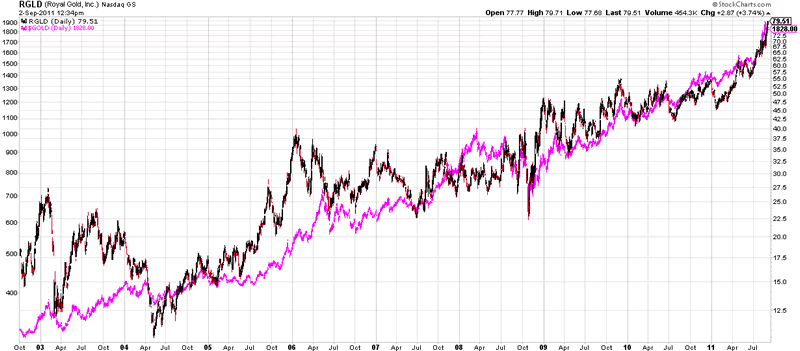

3) Royal Gold (Ticker: RGLD)

Chart courtesy stockcharts.com

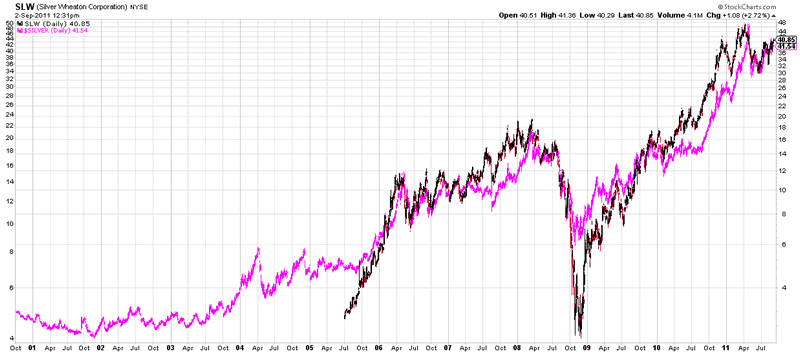

4) Silver Wheaton

Chart courtesy stockcharts.com

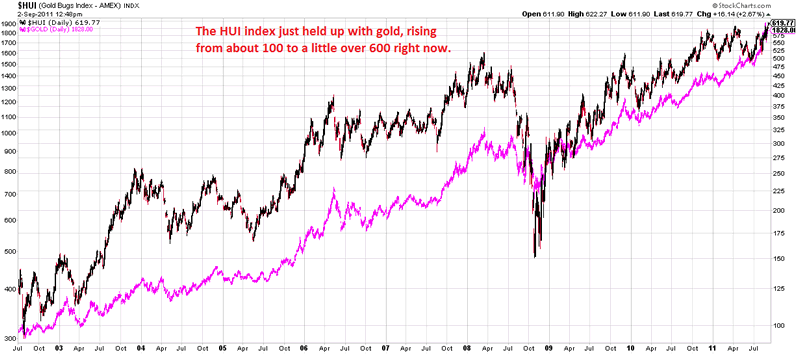

Now let’s have a look at the HUI index, an index composed of several mining companies:

Chart courtesy stockcharts.com

It just kept up with gold, rising 6 fold since 2002. Not bad, but wouldn’t you prefer the Royalty companies after you have seen these charts? Historical results are no indication of future performance, but I think the trend is clear.

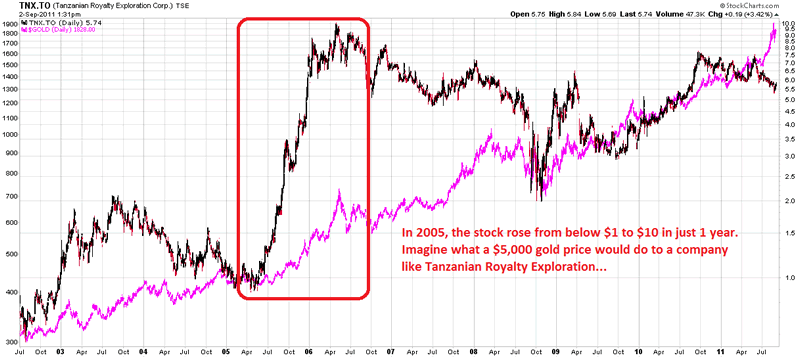

Another Royalty company is Tanzanian Royalty Exploration. Its President is no one less than mr. Jim Sinclair.

Mr. Sinclair proclaimed in the 70′s that gold (then trading around $150 per ounce) would hit $900. It eventually peaked at $887.50 and mr. Sinclair sold his position the following day. He declared the Bull Market dead for the next 2 decades, despite some analysts predicting gold could go as high as $2,000. Boy, was he right. He made a new prediction in the early 2000′s that gold would hit $1,650 by January 14th 2011. It hit this level on August 2nd, so mr. Sinclair was, once again, not far off.

Let’s have a look at the chart:

Chart courtesy stockcharts.com

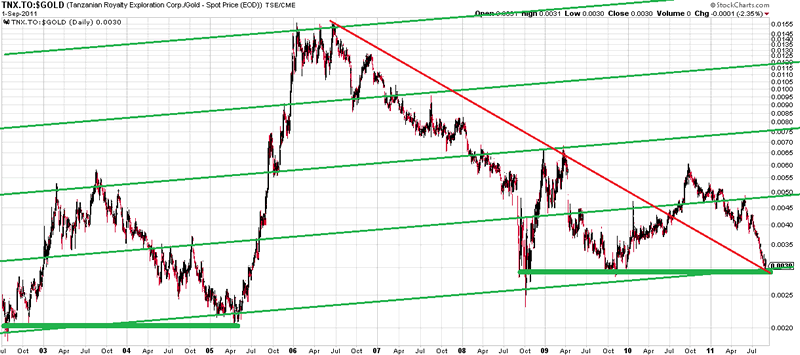

Measured in gold, this stock is trading at the lows of 2008 and 2009 and it is on a long term support line. It also seems to be retesting the breakout above the red resistance line right now. One of Jesse Livermore’s trading rules was: “Be right & Sit Tight”.

Chart courtesy stockcharts.com

For more analyses and trading updates, please visit www.profitimes.com

Willem Weytjens

www.profitimes.com

© 2011 Copyright Willem Weytjens - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.