Fed's Operation Twist a "Visual" Success, 30-Year Treasury Bond Yield Drops 17 Basis Points

Interest-Rates / US Bonds Sep 21, 2011 - 02:30 PM GMTBy: Mike_Shedlock

Curve Watchers Analysis is following the Operation Twist Story.

Operation Twist Early Results

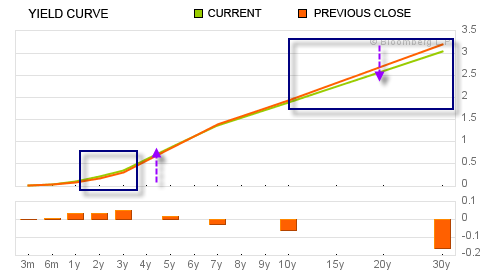

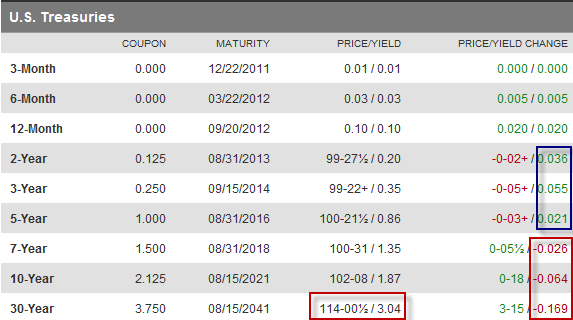

Yields Rise at Short End, Sink on Long End

Yields are behaving as the Fed wanted. Note that the 30-year long bond is flirting with a sub-3% print. However, much of the move in long-term rates was front-run. Nearly everyone expected this move (even 70% of economists). I am wondering what the other economists were thinking.

The one-day results are a spectacular success visually as depicted in the above charts. Unfortunately, none of this can possibly do much of anything for the real economy, and the patient will die

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.