Stock Market Last Gasp, Gold Vs Paper

Commodities / Gold and Silver 2012 Jan 30, 2012 - 03:48 AM GMTBy: Adam_Brochert

I am speaking of the intermediate term move in paper assets versus hard assets, affectionately referred to as "Gold versus paper" around here. Paperbugs had their moment in the sun these past few months and I hope they enjoyed it. The reversal in fortunes has begun.

I am speaking of the intermediate term move in paper assets versus hard assets, affectionately referred to as "Gold versus paper" around here. Paperbugs had their moment in the sun these past few months and I hope they enjoyed it. The reversal in fortunes has begun.

This reversal of fortunes is on a relative basis of course, as the sea of electronic money created out of thin air in the last few months is enough to make Rudolf von Havenstein blush. When the currency units around the globe are dissolving in front of our collective (and dismayed) eyes, relative wealth becomes a more meaningful concept than to contemplate what a quadrillion means.

Bernanke decided to help the US Dollar along last week by extending a monetary policy of insanity, approved by Keynesian clowns everywhere, namely that of further destroying the value of savings and the average person's ability to keep up with the costs of living. In the absence of reason or checks on the power of centralized monetary authorities, debasement of currency can always be achieved in a paper monetary system. And a Gold standard simply means that the Gold standard can be suspended in times of trouble. Easy money, baby. It's almost as old as the concept of money itself.

In the later stages of a monetary system, speculation runs rampant as a means to try to keep up with the ravages of inflation. We are there now and I am one of the many pied pipers claiming to have the answers to establish gains in excess of this pernicious and global monetary catastrophe unfolding at an uncomfortably rapid pace. I believe physical Gold (and silver) held outside the banking system are the easiest and most conservative means of preserving wealth in the current secular cycle (which is far from over), but I also like to speculate with a portion of my capital.

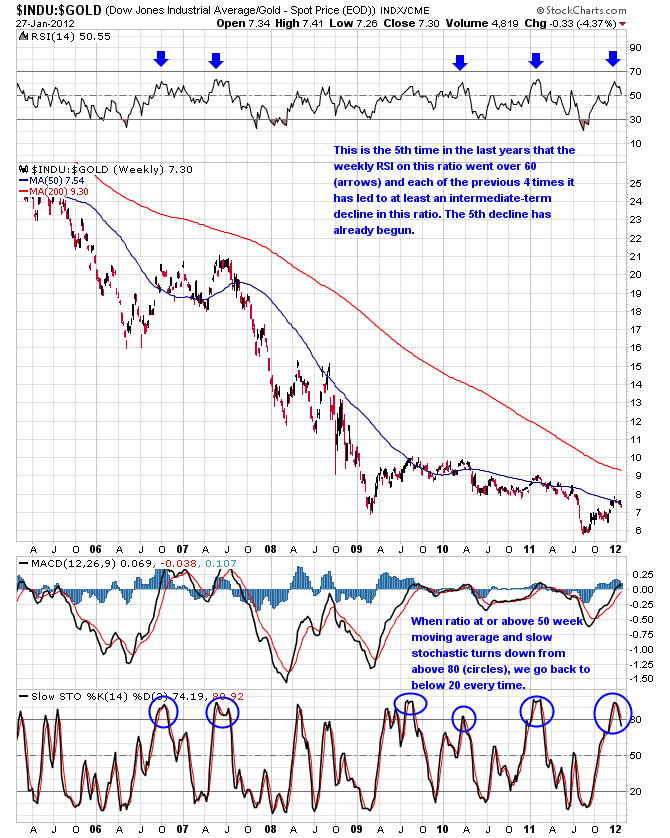

Currently, the charts to me are unambiguous. It is time for hard assets to trump paper once again. First, the chart nearest and dearest to my heart, the Dow to Gold ratio ($INDU:$GOLD). Here is a 7 year log scale ratio chart of $INDU:$GOLD thru Friday's close:

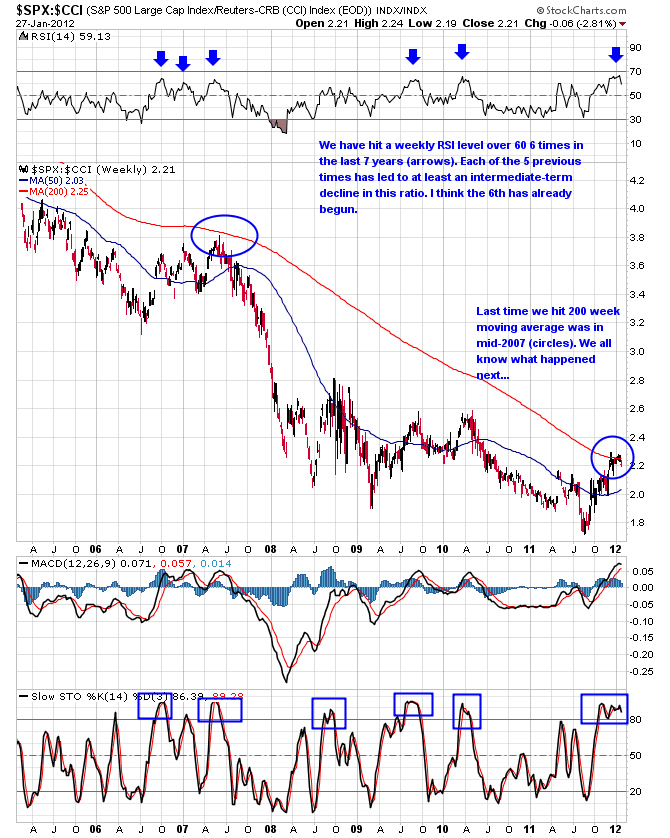

And here is a chart of the S&P 500 index divided by the price of commodities using the CCI Commodities Index (i.e., $SPX:$CCI), employing the same 7 year weekly format thru Friday's close:

In the short-term, I believe both the precious metals sector as well as other risk assets like commodities and common stocks are set to decline for a few weeks. After that, however, my subscribers and I will be looking to go long again in the precious metals sector after closing out trading positions on Friday for big gains. I don't advocate speculation, as it is riskier than buying and holding physical precious metals to profit from the further gains that lie ahead in the secular precious metals bull market.

However, for those who are interested in speculating with a portion of their savings, I offer a low-cost subscription trading service that focuses on the precious metals sector but also looks for opportunities in common stocks, commodities, currencies and bonds. I believe there is a significant amount of money to be made trading in the PM sector over the next few months (and, of course, beyond).

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2012 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.