The Status Of QE3

Interest-Rates / Quantitative Easing Dec 19, 2011 - 03:42 AM GMTBy: Tony_Pallotta

Aside from countless banks calling for QE3 which one has to wonder if their analysis may be slightly biased for personal gain the question remains will we see QE3.

Aside from countless banks calling for QE3 which one has to wonder if their analysis may be slightly biased for personal gain the question remains will we see QE3.

The November 2010 FOMC statement which launched QE2 made it clear why the Fed was expanding their balance sheet by $600 billion.

"To promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate, the Committee decided today to expand its holdings of securities."

Assuming their basis for future QE has not changed then looking at the data may give us a sense of if and when QE3 will happen.

"To promote a stronger pace of economic recovery"

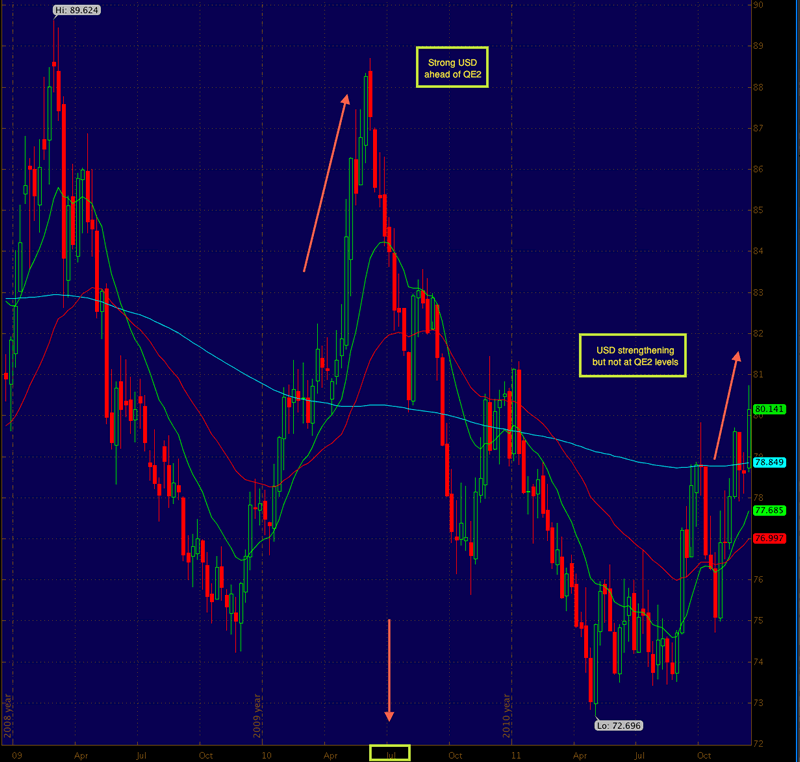

With rates already at zero the only remaining policy tool with a real chance of achieving this goal is a weak USD that will theoretically stimulate export growth. In the summer of 2010 the USD was approaching $88 whereas today it is $80. In other words the USD has room to run higher before the Fed feels the need to "short the dollar" through policy.

"ensure that inflation, over time, is at levels consistent with its mandate"

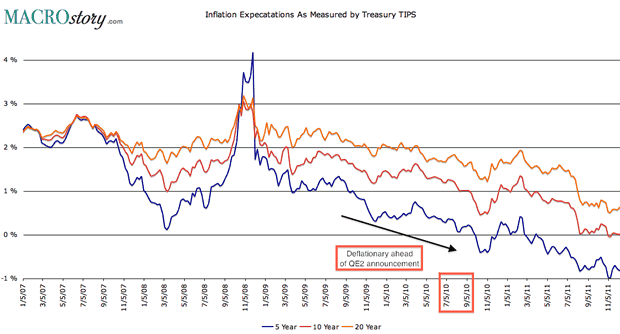

Now this one surprised me when I looked at the data. The Fed wants inflation, they need inflation one can argue. In the summer of 2010 deflation was the dominant trend as indicated by treasury TIPS often referred to as inflation expectations. Not only was inflation below the 2% target but clearly trending lower.

The current inflation expectations are in fact far worse and well below 1% signaling a clear deflationary forecast by credit markets. Why is the Fed not acting though? Neither Bernanke a self proclaimed "student of the great depression" nor the FOMC appears to be preparing the markets for future QE.

I believe the chart above shows the limited ability of the Fed at this juncture in the economic recovery. It is quite possible they are leaving any spare capacity on the balance sheet for the real emergency that will come in 2012 as the European debt crisis spins out of control and US banks as in 2008 will need trillions in secret bailouts or to insure that the payment system does not fail.

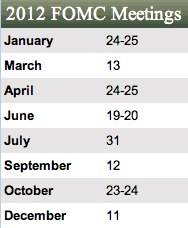

If and when the USD moves to the $88 range as early as a few weeks will the FOMC at their January meeting which is not for six more weeks launch QE3. I suspect in the coming weeks as various Fed speeches are given you will hear far fewer references of large scale asset purchases.

The inflation data clearly points to a deflationary cycle ahead and the simple fact that the Fed is not acting at this moment nor made any reference to act in January speaks volumes to future QE3. Once again equity investors are well advised to listen to credit markets.

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.