The European Union and Silver

Commodities / Gold and Silver 2011 Oct 16, 2011 - 01:03 PM GMTBy: George_Maniere

This was an amazing week! Besides the fact that we got to see some green on the board, the week was totally eclipsed by the latest off Broadway version of “The Mouse That Roared” as Slovakia took the world to the brink and for one bright shining moment held the fate of the world in its hands.

This was an amazing week! Besides the fact that we got to see some green on the board, the week was totally eclipsed by the latest off Broadway version of “The Mouse That Roared” as Slovakia took the world to the brink and for one bright shining moment held the fate of the world in its hands.

On Thursday, October 13th somewhere in the second act, Slovakia approved Europe's enhanced bailout fund completing the ratification process across the 17 euro countries and all was right with the world.

There is just one small little baby hic-cup. Europe is toast! The likelihood of Europe surviving grows slimmer every day. Let’s get this straight right away. Europeans are not happy with the Euro and the common citizens feel the whole creation of the European Union was a big mess. The European politicians don’t see this as a political problem but rather as a logistical one because they have to somehow sell the consolidating of the bonds to the public.

If the European Union is going to survive it has to make the hard choice. It must consolidate all of the existing national debts into one “Eurobond.” The simple fact is that the failure to do this will cause the banks to fail and then we get to see the man behind the curtain. The truth about the accounting will rise to the surface.

The lack of mark to market accounting that was installed as a quick fix following 2007 has only severed to make the bank’s balance sheets even more obtuse. Remember Collateralized Debt obligations (CDO’S) and Credit Default Swaps (CDS) – that’s the man behind the curtain.

The outstanding derivatives would have wiped out much more if left mark to market. What was not told was that you can’t pool mortgages. In order to foreclose on a property, you have to produce the mortgage to show you have the legal right to that property. When mortgages were made, they were typically resold and then they were pooled, sliced into tranches and no single investor held the mortgage anymore. Anyone who understands the law and the markets should have known this is why mortgages were never pooled previously. It’s like trying to seize your neighbor’s house claiming you were the rightful owner. In the real world the court would ask where is your proof of mortgage? This is how many people were able to stay in their house for 3 years or more without paying a penny in mortgage or tax payments.

This is a small but accurate example of the mess that is going on in Europe. Politicians better start waking up. This is the entire financial system they are fooling around with. For far too long politicians have been masking reality to keep the game going hoping nobody notices the man behind the curtain. WE have to revise the world’s monetary system before it wipes out everyone’s future. This is not politics as usual.

An interesting and potentially tradable condition is unfolding this week in the small silver market. Traders worldwide are watching to see if silver “respects” its May lows or instead falls below them to test/establish new correction lows.

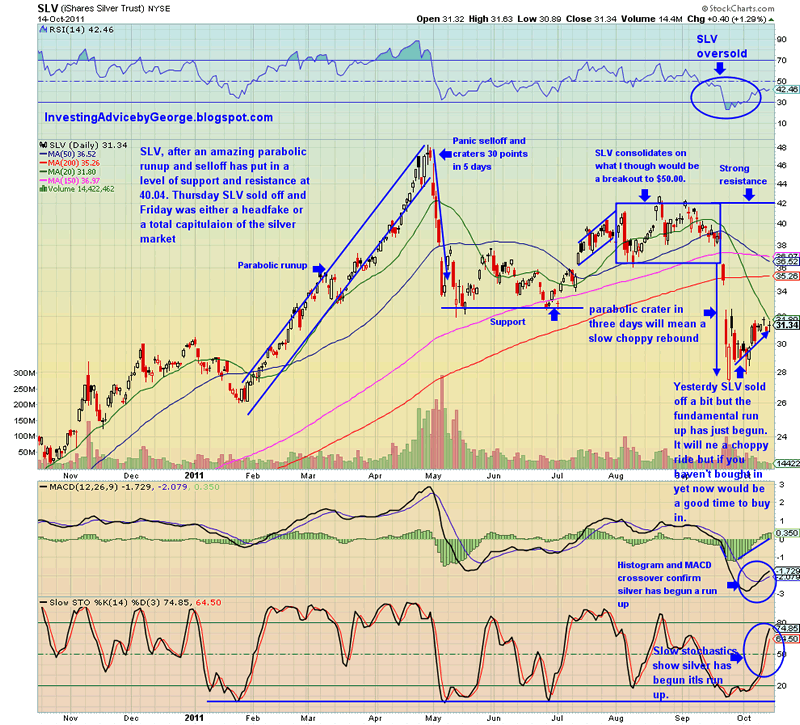

Just below is a chart of the largest silver ETF, (SLV) as a proxy for silver, the commodity.

A look at this chart will show a picture of Silver’s (SLV) late-April sell-off of 40% the first week of May. For almost three months silver seemed to consolidate and began a run up when it ran into resistance at $42.00. I can only conclude that the investors who had bought up in this range wanted out of silver even. From there it bounced from $38.00 to $42.00 when Dr. Bernanke announced “Operation Twist.” This sent the dollar up and investors fleeing gold and silver. A look at the chart will show that silver lost 25% in 1 week. It has fought its way back to close on Friday at $31.34 and that begs the question where do we go from here?

There is no doubt that silver has had a tumultuous year. There is also not a doubt in my mind that silver will continue to increase in value as long as we continue the printing of fiat paper to solve our financial problems. My regular readers know that I am fond of Gerald Loeb. In his epic tome “The Battle for Investment Survival” he writes that it is human nature to see more dollars tan we had last week and think that we are doing well financially. This however is sheer folly. The true test of a currency is not how many you have but rather what is the value of the currency. Voltaire said in the 1700’s “paper currencies will always revert to their intrinsic value – zero.” This leaves the question where does the average man go to protect the value of his money? This leads me to gold and silver.

Gold and silver have always been currency. It has always been so. There are many that would argue that gold is money and silver is an industrial metal. I would beg to differ.

According to Black’s Law Dictionary, it means gold, silver, or paper money used as circulating medium of exchange. In its strict technical sense money means coined metal, usually gold or silver, upon which the governments stamp has been impressed to indicate its value.

I think the U.S. Mint might make a case that we can establish as to the current status, and this is what is clearly stated on their Web site.

American Eagle Silver Bullion Coins are affordable investments, beautiful collectibles, thoughtful gifts and memorable incentives or rewards. Above all, as legal tender, they’re the only silver bullion coins whose weight and purity are guaranteed by the United States Government. They're also the only silver coins allowed in an IRA.

In an email from one of my readers he said that $1923 was the peak for gold and could spend the next few years correcting. $50 silver will depend on gold, the odds of which look extremely low. The correction in USD either finished on Friday or will soon, as with TLT. Equities and metals are set up for an interim fall.

In conclusion, I try never to look at any holding in the micro lens (except leveraged ETFs like SPXU, UPRO, TZA and FAZ). I try and look out further into the future and see where a particular stock or commodity will be in one, two or three years. Bearing this in mind I will continue to do what I have always done and that is when the occasion is right I will buy physical, gold and silver and in the short term keep an eye on the trading ranges of gold (GLL and UGL) and Silver (ZSL and AGQ).

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.