Gold Thoughts on Bursting Sovereign Debt Bubble and Keynesian Super Recession

Economics / Great Depression II Nov 11, 2011 - 06:48 AM GMTBy: Ned_W_Schmidt

Rarely does one live through great events. Mostly we read about them in history books. But, we are today witnessing the bursting of the greatest bubble of all time. This is the big one. More than 70 years in the making, it was inevitable. Was it popular alchemy or just another case of junk science from academia?To prepare your thinking for surviving this momentous event consider the following headlines from tomorrow¹:

Rarely does one live through great events. Mostly we read about them in history books. But, we are today witnessing the bursting of the greatest bubble of all time. This is the big one. More than 70 years in the making, it was inevitable. Was it popular alchemy or just another case of junk science from academia?To prepare your thinking for surviving this momentous event consider the following headlines from tomorrow¹:

SOVEREIGN DEBT BUBBLE BURSTS

TRILLIONS LOST IN GOVERNMENT DEBT

KEYNESIAN SUPER RECESSION ARRIVES

Sovereign debt was to be the super investment, without credit risk. Sovereign debt was to allow for unbridled prosperity. It is now a massive financial anchor around the economic neck of almost every nation in the world gullible enough to adopt Keynesian ideology. Rather, as Greece, Italy, et al have vividly demonstrated, sovereign debt is the road to poverty. Today, only the unborn grandchildren of Greece have any hope of a better life.

Keynesianism was never to be a path to prosperity. Keynesianism, pure and simple, was, and is, a means for the government to ultimately control all income and wealth in a nation. People were to become the wards of the state, fed and cared for by money from selling Keynesian sovereign debt. It remains today nothing more than a means of destroying wealth and freedom, and a myth perpetuated in the great halls of academia.

We ask the purveyors of Keynesian drivel one simple question:

Name one nation in the world that is prosperous because it borrowed money?

Until that question is answered, we should assume that Keynesianism has been another massive failure! It should be tossed on the junk pile of history along with other myths from academia, like global warming from cow flatulence. For those interested in learning of the evolution of economics, and in particular the Keynesian myth, we recommend reading Grand Pursuit: The Story of Economic Genius by Silvia Nasar(2011).

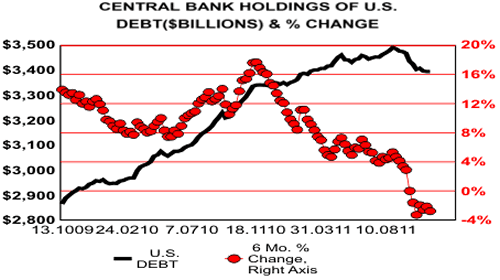

A consequence of the Keynesian Super Recession is that nations, and peoples, around the world are scrambling to find funds to pay their bills. In the following graph, which we have put forth before, is plotted the holdings of U.S. government debt by official foreign institutions at the U.S. Federal Reserve, black line using left axis. Rate of change in those holdings is the red line, using right axis.

Liquidation of U.S. government debt by official foreign institutions continues. Why these investments are being liquidated is not readily known. That acknowledged, two real possibilities exist. One, the countries need the moneyto finance their consumption. Trivial matters such as eating come to mind.

Two, these investors understand the lurking dangers in U.S. government debt. As of yet, absolutely no serious effort has been made to solve the deficit problem of the U.S. The minority government of the U.S. continues to stonewall any effort to reign in spending. Development in the above graph may indicate that the market is about to impose discipline on the greatest experiment in Keynesian alchemy, the greatest of all failed policies of the past.

Over time, investors have turned to two investments as safe havens for wealth. One of those is Gold, which possesses the only long-term investment record. Second has been sovereign debt. Or, should we now refer to it as fiat debt? The latter no longer qualifies as a safe haven, but rather has become simply another risky asset. For that reason alone, investors should retain their Gold.

Despite the risk in the currently elevated price, perhaps to well below $1,500, Gold may be the only safe haven during this period of sovereign debt restructuring and the Keynesian Super Recession. But, it is Gold that investors should own. Now is not the time for pseudo Gold in the form of Silver or paper Gold stocks. In short, when at Wendy's go for the beef, not a veggie burger.

¹These future headlines were provided, in confidence, by a prognosticator with a record far exceeding that of those on any of the cable business media, our favorite cab driver at the airport.

By Ned W Schmidt CFA, CEBS

Copyright © 2011 Ned W. Schmidt - All Rights Reserved

GOLD THOUGHTS come from Ned W. Schmidt,CFA,CEBS, publisher of The Value View Gold Report , monthly, and Trading Thoughts , weekly. To receive copies of recent reports, go to www.valueviewgoldreport.com

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.