U.S. Dollar, Weak Corporate Earnings Indicate Stock Market Top is Near

Stock-Markets / Stock Markets 2012 Jan 17, 2012 - 08:17 AM GMTBy: J_W_Jones

Earnings season is now upon us and so far the only major earnings component that has been released is the J.P. Morgan earnings report that came in Friday before the market opened. After the report was digested by the marketplace, prices fell dramatically.

Earnings season is now upon us and so far the only major earnings component that has been released is the J.P. Morgan earnings report that came in Friday before the market opened. After the report was digested by the marketplace, prices fell dramatically.

While the charlatans in Washington try to sell the American public into believing that the U.S economy is starting to firm up, the underlying truth is that the recovery has been relatively week. If it were not for the massive liquidity injections provided by the Federal Reserve through multiple quantitative easing adjustments, risk assets would likely be priced significantly lower.

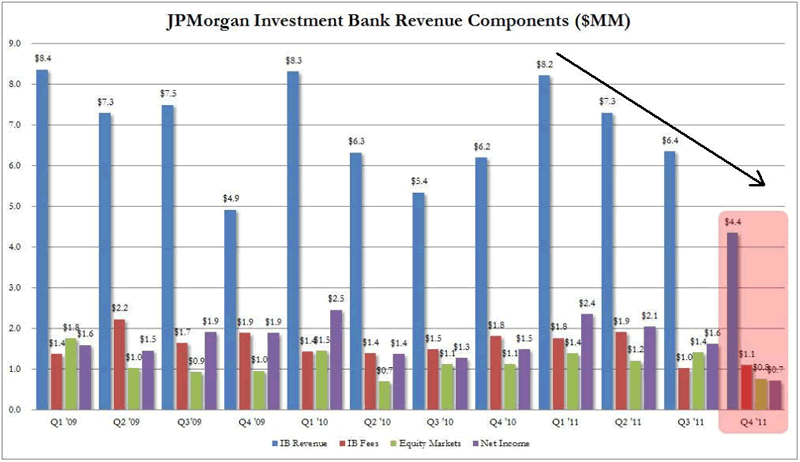

Inquiring minds combed through the data provided in the J.P. Morgan earnings release and a few major outcomes were placed front and center. Earnings disappointed overall due to a massive decline in investment banking activity. Investment banking profits represent a large portion of all of the major banks’ earnings.

On Friday, www.zerohedge.com provided the following chart in its article titled, “Charting Disappearing Investment Banking Revenues And Profits, JPM Edition.” The chart below illustrates the massive decline in investment banking revenue:

To make the chart a bit easier to follow, the blue bars represent investment banking revenue. It is rather obvious that investment banking revenue is in free fall having dropped nearly 50% since the first quarter of 2011. In addition, I would point out the sharp declines in total net income (purple) and the massive decline in equity market revenue (green).

It is without question that the other major banks that have a large investment banking presence are likely to experience similar revenue losses. A significant reduction in investment banking gross revenue puts tremendous pressure on total bank revenues in this quarter and looking ahead.

I am of the opinion that major money-center banks like Bank of America and Citigroup are likely to experience similar revenue reductions. We will know for sure in the coming weeks as most of the large banks are set to report earnings in the near term. Clearly this expected reduction in overall revenue will likely have a major impact on the financial sector of the economy.

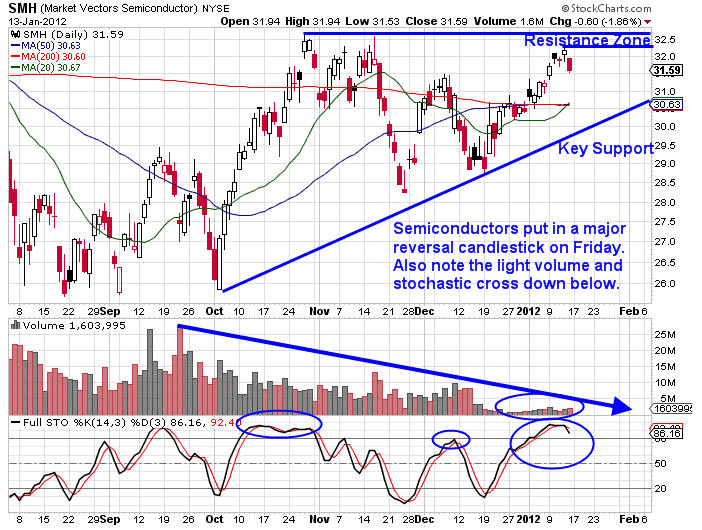

The financial complex is absolutely critical when looking at broad index returns. It is common knowledge that broad indexes such as the S&P 500 and the Dow Jones Industrial Average struggle to rally when the financial complex lags. The same can be said for the semiconductor sector as well.

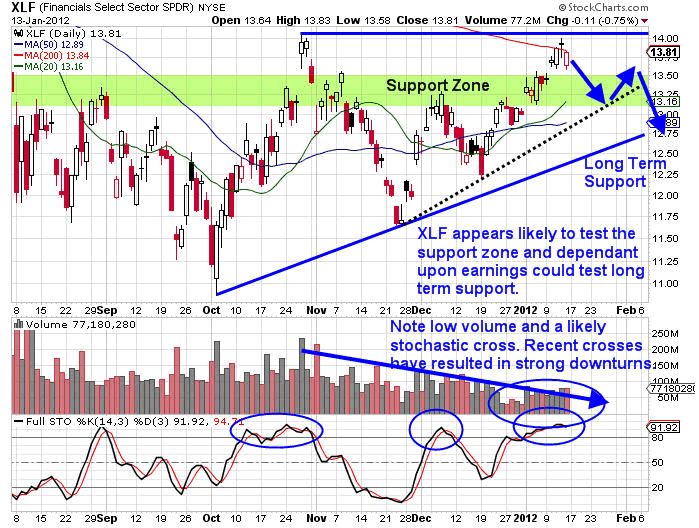

Recently financials (XLF) and the semiconductor (SMH) sectors have worked considerably higher on relatively light volume. Both XLF and SMH are trading into major resistance and both are starting to show signs that they are nearing a potential top The daily charts of XLF and SMH are shown below:

XLF Daily Chart

SMH Daily Chart

Both the XLF and SMH daily charts illustrate that a major top may be forming in both sectors. It is widely noted that if the financials and semiconductors are not showing strength in a rising market, a correction or major reversal may not be far away.

I have been writing about the potential for a major top to be forming for several weeks now and I find that I am not in the majority in this viewpoint. Recent sentiment and momentum in U.S. equities demonstrate that we are very overbought at this time. Retail investors are extremely bullish and the Volatility Index (VIX) is trading near recent lows.

I am unsure whether this is a major top that leads to strong selling pressure or whether a correction is a more likely outcome. What I do know is that tops are a process, not a singular event and at this point more and more evidence is supporting the viewpoint that equities may be getting tired and some profit taking is likely.

In addition to the lackluster price action in the charts above, earnings releases have been revised lower in the 4th quarter of 2011. In fact almost 3.5 companies have announced earnings revisions to the downside for every company that has indicated a stable to rising earnings announcements. This type of scenario has not been present since the first quarter of 2008 which as we know was not exactly a great time frame to be looking to put cash into risk assets.

Furthermore, Goldman Sachs analysts came out with the following commentary, “While the 4th Quarter is typically the strongest quarter for earnings, estimates have fallen 9% since the summer and are now below both realized 2nd and 3rd Quarter results.” Goldman Sachs is also expecting significant price pressure coming from a weak U.S. economy and the fears of a European recession in 2012. Overall, the estimates are far from bullish and are in fact quite concerning when looking at the current valuation of U.S. equities.

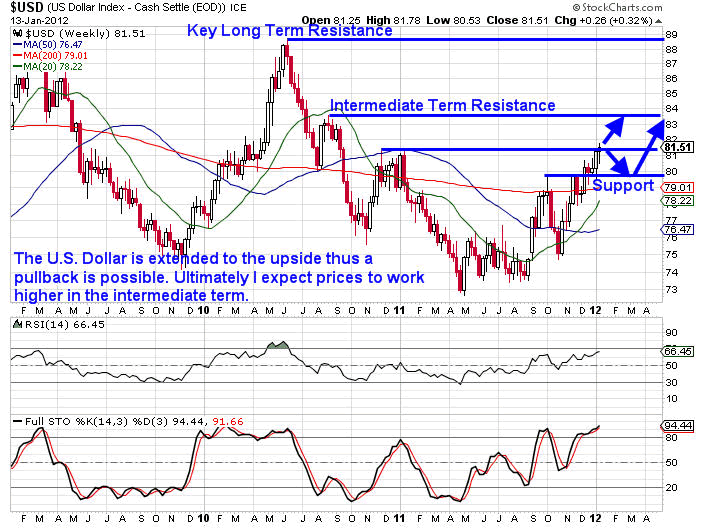

The impact that a stronger U.S. Dollar will have on domestic companies which are used to having a competitive advantage when looking at earnings due to currency adjustments could produce negative surprises. Typically positive earnings adjustments are likely to be revised to the downside as the U.S. Dollar has rallied sharply higher in light of the weakening Euro currency. The weekly chart of the U.S. Dollar Index is shown below:

The U.S. Dollar Index is consolidating directly beneath resistance which is generally seen as a bullish development. I expect a breakout over new highs is only a matter of time. It is unlikely that in the long term the U.S. Dollar can rally while stocks trade flat or work their way higher. While this is always possible, the likelihood of that scenario is unlikely due to earnings pressures that would occur if the Dollar pushes higher in the intermediate term.

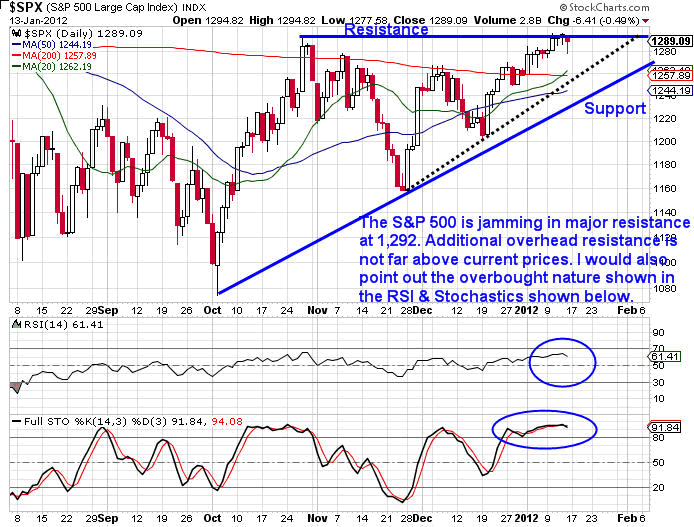

In addition to the variety of above mentioned factors which could have a major impact on equity valuations, the S&P 500 Index is trading into major resistance. Unless the S&P 500 Index can work above the 1,325 area it is unlikely that a new bull market has begun.

If the S&P 500 Index manages to work above the 1,325 level then my analysis may be proven completely incorrect. However, right now the S&P 500 Index has a lot of overhead resistance at the 1,292, 1,300, and 1,310 price levels. The daily chart of the S&P 500 Index is shown below’

Ultimately we are coming into the final week for the January options contracts which are set to expire at the close of business this coming Friday. I would not be shocked to see some volatility late this week and potentially even higher prices for equities.

However, my expectation is that once the January expiration hangover is behind us, increased volatility and lower prices are likely ahead for U.S. equities. The earnings announcements this week will likely have a large impact on the price action. Heads up, risk is exceptionally high!

To learn more about Options Trading Signals visit J.W. Jones Options Newsletter website.

JW Jones

Subscribers of OTS have pocketed more than 150% return in the past two months. If you’d like to stay ahead of the market using My Low Risk Option Strategies and Trades check out OTS at http://www.optionstradingsignals.com/specials/index.php and take advantage of our free occasional trade ideas or a 66% coupon to sign up for daily market analysis, videos and Option Trades each week.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

TOM SAWYER

19 Jan 12, 18:36 |

Top

How long are you going to keep repeating the mantra the economy is about to tank? |